- マーケット分析

- マーケットセンチメント

WEEKLY TOP GAINERS/LOSERS: 04.07.2018

Top Gainers – The World Market

Top Gainers – The World Market

1. SBERBANK (ADR) – stock prices of the Russian bank rose after the successful placement of government bonds in the amount of 50 billion rubles. ($800 million).

2. RWE AG – stock prices of the German energy company rose amid good financial forecasts, as well as the acquisition of energy assets in the US by a subsidiary of RWE Innogy.

Top Losers – The World Market

Top Losers – The World Market

1. Sands China Ltd – stock prices of the Chinese owner of hotels and casinos in Macau fell after the publication of data on the aggregate profit of the gaming industry. Macau is the only Chinese territory where gambling is allowed. In June, the aggregate profit of casino operators increased for the 23rd consecutive month. The growth was 12.5%. Nevertheless, investors were disappointed, as it was expected that the growth would be 17-21%.

2. Tesla Motors Inc. – stock prices of the US manufacturer of electric cars fell after the announcement of the suspension of the release of the new Model 3 for several days. In the last week of June, the company reached the target level of 5 thousand electric vehicles. However, investors doubt that it can persist for a long time.

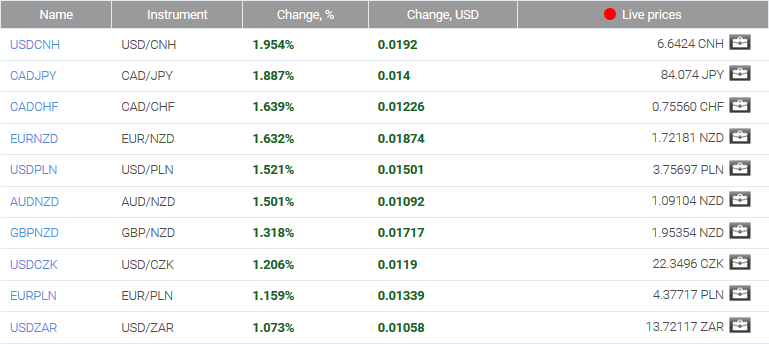

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. USDCNH - the growth of the Chinese yuan on the chart indicates its weakening against the US dollar. Investors are afraid of a new round of trade war between the two countries after the entry into force of customs duties on the import of Chinese goods to the US for $34 billion a year.

2. CADJPY, CADCHF - The Canadian dollar strengthened against the yen and the Swiss franc amid stable high world oil prices - a significant part of Canada's exports. The growth of business activity in the manufacturing sector and an increase in the IHS Markit Canada Manufacturing PMI were additional positive factors.

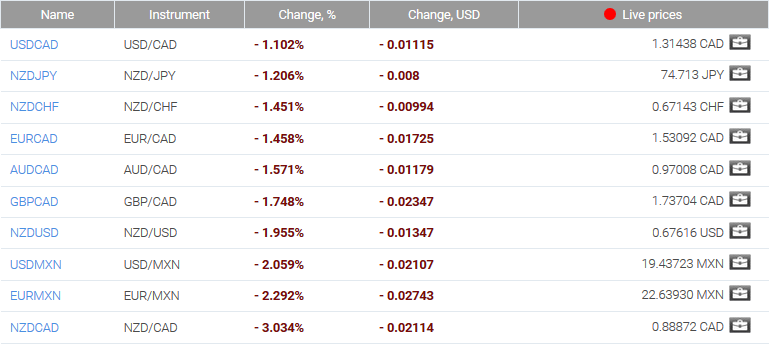

Top Losers - Foreign Exchange Market (Forex)

Top Losers - Foreign Exchange Market (Forex)

1. USDCAD - the decline of this chart indicates the strengthening of the Canadian dollar against the US dollar. The reasons are indicated in the previous section.

2. NZDJPY, NZDCHF - The New Zealand dollar has weakened amid risks of trade wars and a possible deterioration of the Chinese economy. China is an important trading partner of New Zealand. An additional negative was the decline in powdered milk prices. Dairy products account for about a quarter of New Zealand's exports.

【重要な注意事項】:

本レポートは、当社の親会社であるアイエフシーマーケットが作成したものの邦訳です。本レポートには、当社のサービスと商品についての情報を含みますが、お客様の投資目的、財務状況、資金力にかかわらず、情報の提供のみを目的とするものであり、金融商品の勧誘、取引の推奨、売買の提案等を意図したものではありません。 本レポートは、アイエフシーマーケットが信頼できると思われる情報にもとづき作成したものですが、次の点に十分ご留意ください。アイエフシーマーケットおよび当社は、本レポートが提供する情報、分析、予測、取引戦略等の正確性、確実性、完全性、安全性等について一切の保証をしません。アイエフシーマーケットおよび当社は、本レポートを参考にした投資行動が利益を生んだり損失を回避したりすることを保証または約束あるいは言外に暗示するものではありません。アイエフシーマーケットおよび当社は、本レポートに含まれる不確実性、不正確性、不完全性、誤謬、文章上の誤り等に起因して、お客様または第三者が損害(直接的か間接的かを問いません。)を被った場合でも、一切の責任を負いません。

前回の市場センチメント

- 3月18日Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The...

- 3月10日Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 3月4日Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened...