- Analytics

- Technical Analysis

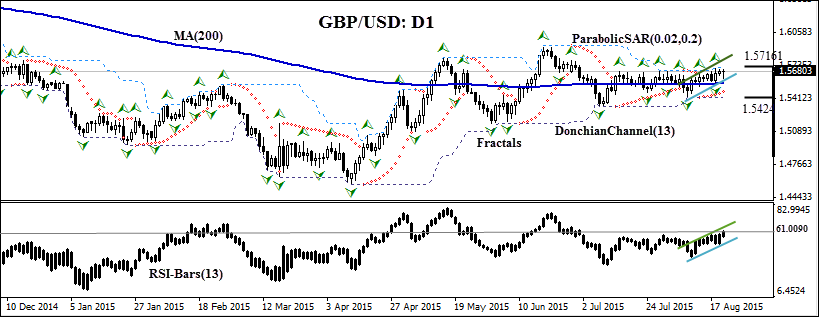

GBP USD Technical Analysis - GBP USD Trading: 2015-08-20

Dovish Fed minutes support the pair

Let us consider the GBP/USD pair on the daily timeframe. On Tuesday the UK Office of National statistics reported inflation inched up from 0% in June to 0.1% in July, reaching the highest level in six months. On Thursday retail sales readings for July came out, recording 4.2% increase on year, slightly lower than expected. On this backdrop, the minutes from the Federal Open Market Committee’s July 28-29 meeting released on Wednesday indicated several policy makers were concerned about low inflation, which was interpreted by investors that the likelihood of September rate hike diminished. US treasury yields fell, and according to CME Group’s FedWatch tool Fed funds futures traders priced in a 23.57% probability of a September rate hike the next day, down from 45% on Wednesday. This weakened the US dollar against several major currencies, including British Pound.

The GBP/USD has been rising after the comment by Federal Reserve Vice Chairman Stanley Fischer on August 10 that he doesn’t expect the interest rate hike will happen until after inflation climbs closer to the Fed’s target of around 2. The pair is edging up from the 200-day moving average in a rising channel. The Donchian channel is tilted upward. The Parabolic indicator gives a buy signal. The RSI-Bars oscillator is rising and hasn't reached the overbaught zone yet. We believe the bullish momentum will be continue after the pair closes above the last fractal high at 1.57161. A pending order to buy can be placed above that level. The stop loss can be placed below the lower Donchian channel at 1.5424, which is confirmed also by Parabolic indicators. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

| Position | Buy |

| Buy stop | above 1.57161 |

| Stop loss | below 1.5424 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.