- Analytics

- Market Overview

Chinese influence on US Dollar - 24.8.2015

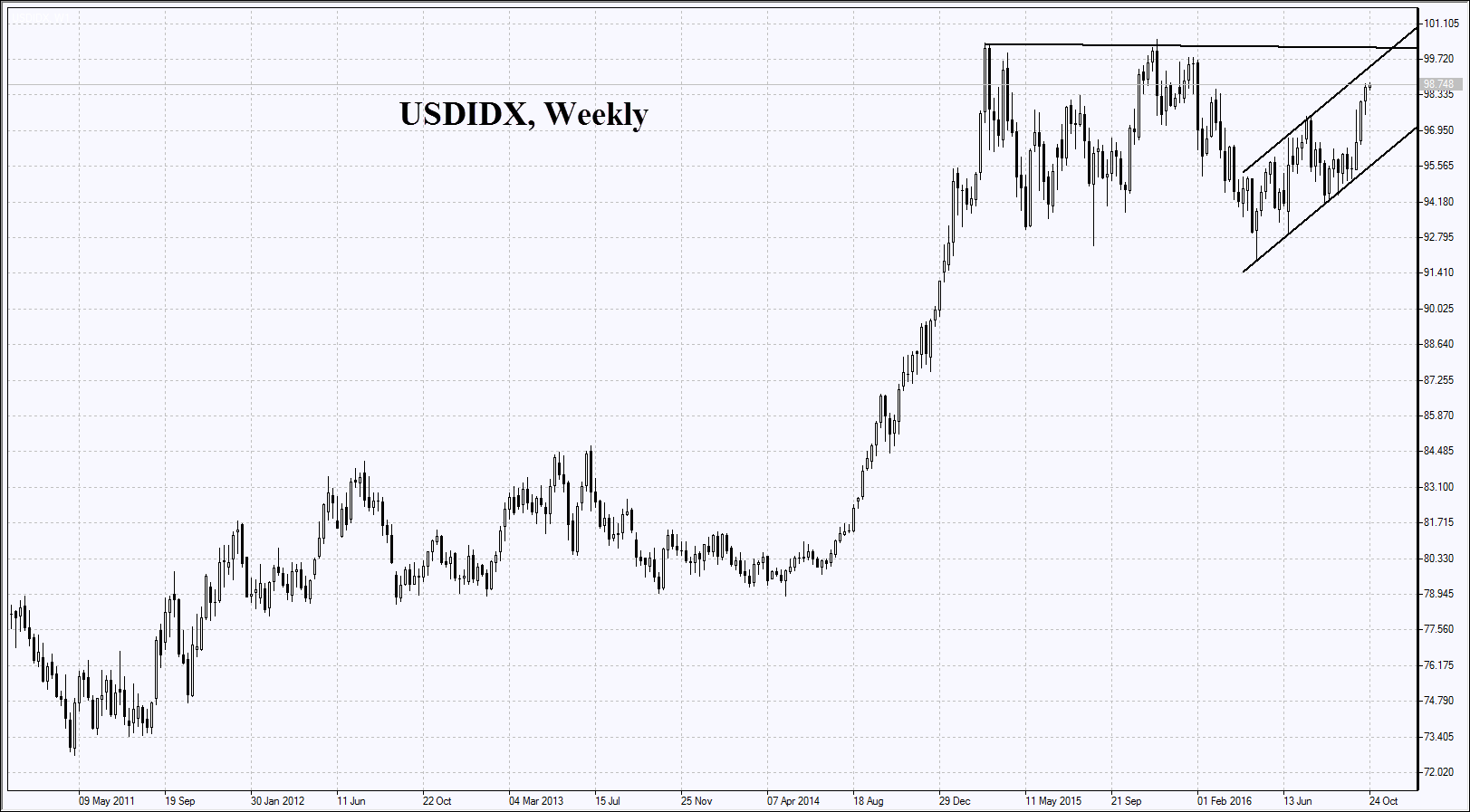

We will try to explain in brief the interconnections between the Chinese and global economies. Logically, the economic difficulties in China could have been provoked by the contracted demand on its goods all over the world. This, in turn, may reveal the signs of crisis in the world economy that are to emerge some time later. Let’s emphasize that the Chinese import to the US is about $0,5 trn. a year while the US export to China is almost 4 times less. The imbalance of about $350 bln. a year may have been covered by acquiring the US treasuries as part of the Chinese foreign exchange reserves. In the first quarter of 2008 the Chinese reserves equaled $1,68 trn. and reached their high of almost 4 trn. till the second quarter of 2014. After that they began to diminish gradually. The fall of the American S&P 500 stock index by 5,8% last week happened to be the ultimate since September 2011. The trade turnover on the US stock exchanges exceed the monthly average by 57% and reached 10,6 bln. shares. Today we are expecting no significant US macroeconomic data.

The European stock indices have opened with a significant gap down and the German DAX is plummeting for the 6th day in a row mainly due to the risks of the global economy we have mentioned above. The weekly fall of the European index FTSEurofirst 300 is the maximum since the August 2011. The Euro has strengthened notably as investors bet the US economy may suffer more than the European and than economies of the other developed countries. Moreover, Europe is a Chinese competitor in manufacture in some degree. Today we are expecting no significant releases of the data in the European region.

The Japanese Nikkei has been slumping today for the 5th consecutive day together with the other world indices. The Yen is strengthening against the US Dollar due to the same reasons as the Euro is. The high trade turnover on the Tokyo Stock Exchange (TSE) is worth mentioning, today it exceed the monthly average by 80%. This week's significant statistics of Japan is expected early on Friday morning. The inflation statistics and other data are to be released.

The commodities market demonstrates the unusual dynamics. Prices for the majority of the commodities futures traded in the US Dollars fall despite the significant weakening of the US currency. In our opinion, that is one of the deflation signs that contradicts the macroeconomic statistics. Apparently, the market participants are disposing of the high risk assets amid the possible decrease in demand from the decelerating Chinese economy.

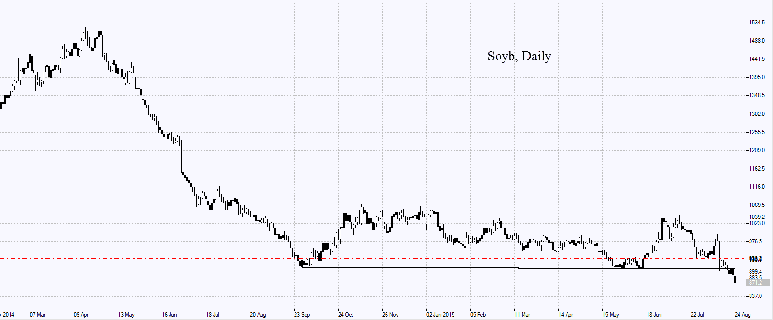

The soy quotes have hit a 6-year minimum on the concerns of the market participants that China would reduce its demand on soy in the world market. China is the major soy importer. Yet the agricultural agency Pro Farmer expects this year's US soy production to be 3,887 bln. bushels given the average crop yield of 46,5 bushels per acre. This is less than the official estimate of the US Agricultural Department of 3,916 bln. bushels with the crop yield of 46,9 bushels per acre.

See Also