- 분석

- 기술적 분석

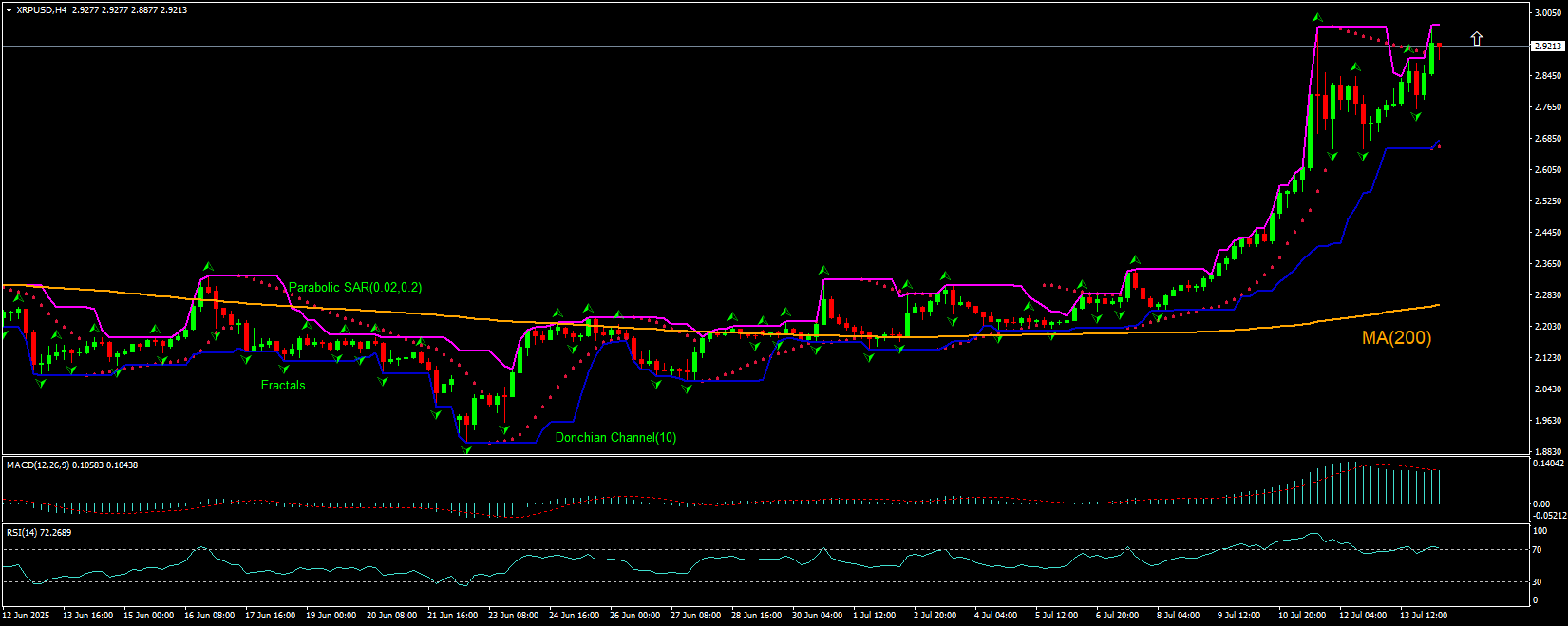

XRPUSD 기술적 분석 - XRPUSD 거래: 2025-07-14

XRPUSD 기술적 분석 요약

위에 2.9751

Buy Stop

아래에 2.7608

Stop Loss

| 인디케이터 | 신호 |

| RSI | 판매 |

| MACD | 중립적 |

| Donchian Channel | 구매 |

| MA(200) | 구매 |

| Fractals | 구매 |

| Parabolic SAR | 구매 |

XRPUSD 차트 분석

XRPUSD 기술적 분석

The XRPUSD technical analysis of the price chart on 4-hour timeframe shows XRPUSD,H4 is advancing above the 200-period moving average MA(200) after retracing lower following a rebound to 4-month high three days ago. RSI indicator is in overbought zone. We believe the bullish momentum will continue after the price breaches above the upper bound of Donchian channel at 2.9751. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 2.7608. After placing the order, the stop loss is to be moved to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

암호화 - XRPUSD 기본 분석

Vincent Van Code, a popular software developer, made a claim that SWIFT might soon declare its plan to employ XRP and Ripple as an alternate settlement layer for interbank payments. Will the XRPUSD price continue advancing?

SWIFT has been the industry standard for interbank communication thanks to its vast network of more than 11,000 member institutions. Inefficiencies of the current global payments infrastructure could be resolved by a SWIFT-Ripple alignment, especially one that incorporates XRP. Vincent Van Code, a strong advocate for blockchain adoption, hinted that SWIFT might soon declare its plan to employ XRP and Ripple as an alternate settlement layer for interbank payments. RippleNet and On-Demand Liquidity (ODL) have introduced a real-time, blockchain-based solution. It is very appealing to financial institutions trying to boost capital efficiency and lower operational friction because the ODL solution does away with the need for expensive nostro/vostro accounts. In the past Ripple has acknowledged conversations with SWIFT and its expanding network of partnerships, including those with central banks. Possible employment of XRP as an alternate settlement layer for interbank payments is bullish for XRPUSD.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.