- マーケット分析

- 値上がり率と値下がり率

Top Gainers and Losers: Japanese Yen and Turkish Lira

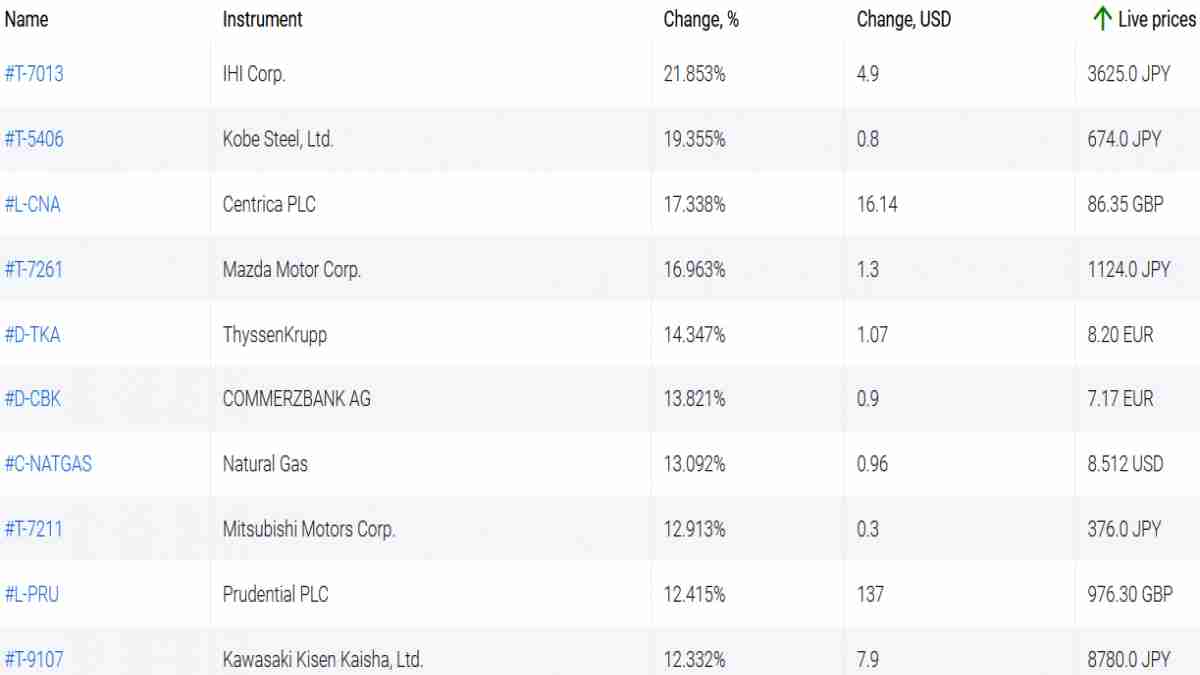

Top Gainers - global market

Top Gainers - global market

Over the past 7 days, the US dollar index has dropped significantly. Investors were disappointed that inflation fell very slightly in April - to 8.3% y/y from 8.5% in March. At the same time, the profitability of U.S. 10-Year Bond over the past 10 days has fallen quite noticeably - to 2.8% per annum from 3.2%. An additional negative was the increase in the number of new unemployed (United States Initial Jobless Claims) for the week. However, the US dollar did not fall into the loss leaders due to the fact that the euro and the currencies of European countries felt even worse against the backdrop of the ongoing conflict in Ukraine. The Norwegian krone weakened after negative Norway Goods Trade Balance data in April. In addition, a weak GDP for the 1st quarter was published there last week. Danish GDP in the 1st quarter also turned out to be worse than expected. The weakening of the Turkish lira is supported by high inflation (+70% y/y in April) amid the low rate of the Central Bank of the Republic of Turkey (+14%). The Russian ruble continued to strengthen after Russia's decision to sell some natural raw materials for rubles. Strengthening of the Japanese yen was facilitated by good economic indicators. The increase in Japan Core Machinery Orders in March exceeded the forecast. Japanese exports continued to grow in April (+12.5% y/y).

1.IHI Corporation, +21,9% – Japanese aircraft engine manufacturer.

2. Kobe Steel, Ltd., +19,4% – Japanese steel company.

Top Losers - global market

Top Losers - global market

1. Canadian Imperial Bank of Commerce (CIBC) – Canadian bank.

2. Twitter – American social network.

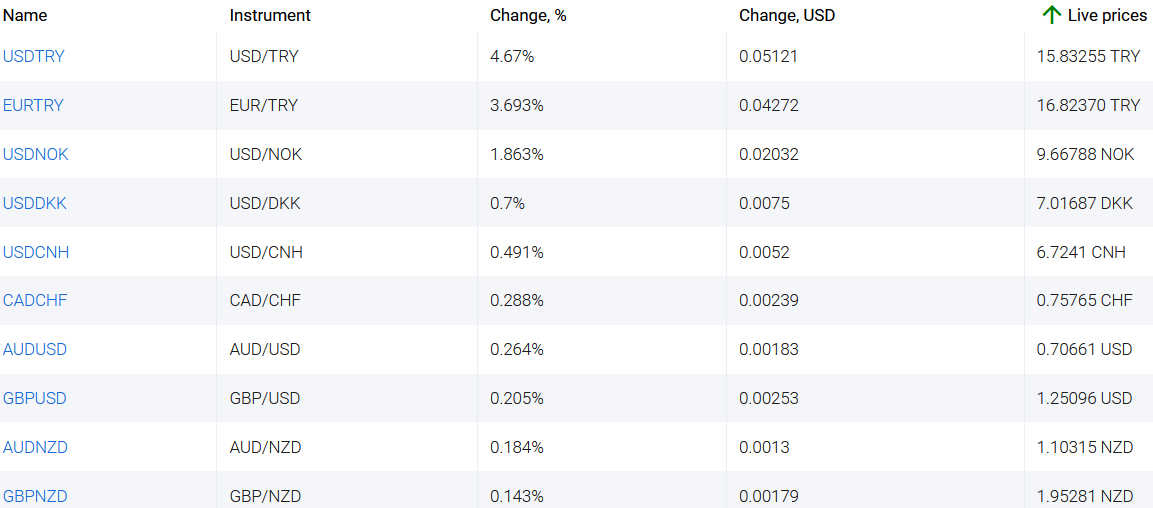

Top Gainers - foreign exchange market (Forex)

Top Gainers - foreign exchange market (Forex)

1. EURTRY, USDTRY - the growth in these charts means the strengthening of the euro and the US dollar against the Turkish lira.

2. USDNOK, USDDKK - the growth in these charts means the weakening of the Norwegian krone and the Danish krone against the US dollar.

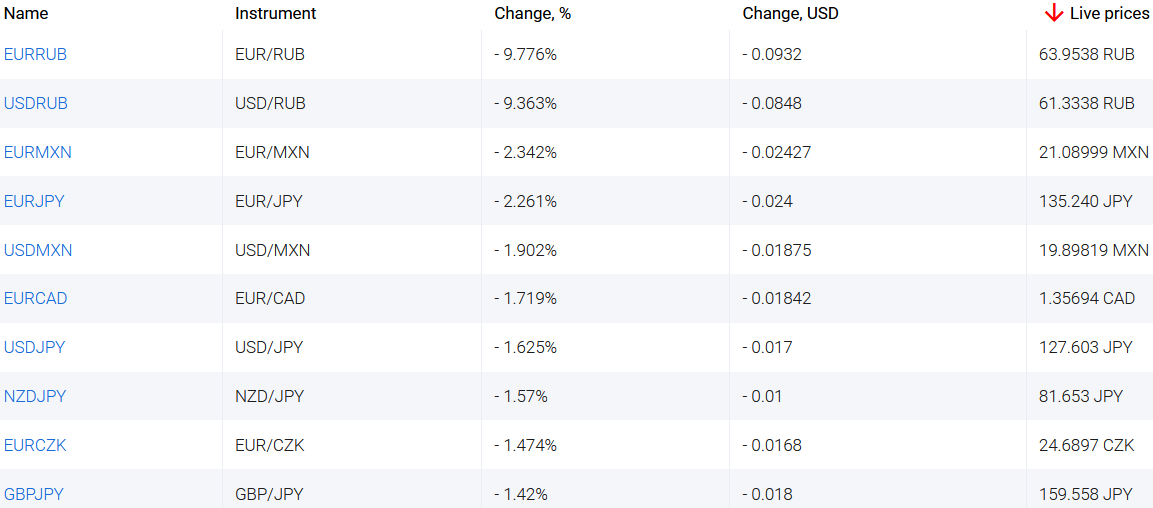

Top Losers - foreign exchange market (Forex)

Top Losers - foreign exchange market (Forex)

1. USDRUB, EURRUB - the decline in these charts means the weakening of the US dollar and the euro against the Russian ruble.

2. EURMXN, EURJPY - the decline in these charts means the strengthening of the Japanese yen and the Mexican peso against the euro.

【重要な注意事項】:

本レポートは、当社の親会社であるアイエフシーマーケットが作成したものの邦訳です。本レポートには、当社のサービスと商品についての情報を含みますが、お客様の投資目的、財務状況、資金力にかかわらず、情報の提供のみを目的とするものであり、金融商品の勧誘、取引の推奨、売買の提案等を意図したものではありません。 本レポートは、アイエフシーマーケットが信頼できると思われる情報にもとづき作成したものですが、次の点に十分ご留意ください。アイエフシーマーケットおよび当社は、本レポートが提供する情報、分析、予測、取引戦略等の正確性、確実性、完全性、安全性等について一切の保証をしません。アイエフシーマーケットおよび当社は、本レポートを参考にした投資行動が利益を生んだり損失を回避したりすることを保証または約束あるいは言外に暗示するものではありません。アイエフシーマーケットおよび当社は、本レポートに含まれる不確実性、不正確性、不完全性、誤謬、文章上の誤り等に起因して、お客様または第三者が損害(直接的か間接的かを問いません。)を被った場合でも、一切の責任を負いません。

過去の安値・高値

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...