- Education

- Trading CFDs

- Gold Instruments

Gold Instruments

In contrast to traditional gold trading, quoted against the US dollar or the euro, this group includes the following unique instruments, in which gold is quoted against other assets:

Unique Gold Instruments

These brand new trading instruments offer large opportunities for trading and construction of strategies, having new characteristics, due to the specific formation of values of each asset. "Gold Instruments" is a real godsend for technical and system traders as they regularly offer reliable signals to open positions, which are well balanced against risks.

They can also be even used as market sentiment indicators for an in-depth analysis of gold market trends, as their performance may be more evident and pronounced than that of traditional instruments, in periods of instability, when the dynamics of the instruments will considerably differ from periods of rising optimism. It is obvious that the traditional XAUUSD instrument does not always provide the analyst with a complete picture in the market due to existing fluctuations of the US currency amid increasing monetary expansion of the Fed. These are the Gold Instruments which can be used for a more detailed comparative analysis between asset classes.

The quote of each trading instrument reflects the current value of one ounce of gold, the base asset, expressed in the corresponding quoted asset (silver, oil or S&P 500 stock index). In other words the quote shows how many ounces of silver, contracts for oil or contracts for S&P 500 one ounce of gold worth. Finally, when closing a position the investor may gain or lose a number of quoted assets, for example several ounces of silver, a couple barrels of oil or a contract for the stock index, which are then translated into the currency of investor’s balance.

Get More Information about Trading Conditions for Gold Instruments

Profit/loss calculation

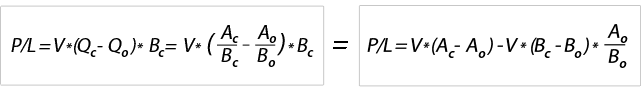

An open position’s profit/loss in US dollars is calculated according to an easy and transparent formula presented below. The formula on the left shows profit/loss calculation for a long position with Gold Instruments. It can be simply proved that the financial result equals exactly the sum of two equivalent operations (formula on the right) with the same assets quoted against the US dollar, with the same volumes, but opposite directions.

where:

P/L - profit or loss;

V - volume;

Qo - “Golden instrument” quote at position’s open;

Qc - “Golden instrument” quote at position’s close;

Ao - US dollar value of base asset at position’s open;

Ac - US dollar value of base asset at position’s close;

Bo - US dollar value of quoted asset at position’s open;

Bc - US dollar value of quoted asset at position’s close.

Profit/loss calculation example for operations with Gold Instruments

Suppose that an investor opens simultaneously two positions at time 1:

- buy 10 ounces of gold at 1500 US dollars per ounce

- sell 750 ounces of silver at 20 US dollars per ounce

Important: dollar value of each position equals 15000 USD.

Suppose that at time 2 the investor closes simultaneously both positions (performs opposite operations):

- sell 10 ounces of gold at 1600 US dollars per ounce

- buy 750 ounces of silver at 21 US dollars per ounce

Profit/loss:

- profit of 1000 US dollars (10*($1600-$1500) = $1000) from operations with gold

- loss of 750 US dollars (-750*($21-$20) = -$750) from operations with silver

Finally investor’s profit is 250 US dollars ($1000-$750).

Suppose that at time 1 (asset prices are derived from the example above mentioned) another investor opens the following position with the Gold Instrument XAUXAG:

- buy 10 ounces of gold at 750 ounces of silver (10*$1500/$20 = 750), the value of 1 ounce of gold equals the value of 75 ounces of silver ($1500/$20)

At time 2 the second investor closes his position (performs opposite operation) with the Gold instrument XAUXAG:

- sell 10 ounces of gold, but now – in exchange of 761.9 ounces of silver (10*$1600/$21 = 761.9), the value of 1 ounce of gold equals the value of 76.19 ounces of silver ($1600/$21)

Profit/loss:

- profit of 250 US dollars ((761.9 ounces of silver – 750 ounces of silver)*$21 = $250).

Both investors have identical financial results despite making different number of operations with different trading instruments. This proves that the profit/loss calculation for Gold Instruments is simple and transparent.

Exactly the same result can be reached using the formulas mentioned in the Gold Instruments description:

V = 10;

Qo = $1500/$20 = 75;

Qc = $1600/$21 = 76.19;

Ao = $1500;

Ac = $1600;

Bo = $20;

Bc = $21.

$250 = 10*(76.19 – 75)*$21 = 10*($1600/$21 – $1500/$20)*21 = 10*($1600 – $1500) – 10*($21 – $20)*$1500/$20 = $250