- マーケット分析

- テクニカル分析

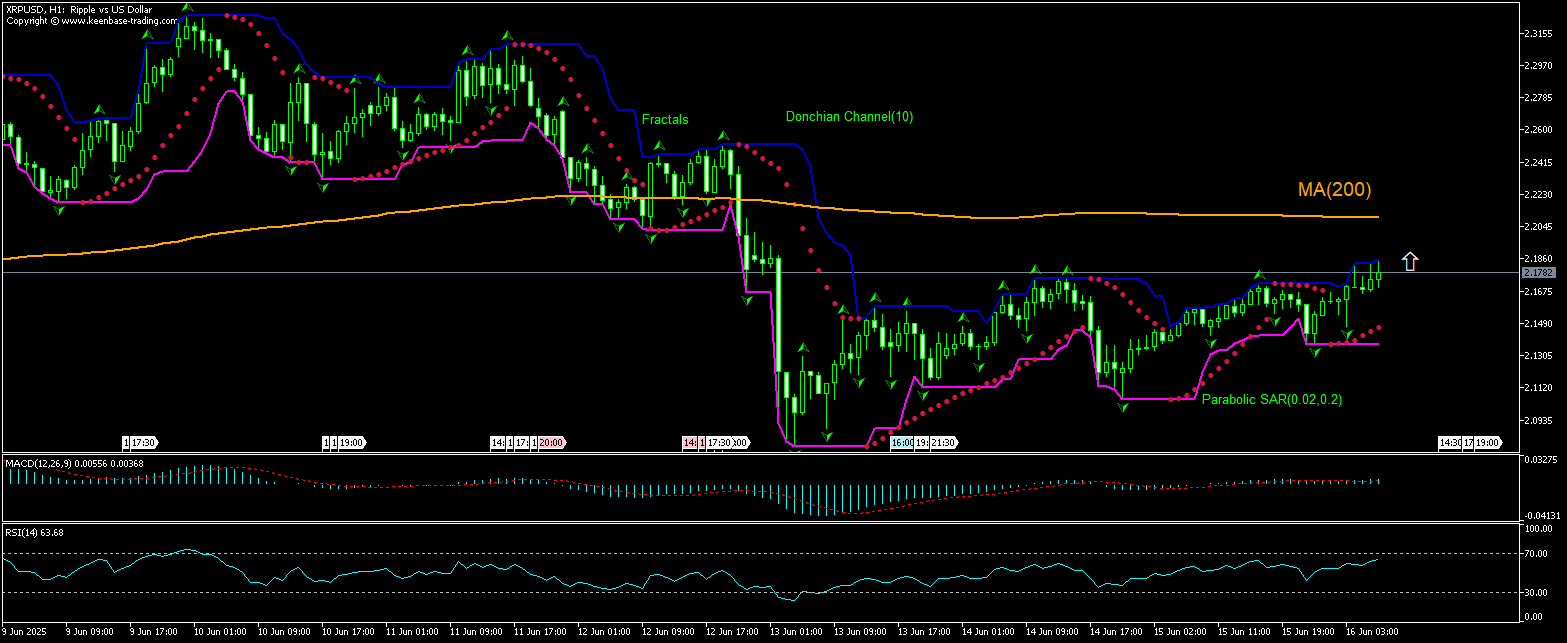

XRPUSD テクニカル分析 - XRPUSD 取引:2025-06-16

XRPUSD テクニカル分析のサマリー

Above 2.1858

Buy Stop

Below 2.1499

Stop Loss

| インジケーター | シグナル |

| RSI | 横ばい |

| MACD | 買い |

| Donchian Channel | 買い |

| MA(200) | 売り |

| Fractals | 買い |

| Parabolic SAR | 買い |

XRPUSD チャート分析

XRPUSD テクニカル分析

The XRPUSD technical analysis of the price chart on 1-hour timeframe shows XRPUSD,H1 is retracing up toward the 200-period moving average MA(200) as it rebounds from ten-day low it hit three days ago. We believe the bullish momentum will continue after the price breaches above the upper bound of Donchian channel at 2.1858. A level below this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 2.1499. After placing the order, the stop loss is to be moved to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

分析 クリプト - XRPUSD

Ripple CEO Brad Garlinghouse says XRP is positioned to capture 14% of SWIFT’s cross-border payments market within five years. Will the XRPUSD price continue rebounding?

Ripple CEO says the blockchain-based Ripple Payments system with its XRP and Ripple USD (RLUSD) will benefit from shifting dynamics in payments settlement marklets. The SWIFT Worldwide Interbank Financial Telecommunication (SWIFT), which has long dominated the interbank communication and settlement space, is used as a tool for two main purposes: secure messaging and payment settlement. Garlonghouse says SWIFT’s model relies on multiple intermediaries, manual processes, and often inconsistent messaging standards. Its procedures are vulnerable to errors as a typo in an account number, an incorrect SWIFT code or incomplete payment instructions can all cause a transaction to fail. The model has high fees and slow settlement times. Ripple promotes its blockchain-based Ripple Payments system as an advanced alternative, leveraging XRP and the Ripple USD (RLUSD) stablecoin to offer real-time, transparent, and lower-cost settlements across borders. The crypto firm claims its platform has access to over 90% of the world’s FX markets as it seeks to reduce operational risks. Expectations of winning higher share of cross-border payments market are bullish for XRPUSD price.

【重要な注意事項】:

本レポートは、当社の親会社であるアイエフシーマーケットが作成したものの邦訳です。本レポートには、当社のサービスと商品についての情報を含みますが、お客様の投資目的、財務状況、資金力にかかわらず、情報の提供のみを目的とするものであり、金融商品の勧誘、取引の推奨、売買の提案等を意図したものではありません。 本レポートは、アイエフシーマーケットが信頼できると思われる情報にもとづき作成したものですが、次の点に十分ご留意ください。アイエフシーマーケットおよび当社は、本レポートが提供する情報、分析、予測、取引戦略等の正確性、確実性、完全性、安全性等について一切の保証をしません。アイエフシーマーケットおよび当社は、本レポートを参考にした投資行動が利益を生んだり損失を回避したりすることを保証または約束あるいは言外に暗示するものではありません。アイエフシーマーケットおよび当社は、本レポートに含まれる不確実性、不正確性、不完全性、誤謬、文章上の誤り等に起因して、お客様または第三者が損害(直接的か間接的かを問いません。)を被った場合でも、一切の責任を負いません。