- Analytics

- Market Overview

Global stock markets growth stumbles on the Fed’s vice-president statement - 31.8.2015

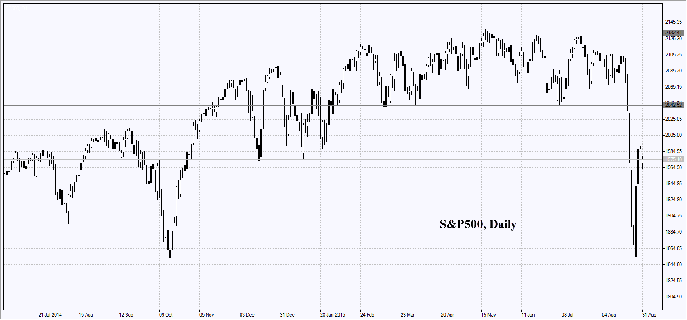

The shares growth on the world stock markets faltered on Friday on the statement by the Fed’s vice-president Stanley Fisher about the persisting probability of the rate hike on the Federal Reserve meeting on September 17. Judging by the interest rate swap quotations, the market estimates this probability at 35% against 22% in the beginning of last week. The possible rate hike by the Fed has supported the Dollar Index which has surged from its three-month low. Nevertheless, presently its growth has stumbled waiting for the release of the US economic statistics. The data released on Friday proved to be negative for both equities and Dollar. The personal expenditure growth in July was slower than expected while the Per Capita Expenditure (PCE) ex-food and energy for 12 months to July was 1.2% (the minimum since the march 2011). What is more, the University of Michigan Consumer Sentiment Index descended in August. No significant macroeconomic data is expected to come out today in the US. It will be released after Tuesday with the most important data, that is Labour statistics, to be published on Friday.

The European stock indices are down presently, together with the US stock index futures, after the Stanley Fisher statement. The British stock exchanges are closed due to the holiday. The slump of the DAX, CAC и Euro STOXX 50 indices in August may run at 9% and be the biggest in 4 years. The main reason is the response to the Chinese economic slowdown and the plunge of the Shanghai Composite Index by more than 40%. Today in the morning were released some positive European macroeconomic data supporting the Euro. The inflation in August has grown from 0.1% to 0.2% which decreases the deflation risk. No more significant macroeconomic statistics is expected to be released in the EU today.

The Nikkei Index has decreased today together with the other world indices. Its slump in August exceeded 8% and was the biggest since the January 2014. Today in the morning the negative macroeconomic data on the industrial production drop by 0.6% in July instead of the expected growth of 0.1% were released in Japan. The shares of the companies exporting their products to China were looking down: JFE Holdings (-3,3%), Komatsu (-2,9%), Daikin Industries (-2,3%). The weak statistics has put a hold on the strengthening of Yen against the US Dollar. The next economic statistics in Japan is to be released tomorrow morning at 1:50 CET: the capital spending and the company profits in the second quarter.

The crude oil quotes surged on Thursday-Friday by more than 15%. We assume the market participants are concerned that low prices may trigger the decline in its production. According to the oilfield services company Baker Hughes, the number of rigs drilling for oil in the US totaled 675 compared with 674 in the prior week. Several oil experts claim the price of about $60 a barrel is needed for the further light tight oil development. Shall we remind you of the fact that the previous October there were 1609 drilling rigs working in the US. Amid the extremely low oil prices its consumption is growing notably. Indeed, the petrochemicals sales in the US advanced 1% in July reaching the 2-year high and the petrol sales increased by 5.4%. The oil export to Japan surged by 10.9% in July to 3,43 mln. barrels a day while the supplies from Iran shot up by 20%.

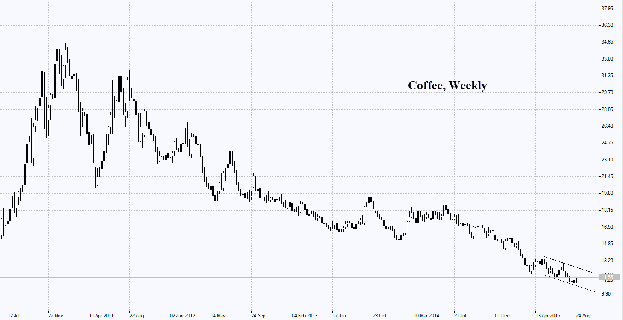

According to the International Coffee Organization, the world coffee export in July contracted by 3.6% to 9,59 mln. 60kg bags. In 10 months of season 2014/2015 beginning October 1st this indicator has lost 2.8% and totaled 92.85 mln. bags. The Association of Indonesian Coffee Exporters and Industries has downgraded its forecast of coffee export from Indonesia by 100 thousand tonnes to 500 thousand tonnes due to the negative impact of El Nino hurricane. The European Coffee Federation stated the contraction of the coffee stocks by 4.8% in the European harbors in June. We assume that it may provoke the rise in coffee quotations.

See Also