- Trading

- Markets

- Commodities

Trade Commodity CFDs without an Expiration Date

CFD Trading Commodities gives traders a flexible way to invest in some of the world’s most important resources, such as gold, oil, natural gas, coffee, and wheat. Instead of physically buying or storing these assets, traders can speculate on their price movements through CFDs.

One of the key features is that commodity CFDs at many brokers don’t have expiration dates. That means you can hold your position for as long as you want, without worrying about contract rollovers or expiry dates common in traditional futures markets.

Generally, commodities are traded in the form of futures contracts on the commodity exchanges. Each such contract has its own expiration date, which may be uncomfortable for those traders who trade in commodity CFDs and do not want to close the positions when the relevant futures is about to expire.

For such customers we at IFC Markets have developed and implemented a special price calculation formula, based on the value of the two relevant futures with the closest expiration date.

Such approach allows us to provide our clients with commodity CFDs which do not expire and removes price gaps which may occur when the closest futures expires.

Learn morePopular Commodities to Trade

Some Commodities move more than others, which can create more trading opportunities. Below are the most commonly traded instruments:

Looking for a Trading Instrument?

Please, choose the platform and the account type

Online Commodity Trading

Most traders access commodities through digital platforms, making trading online commodities easier than ever. With just a trading account, you can speculate on gold, crude oil, silver, or even agricultural products without physically owning them.

Through CFD Trading Commodities, you can go long if you expect prices to rise, or short if you believe prices will fall. If oil prices are currently $75 per barrel and you expect them to increase, you can open a long CFD position. If oil rises to $80, you profit from the difference. If you expect prices to fall, you can open a short position and potentially benefit as the market declines.

This flexibility is what makes trading online commodities attractive. There’s no need for storage, delivery, or dealing with commodity futures contracts, everything is managed digitally on your trading platform.

What is Commodity Trading?

Online commodity trading is the act of speculating on the price of raw materials and natural resources that drive the global economy. Commodities are typically grouped into two categories:

- Hard commodities – Natural resources that are mined or extracted, such as gold, silver, crude oil, and natural gas.

- Soft commodities – Agricultural products and livestock, such as coffee, wheat, corn, and cotton.

For example, gold is often seen as a safe haven asset during uncertain economic times, while oil prices can fluctuate based on global supply and demand, OPEC decisions. By trading commodities online, you can take advantage of these price movements without directly buying gold bars or storing barrels of oil.

How to Start Online Commodity Trading?

Getting started with commodities is easier than it may seem. Here is a simple step by step process to begin trading Commodity CFDs.

- Choose a trading platform – Open an account with a broker that offers Commodity CFDs.

- Select a commodity market – Decide which commodity you want to trade: gold, oil, silver, natural gas, or agricultural products.

- Decide on direction – Conduct technical analysis and based on that go long or short.

- Set leverage and position size – Many brokers allow leverage, which increases your exposure to the market. Remember, leverage can magnify both profits and losses.

- Use risk management tools – Protect your trades with stop-loss and take-profit orders.

- Monitor and close your position – Keep an eye on global news and commodity reports. Once your trade meets your goal (or to limit risk), you can close the position.

Suppose gold is trading at $2,400 per ounce. You believe it will rise due to economic event, so you open a long position. If gold climbs to $2,450, you earn a profit on the difference.

Key Benefits of Investing In Commodities

Trading commodities through CFDs has advantages. Here are the main benefits of CFD Trading Commodities:

- No expiration dates – Commodity CFDs without an expiration date allow you to hold positions as long as you want.

- Trade rising or falling prices – Profit potential exists in both bullish and bearish markets.

- Leverage opportunities – Control larger positions with less capital, but remember this also increases risk.

- Diversification – Commodities often move differently than stocks or indices, giving you another way to balance your portfolio.

- Accessibility – With online platforms, you can access major commodity markets 24/5 from anywhere.

- Lower barriers to entry – You don’t need to buy physical gold, oil, or wheat—just trade based on price movement.

For example, if you already invest in stocks, adding commodities like gold or oil can help reduce overall portfolio risk, since these assets often respond differently to global events.

More Markets to Consider

Commodity CFDs allow you to speculate on the price of resources like gold, oil, or coffee without owning them directly. They provide flexibility, leverage, and the ability to trade without worrying about expiration dates.

To do commodity trading online, you need to open an account with a broker, choose a trading platform, and select a commodity to trade. Through CFD Trading Commodities, you can buy or sell depending on whether you expect prices to rise or fall.

Yes, you can trade a wide range of commodities using CFDs, including metals, energy products, and agricultural goods. CFDs make it possible to trade commodities without storage, delivery, or futures contracts, all through an online trading platform.

Latest Trading News

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in...

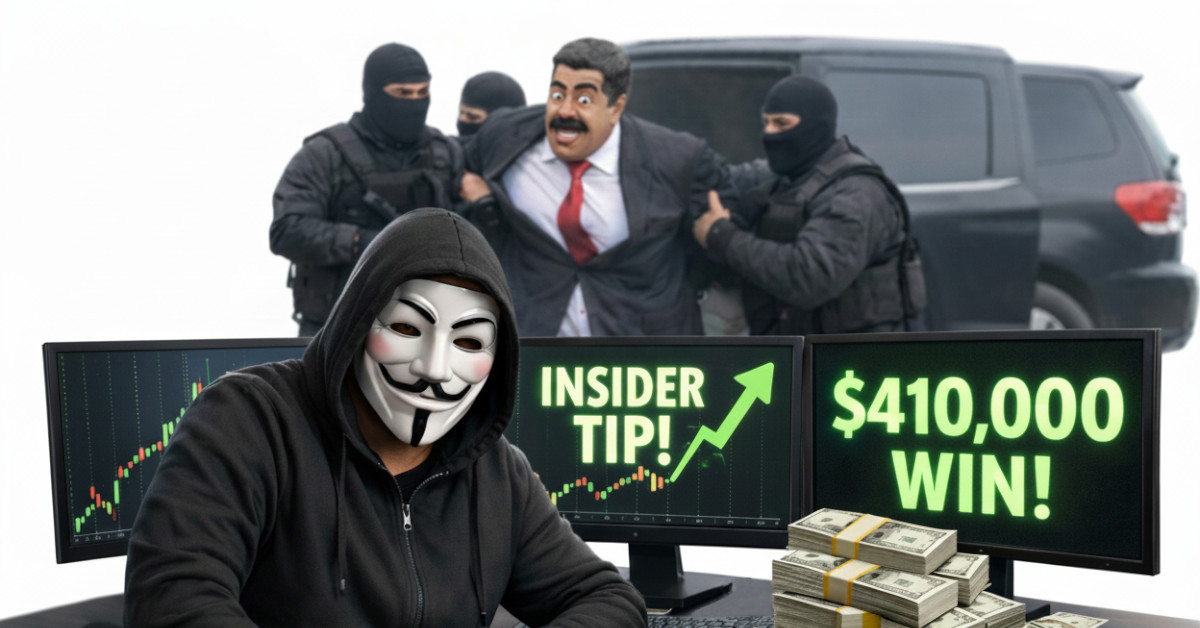

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that...

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production...