- マーケット分析

- 値上がり率と値下がり率

Top Gainers and Losers: Swiss Franc and Australian Dollar

Top Gainers - global market

Top Gainers - global market

Over the past 7 days, the US dollar index has remained almost unchanged. Investors were disappointed by the increase in United States Unemployment in February to 3.6% from 3.4% in January. The probability of a Fed rate hike (4.75%) by 0.5% at the March 22 meeting fell to 48%, compared to over 70% in the middle of last week. This weakened the US dollar on Friday, but it was still able to maintain growth against some currencies over the past week. The Swiss franc strengthened in anticipation of further tightening of monetary policy by the Swiss National Bank (1%) at its meeting on March 23. This was helped by the increase in the Switzerland Consumer Price Index in February by 3.4% y/y, with most market participants expecting inflation to decrease to 2.9% y/y. The Australian dollar weakened as investors decided that the Reserve Bank of Australia's 0.25% rate hike to 3.6% from 3.35% may not be enough given the inflation rate of +7.8% y/y in the fourth quarter of 2022. The New Zealand dollar also demonstrated a weakening, along with the Australian dollar. This was compounded by the decrease in New Zealand Manufacturing Sales by -4.7% q/q in the fourth quarter of 2022, after a growth of +2.6% in the third quarter. It is worth noting that on March 16, New Zealand GDP for the fourth quarter will be published, which theoretically, after the decrease in sales, may also disappoint investors. Cryptocurrencies fell in price amid difficulties in the operations of the cryptocurrency company Silvergate.

1. China Communications Construction Company Limited, +17.1% – Chinese construction company

2. Kobe Steel, Ltd, +16.8% – Japanese steel company

Top Losers - global market

Top Losers - global market

1. DASHUSD – DASH (DSH) cryptocurrency

2. ZECUSD – Zcash (ZEC) cryptocurrency.

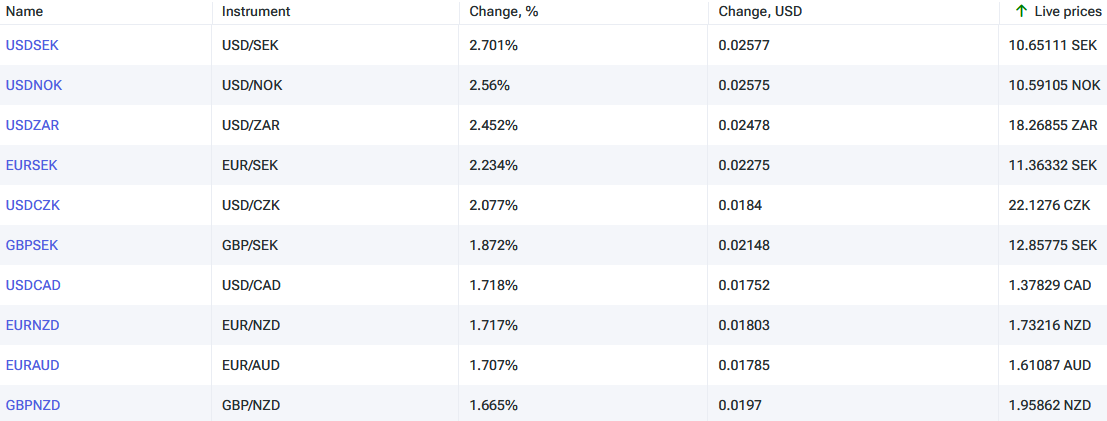

Top Gainers - foreign exchange market (Forex)

Top Gainers - foreign exchange market (Forex)

1. USDSEK, EURSEK - the growth in these charts means the strengthening of the US dollar and euro against the Swedish krona.

2. USDZAR, USDNOK - the growth in these charts means the weakening of the South African franc and the Norwegian krone against the US dollar.

Top Losers - foreign exchange market (Forex)

Top Losers - foreign exchange market (Forex)

1. NZDCHF, AUDCHF - the decline in these charts means the weakening of the New Zealand and Australian dollars against the Swiss franc.

2. AUDUSD, NZDUSD - the decline in these charts means the strengthening of the US dollar against the Australian New Zealand dollar.

【重要な注意事項】:

本レポートは、当社の親会社であるアイエフシーマーケットが作成したものの邦訳です。本レポートには、当社のサービスと商品についての情報を含みますが、お客様の投資目的、財務状況、資金力にかかわらず、情報の提供のみを目的とするものであり、金融商品の勧誘、取引の推奨、売買の提案等を意図したものではありません。 本レポートは、アイエフシーマーケットが信頼できると思われる情報にもとづき作成したものですが、次の点に十分ご留意ください。アイエフシーマーケットおよび当社は、本レポートが提供する情報、分析、予測、取引戦略等の正確性、確実性、完全性、安全性等について一切の保証をしません。アイエフシーマーケットおよび当社は、本レポートを参考にした投資行動が利益を生んだり損失を回避したりすることを保証または約束あるいは言外に暗示するものではありません。アイエフシーマーケットおよび当社は、本レポートに含まれる不確実性、不正確性、不完全性、誤謬、文章上の誤り等に起因して、お客様または第三者が損害(直接的か間接的かを問いません。)を被った場合でも、一切の責任を負いません。

過去の安値・高値

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...