- マーケット分析

- テクニカル分析

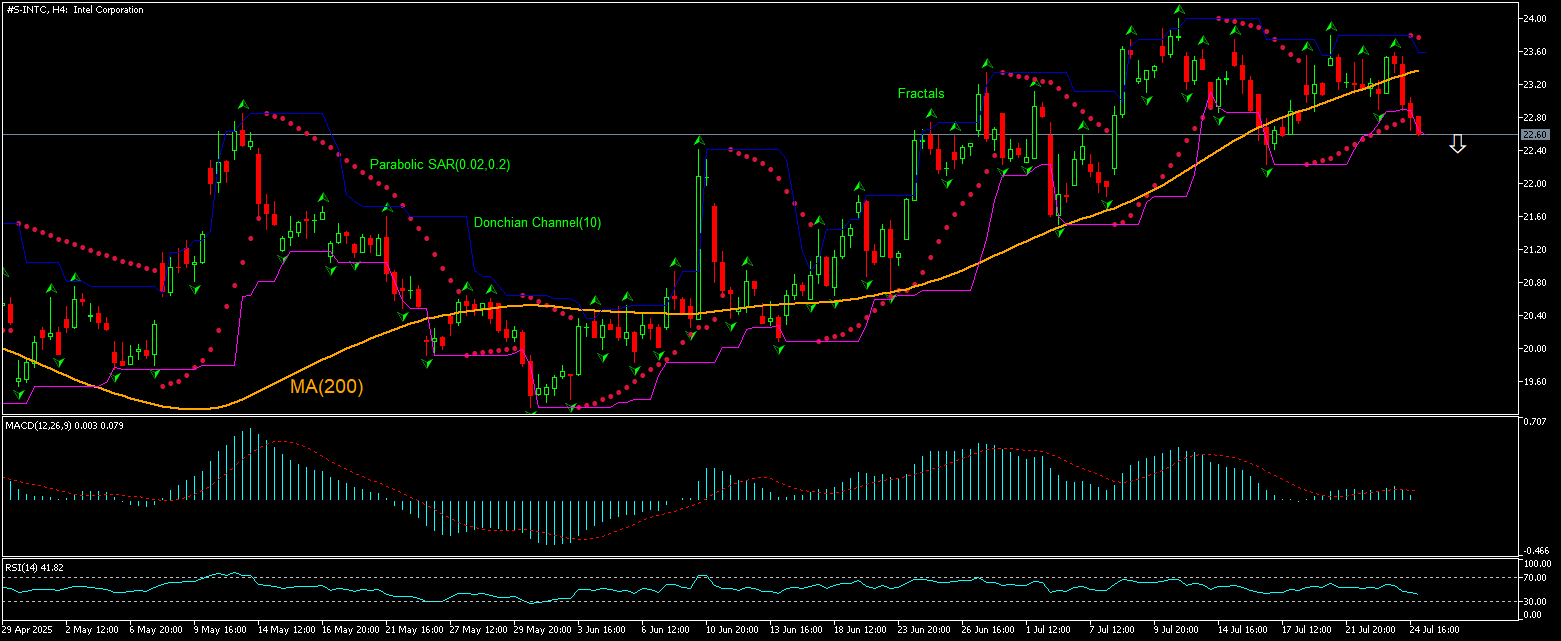

Intel テクニカル分析 - Intel 取引:2025-07-25

Intel テクニカル分析のサマリー

Below 22.58

Sell Stop

Above 23.59

Stop Loss

| インジケーター | シグナル |

| RSI | 横ばい |

| MACD | 売り |

| Donchian Channel | 売り |

| MA(200) | 売り |

| Fractals | 横ばい |

| Parabolic SAR | 売り |

Intel チャート分析

Intel テクニカル分析

The technical analysis of the Intel stock price chart on 4-hour timeframe shows #S-INTC,H4 beached below the 200-period moving average MA(200) which is rising still. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 22.58. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 23.59. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (23.59) without reaching the order (22.58), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

分析 証券 - Intel

Intel stock closed down on Thursday despite the chip maker reporting better than expected Q2 revenue. Will the Intel stock price continue declining?

Yesterday Intel reported Q2 revenue of $12.8 billion against an anticipated revenue of $11.8 billion. The chip maker had posted $12.8 billion in revenue in the same period last year. Intel said it took an $800 million non-cash impairment and accelerated depreciation charges related to "excess tools with no identified re-use" and roughly $200 million one-time period costs for Q2. The company said it will lay off 15% of its work force and expects to have approximately 75,000 employees by the end of the year. The chip maker revealed it has canceled planned projects in Germany and Poland and is slowing construction of its facility in Ohio. And while Intel offered an upbeat Q3 revenue forecast of between $12.6 billion and $13.6 billion, above Wall Street estimate of $12.6 billion, Intel stock closed down on the day as it gave back earlier gains of more than 2%. Despite better than expected second quarter Intel results and an upbeat guidance, continuing uncertainty about Intel’s turnaround remains a serious downside risk for Intel stock price.

【重要な注意事項】:

本レポートは、当社の親会社であるアイエフシーマーケットが作成したものの邦訳です。本レポートには、当社のサービスと商品についての情報を含みますが、お客様の投資目的、財務状況、資金力にかかわらず、情報の提供のみを目的とするものであり、金融商品の勧誘、取引の推奨、売買の提案等を意図したものではありません。 本レポートは、アイエフシーマーケットが信頼できると思われる情報にもとづき作成したものですが、次の点に十分ご留意ください。アイエフシーマーケットおよび当社は、本レポートが提供する情報、分析、予測、取引戦略等の正確性、確実性、完全性、安全性等について一切の保証をしません。アイエフシーマーケットおよび当社は、本レポートを参考にした投資行動が利益を生んだり損失を回避したりすることを保証または約束あるいは言外に暗示するものではありません。アイエフシーマーケットおよび当社は、本レポートに含まれる不確実性、不正確性、不完全性、誤謬、文章上の誤り等に起因して、お客様または第三者が損害(直接的か間接的かを問いません。)を被った場合でも、一切の責任を負いません。