- 분석

- 기술적 분석

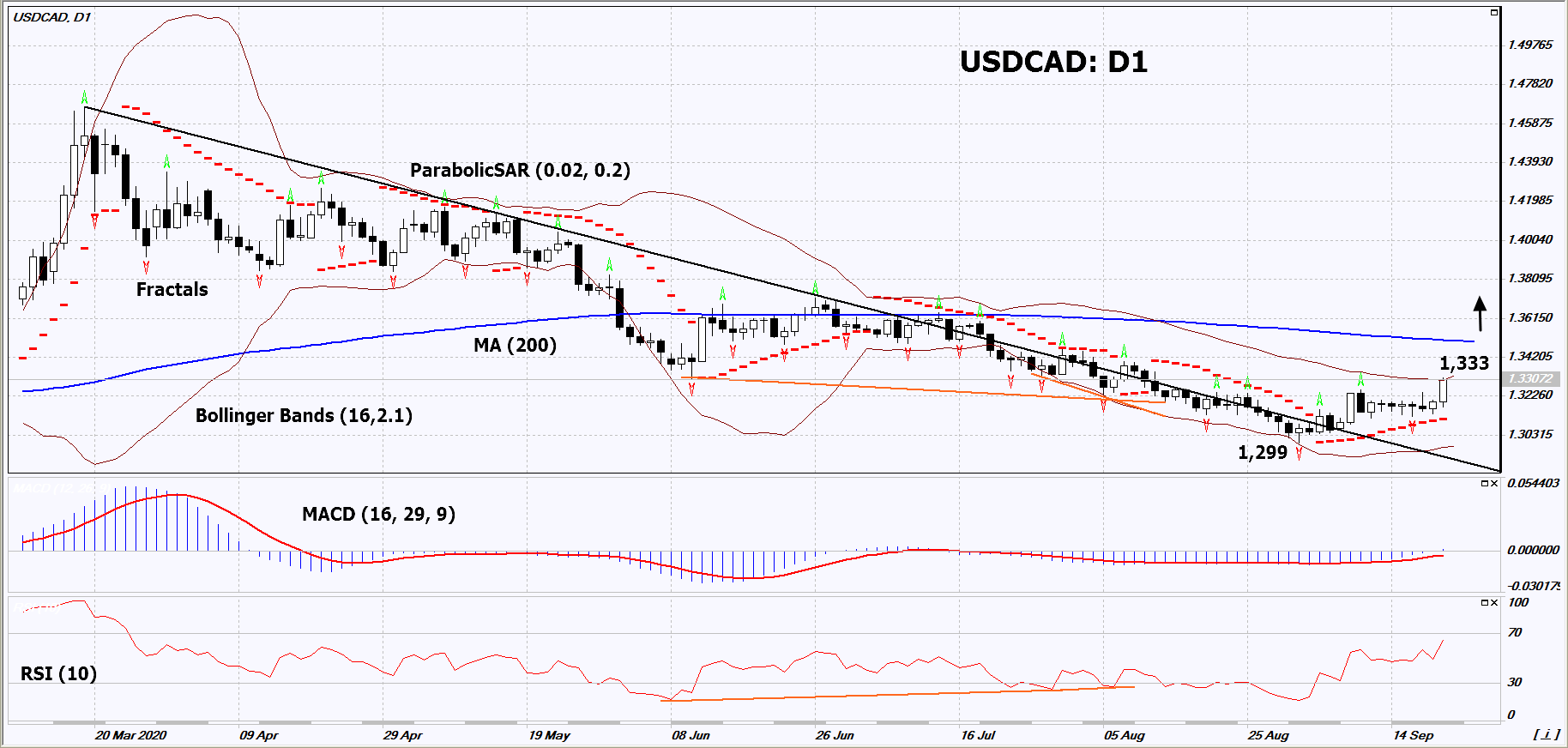

USD CAD 기술적 분석 - USD CAD 거래: 2020-09-22

USD/CAD 기술적 분석 요약

위에 1,333

Buy Stop

아래에 1,299

Stop Loss

| 인디케이터 | 신호 |

| RSI | 중립적 |

| MACD | 구매 |

| MA(200) | 중립적 |

| Fractals | 구매 |

| Parabolic SAR | 구매 |

| Bollinger Bands | 구매 |

USD/CAD 차트 분석

USD/CAD 기술적 분석

On the daily timeframe, USDCAD: D1 exceeded the downtrend resistance line. A number of technical analysis indicators formed signals for further growth. We do not exclude a bullish movement if USDCAD rises above the upper Bollinger band: 1.333. This level can be used as an entry point. We can place a stop loss below the Parabolic signal, the lower Bollinger band and the last two lower fractals: 1.299. After opening a pending order, we can move the stop loss to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (1.299) without activating the order (1.333), it is recommended to delete the order: some internal changes in the market have not been taken into account.

Forex - USD/CAD 기본 분석

The Canadian economy is showing signs of slowing recovery from the coronavirus pandemic. Will the USDCAD quotes rise?

The upward movement means the weakening of the Canadian dollar. At the end of last week data on retail sales and ADP's negative data on the labor market were released in Canada. The number of jobs in August fell for the 6th month in a row (-205.4 thousand). Retail sales in Canada increased by 0.6% in July. This is much less than the 22.7% growth in June. No significant Canadian macroeconomic data is expected this week. However, the emerging correction in world oil prices may support the sliding of the Canadian dollar. Oil is getting cheaper in anticipation of increased production in Libya, as well as amid the increase in the number of new coronavirus cases worldwide. This may strengthen quarantine measures in some countries and weaken global demand. The U.S. Energy Information Administration notes a 13% decline in current US oil demand compared to 2019, and a 20% decrease in motor fuel demand. The International Energy Agency (IEA) projects a drop in the total global oil consumption in 2020 to 91.7 million barrels per day from 100.1 million in 2019. At the same time, according to the IEA, the recovery of global demand to last year's level may occur no earlier than 2023.

Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.