- マーケット分析

- テクニカル分析

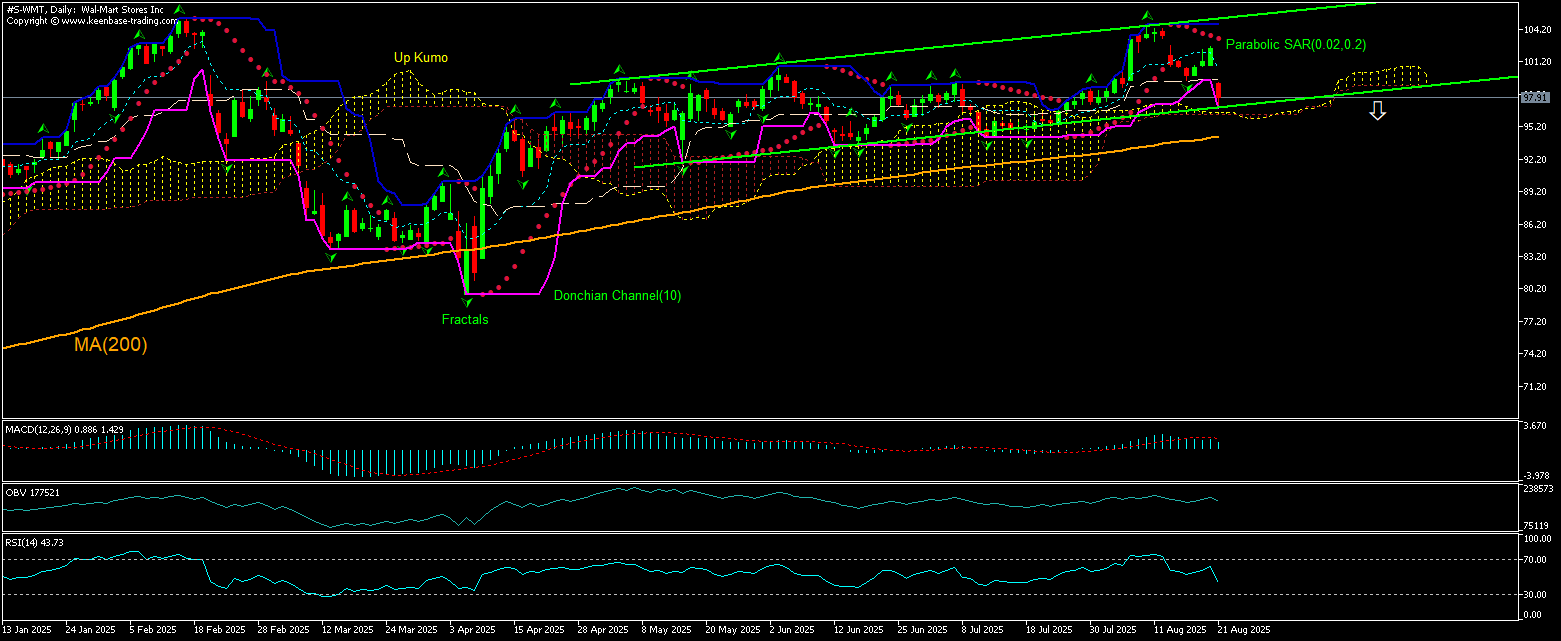

Wal-Mart Stores テクニカル分析 - Wal-Mart Stores 取引:2025-08-22

Wal-Mart Stores テクニカル分析のサマリー

Below 96.35

Sell Stop

Above 103.35

Stop Loss

| インジケーター | シグナル |

| RSI | 横ばい |

| MACD | 売り |

| Donchian Channel | 売り |

| MA(200) | 買い |

| Fractals | 横ばい |

| Parabolic SAR | 売り |

| On Balance Volume | 売り |

| Ichimoku Kinko Hyo | 買い |

Wal-Mart Stores チャート分析

Wal-Mart Stores テクニカル分析

The technical analysis of the Walmart stock price chart on 4-hour timeframe shows #S-WMT,H4 is retracing down toward the 200-period moving average MA(200) after hitting 6-month high 2 weeks ago. We believe the bearish momentum will resume after the price breaches below the lower Donchian bound at 97.91. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed at 103.35. After placing the order, the stop loss is to be moved every day to the next fractal high indicator, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (103.35) without reaching the order (96.35), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

分析 証券 - Wal-Mart Stores

Walmart stock tumbled after Q2 earnings missed Wall Street estimates. Will the Walmart stock price continue retreating?

Walmart stock fell 4.5% yesterday as earnings missed Wall Street estimates. The stock sold off despite 4.8% rise in Q2 sales to $177.4 billion which beat the consensus revenue estimate of $175.5 billion. Overall gross margins were about flat at 24.5% versus 24.4% last quarter, missing consensus estimates of 24.9%. On a constant-currency basis, revenues grew 5.6%, reflecting strong performance across all business segments. Walmart stock sold off despite reporting better results than rival Target. Walmart's comparable sales growth at stores open at least one year was 4.6% in Q2, up from 4.2% one year ago. Transactions rose 1.5%, down from 3.6% last year, while average ticket, or the amount spent per transaction, rose 3.1%, up from 0.6%. For comparison, Target reported a 1.9% comparable sales decline and an online sales growth of only 4.3% in the quarter. The retail and wholesale giant indicated the average ticket growth was partly due to inflation and passing along higher costs associated with tariffs, which increased Walmart's import costs, and the company would increase prices this summer as announced earlier to offset tariff-related costs. Walmart said it continued to see cost increases each week as inventory was replenished at post-tariff price levels and those costs will continue rising in the second half of the year. However, the company reported tariff impact wasn't as big as expected so far as Walmart has raised prices maybe 1% since the end of the first quarter. The company’s operating income decreased 8.2% year over year to $7.3 billion. The company cited tariffs as the primary challenge, as well as discrete legal and restructuring costs. Adjusted operating income is up 0.4% in current currency terms. Still, management raised its full-year guidance: sales guidance was increased to 3.75% to 4.75% growth from 3% to 4% prior forecast while operating income growth guidance was unchanged - up 3.5% to 5.5%. Higher than expected revenue growth and guidance is bullish for Walmart stock price while earnings miss is a downside risk.

【重要な注意事項】:

本レポートは、当社の親会社であるアイエフシーマーケットが作成したものの邦訳です。本レポートには、当社のサービスと商品についての情報を含みますが、お客様の投資目的、財務状況、資金力にかかわらず、情報の提供のみを目的とするものであり、金融商品の勧誘、取引の推奨、売買の提案等を意図したものではありません。 本レポートは、アイエフシーマーケットが信頼できると思われる情報にもとづき作成したものですが、次の点に十分ご留意ください。アイエフシーマーケットおよび当社は、本レポートが提供する情報、分析、予測、取引戦略等の正確性、確実性、完全性、安全性等について一切の保証をしません。アイエフシーマーケットおよび当社は、本レポートを参考にした投資行動が利益を生んだり損失を回避したりすることを保証または約束あるいは言外に暗示するものではありません。アイエフシーマーケットおよび当社は、本レポートに含まれる不確実性、不正確性、不完全性、誤謬、文章上の誤り等に起因して、お客様または第三者が損害(直接的か間接的かを問いません。)を被った場合でも、一切の責任を負いません。