- Analytics

- Technical Analysis

NZD USD Technical Analysis - NZD USD Trading: 2015-12-11

New Zealand dollar strengthens after rate cut

The Reserve Bank of New Zealand cut the interest rates on Thursday. The New Zealand dollar rose following easing by the central bank. Will the New Zealand dollar continue strengthening?

The Reserve Bank of New Zealand cut the Official Cash Rate on Thursday 0.25% for the fourth time this year to 2.5%. The NZDUSD pair had been strengthening ahead of the interest rate meeting despite the widespread belief that the central bank will ease further. The central bank policy statement was perceived a bullish signal by investors as it implied that policy makers expect no need for further easing - Reserve Bank Governor Graeme Wheeler said in his statement they expect inflation will settle near the middle of the target range of 1 to 3 percent at current interest rate settings. Another positive development for kiwi was the milk price forecast upgrade by Fonterra, New Zealand dairy cooperative and world’s biggest exporter of dairy products. Dairy exports account for about 30% of country’s merchandise exports. Improved economic performance of Australia, New Zealand’s second largest trading partner accounting for over 17% of country’s exports, also boosted kiwi’s prospects. Australia’s economic growth accelerated to 2.5% in the third quarter year-over-year against a 1.9% increase in the previous quarter. And on Thursday labor market report indicated unemployment in Australia unexpectedly fell for the second month in a row to a 19-month low of 5.8 %.

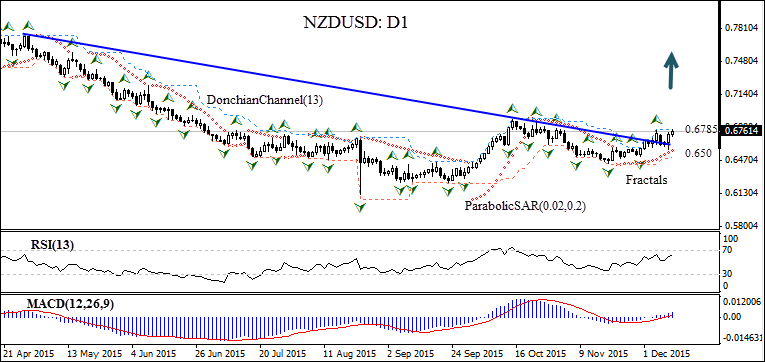

NZDUSD has been trading with upside bias the last couple of weeks and has breached above trend line resistance. The Parabolic indicator gives a buy signal. The RSI oscillator is above 50 and rising and hasn’t reached the overbought zone yet. The Donchian channel is tilted upward, indicating an uptrend. The MACD indicator is above the signal line and the zero level which is a bullish signal. We believe the bullsh momentum will continue after the price closes above the upper Donchian channel and last fractal high at 0.6785. A pending order to buy can be placed above that level. The stop loss can be placed below the last fractal low and lower Donchian channel at 0.65. After placing the pending order the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

| Position | Buy |

| Buy stop | above 0.6785 |

| Stop loss | below 0.65 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.