- Analisi

- Analisi Tecnica

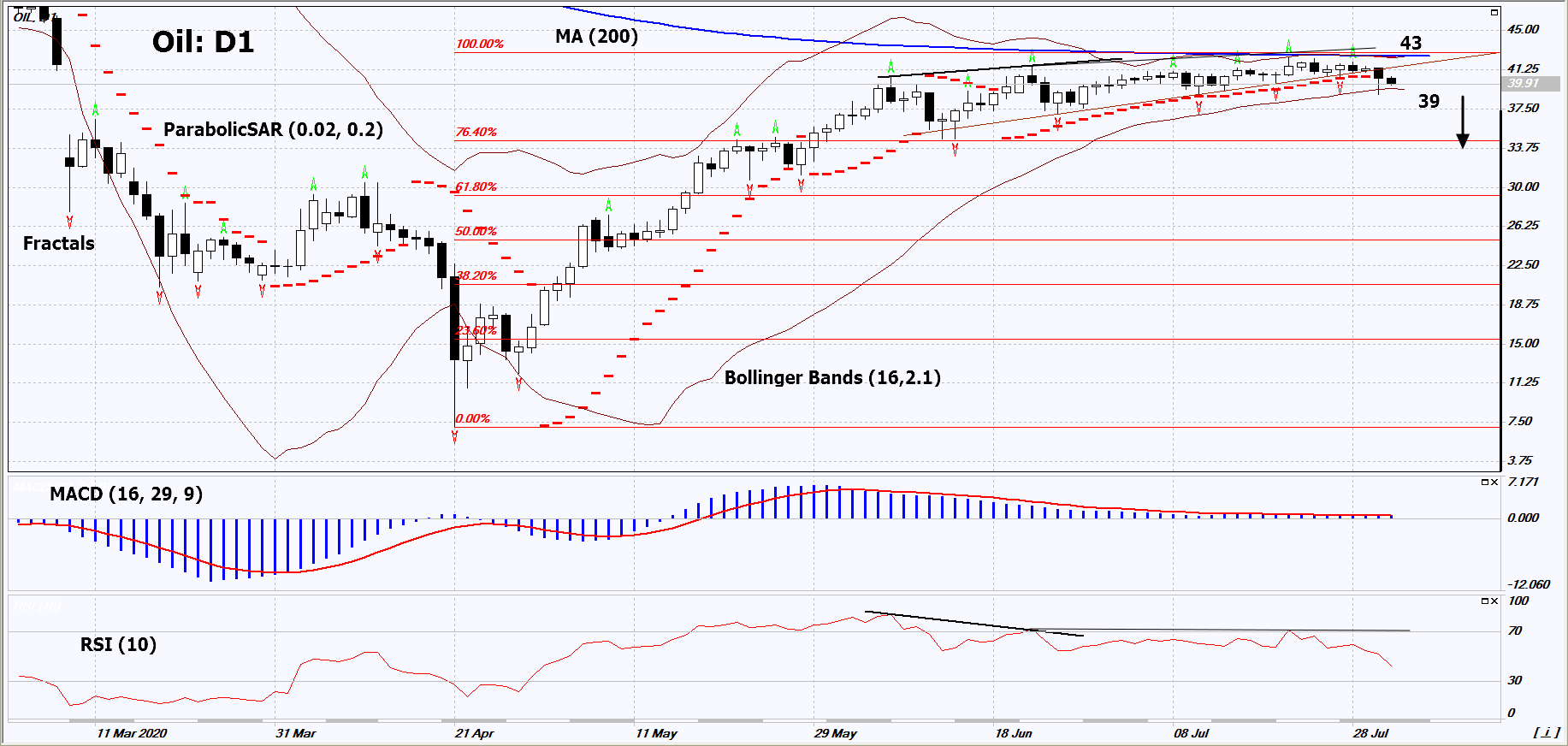

Petrolio WTI Analisi Tecnica - Petrolio WTI Trading: 2020-08-03

WTI Technical Analysis Summary

Sotto 39

Sell Stop

Sopra 43

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Neutro |

| MA(200) | Neutro |

| Fractals | Neutro |

| Parabolic SAR | Sell |

| Bollinger Bands | Neutro |

WTI Chart Analysis

WTI Analisi Tecnica

On the daily timeframe, Oil: D1 is being traded in a narrow neutral range for almost 2 months. A number of technical analysis indicators formed signals for a decline. We do not rule out a bearish movement if Oil falls below the lower Bollinger band: 39. This level can be used as an entry point. We can set a stop loss above the last two upper fractals, the upper Bollinger line, the 200-day moving average line and the Parabolic signal: 43. After opening a pending order, we should move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. The most risk-averse traders, after the transaction, can switch to a four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (43) without activating the order (39), it is recommended to delete the order: some internal changes in the market have not been taken into account.

Analisi Fondamentale Materie Prime - WTI

Since August 1, 2020, OPEC + countries will increase oil production by 1.5 million barrels per day (bpd). Will oil quotes go down ?

On July 15, 2020, the OPEC + countries agreed to reduce the oil production limit from 9.7 million bpd to 7.7 million bpd from August 1. This means that the difference (or 2 million bpd) will additionally enter the world market. The real increase will be less, and will amount to 1.5 million bpd, as a number of countries such as Iraq and Nigeria have exceeded their oil production quotas in the past. In May, the overall OPEC + reduction quota was met by only 87%, bringing additional 1.26 million barrels per day to the world market. This did not prevent the growth in oil quotes. In June, the quota was met by 107%. The next increase in production, by another 2 million bpd, is expected only in early 2021, when the OPEC + production limit will be reduced to 5.7 million bpd. The continuation of the coronavirus pandemic may be another negative factor for oil prices. A number of countries are inclined to reintroduce quarantine, which will lead to lower demand.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.