- Analytics

- Market Overview

Dollar will depend on inflation - 17.4.2015

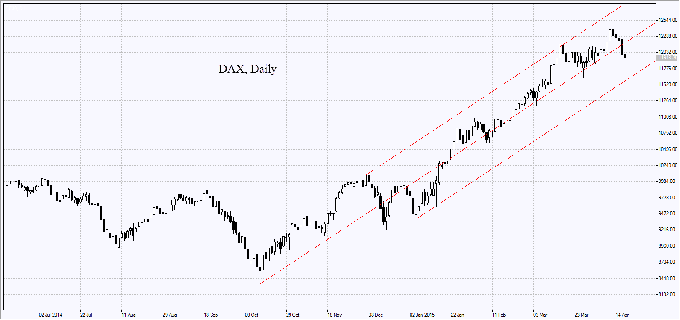

European stocks have been decreasing further on concerns about the default in Greece. We remind that European indexes have added 20% since the beginning of the year. IMF stated that it was not going to grant another delay of payment, which is supposed to be made in May. However, the euro edged higher because Greece still has an opportunity to bargain additional financial aid from the European Union during the negotiations, held on April. 24. To be noted, at the moment the Greek government bonds yield is 12.8% as compared to 0.075% German bonds yield. In our opinion, an exit of Greece from the EU is very likely. Today at 11:00 CET CPI in eurozone will be announced. It is expected to climb, which may lead to the weakening euro.

Nikkei fell together with other global indices. A new financial year started in Japan in April. Market participants anticipate corporate earnings forecasts and quarterly reports. The yen have been strengthening within a mid-term range since the beginning of the week. It should be noted that today G20 central bank presidents and finance ministers will start a 3-day meeting. Their statements may affect major currencies.

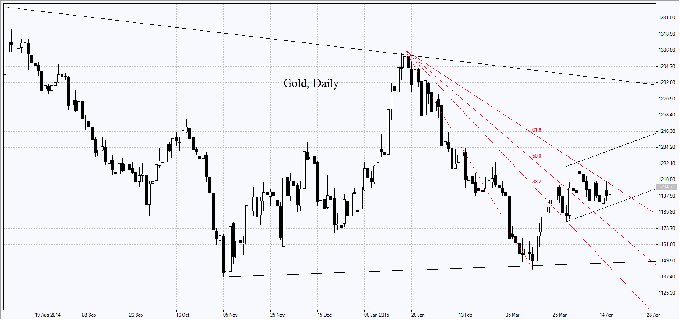

Gold price increased above $1200 per ounce as Fed rate hike became less likely due to weak American statistics. We believe that US CPI data may have an impact on gold quotes. If the inflation appears to be low, precious metal futures are likely to advance further. Gold prices were also underpinned by the news that gold import to India in March jumped to 125 tons as compared to 60 tons the previous year.

Oil have been pulling back today. OPEC reported the production to grow by 810 th. barrels to 30.79 mln. Barrels per day. According to International Energy Agency, oil production in OPEC countries has already reached 31 mln. barrels per day. Many large western oil-trading companies forecasted that the global oversupply will rise to 2.4-2.7 mln. barrels per day and produce pressure on oil quotes. This, however, hasn't yet affected current price dynamics.

See Also