- マーケット分析

- テクニカル分析

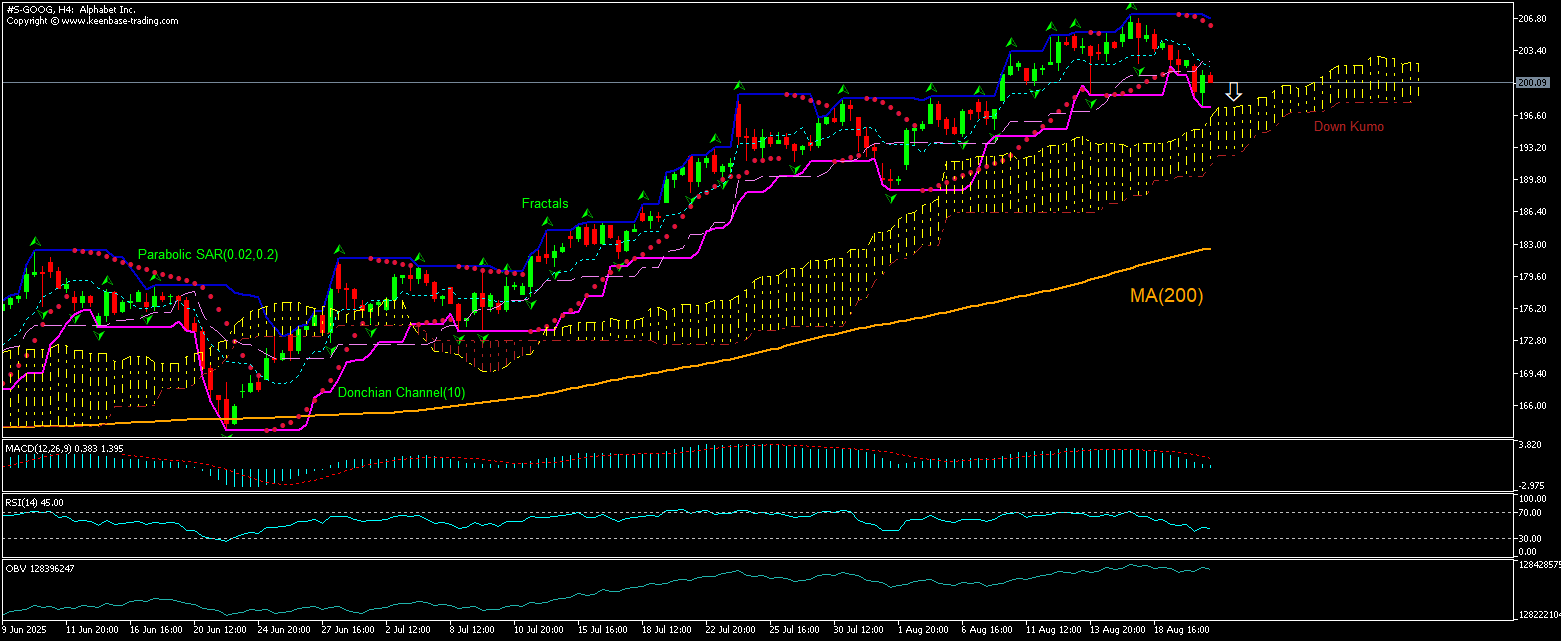

Alphabet テクニカル分析 - Alphabet 取引:2025-08-21

Alphabet テクニカル分析のサマリー

Below 197.39

Sell Stop

Above 206.08

Stop Loss

| インジケーター | シグナル |

| RSI | 横ばい |

| MACD | 売り |

| Donchian Channel | 売り |

| MA(200) | 買い |

| Fractals | 横ばい |

| Parabolic SAR | 売り |

| On Balance Volume | 売り |

| Ichimoku Kinko Hyo | 買い |

Alphabet チャート分析

Alphabet テクニカル分析

The technical analysis of the GOOGLE stock price chart on 4-hour timeframe shows #S-GOOG,H4 is retreating down toward the 200-period moving average MA(200) after rebounding to six-month high six days ago. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 197.39. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 206.08. After placing the order, the stop loss is to be moved every day to the fractal high indicator following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (206.08) without reaching the order (197.39), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

分析 証券 - Alphabet

Alphabet stock continued declining after the company revised its Google Play terms. Will the GOOGLE stock price retreating reverse?

The stock of Alphabet, Google’s parent company, fell 1.14% on Wednesday after reports the company is updating its External Offers Program for the European Union with revised fees and more options for Android developers. Alphabet has made updates to its external offers program to offer more flexibility for developers as part of its continued compliance with the EU Digital Markets Act, or DMA. In March, the EU competition watchdog found Google failed to comply with the region's DMA for two services. The Commission alleged that parent Alphabet treats Google Shopping, Hotels, Flights, etc., "more favorably" in search results versus services offered by third parties and gives "more prominent treatment" to its own offerings. Furthermore, the EC said the company's app store Google Play prevents developers from steering customers to offers and distribution channels of their choice and unjustly charges them for customer acquisition. Revised Google Play terms are designed to make it easier for app developers to steer customers to platforms other than Google after the European Commission found that the company allegedly breached EU's rules. Developers must meet eligibility requirements, and complete their enrollment in this program before promoting external offers. Revision of search results terms that will restrict the favorable treatment of services offered by Google versus services offered by third parties is bearish for Google stock price.

【重要な注意事項】:

本レポートは、当社の親会社であるアイエフシーマーケットが作成したものの邦訳です。本レポートには、当社のサービスと商品についての情報を含みますが、お客様の投資目的、財務状況、資金力にかかわらず、情報の提供のみを目的とするものであり、金融商品の勧誘、取引の推奨、売買の提案等を意図したものではありません。 本レポートは、アイエフシーマーケットが信頼できると思われる情報にもとづき作成したものですが、次の点に十分ご留意ください。アイエフシーマーケットおよび当社は、本レポートが提供する情報、分析、予測、取引戦略等の正確性、確実性、完全性、安全性等について一切の保証をしません。アイエフシーマーケットおよび当社は、本レポートを参考にした投資行動が利益を生んだり損失を回避したりすることを保証または約束あるいは言外に暗示するものではありません。アイエフシーマーケットおよび当社は、本レポートに含まれる不確実性、不正確性、不完全性、誤謬、文章上の誤り等に起因して、お客様または第三者が損害(直接的か間接的かを問いません。)を被った場合でも、一切の責任を負いません。