- マーケット分析

- テクニカル分析

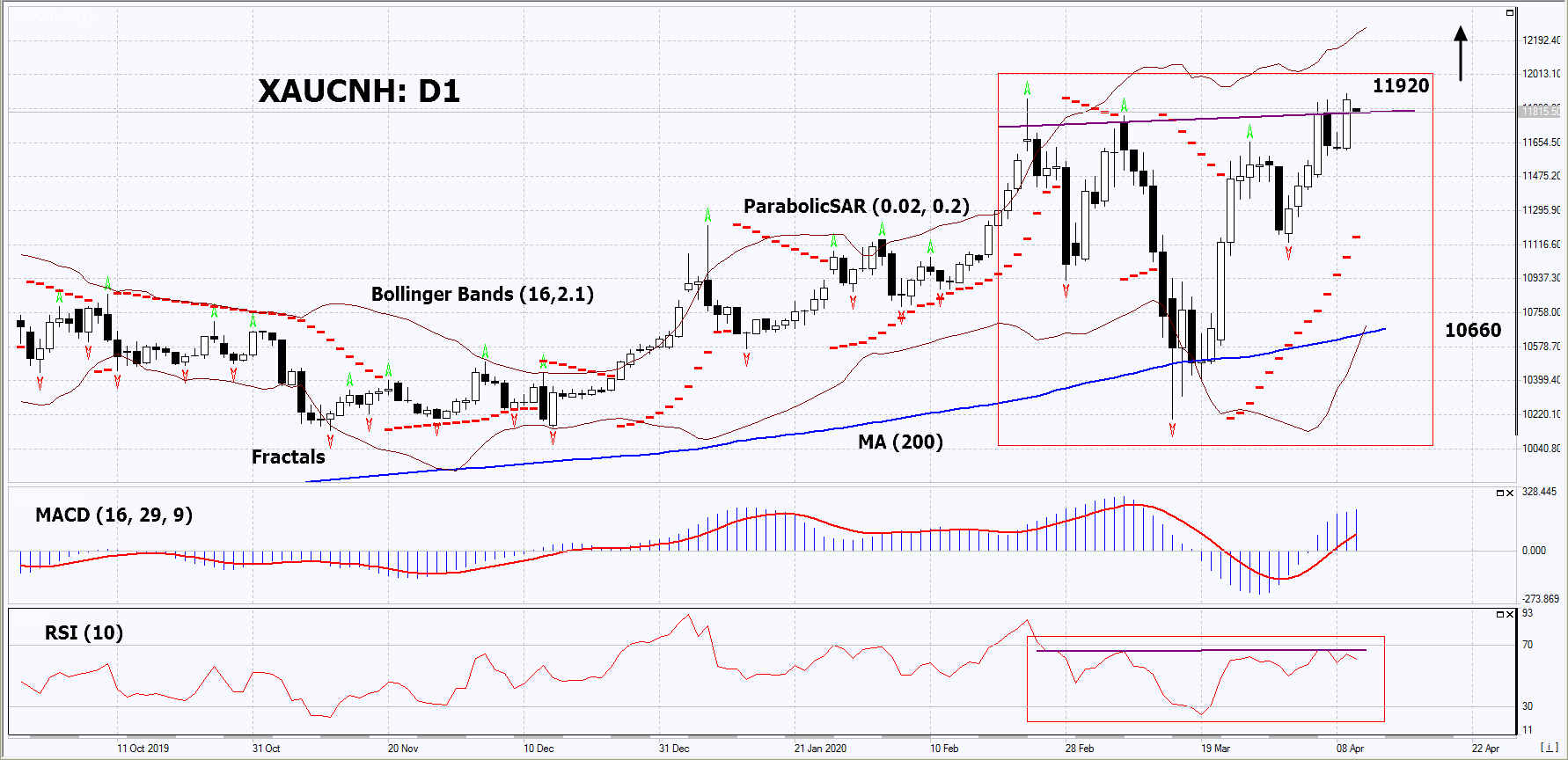

ゴルド対人民元 テクニカル分析 - ゴルド対人民元 取引:2020-04-13

ゴルド対人民元 テクニカル分析のサマリー

Above 11920

Buy Stop

Below 10660

Stop Loss

| インジケーター | シグナル |

| RSI | 横ばい |

| MACD | 買い |

| MA(200) | 買い |

| Fractals | 横ばい |

| Parabolic SAR | 買い |

| Bollinger Bands | 買い |

ゴルド対人民元 チャート分析

ゴルド対人民元 テクニカル分析

On the daily timeframe, XAUCNH: D1 formed the "Inverse Head And Shoulders" graphical price pattern. It may turn out to be a signal of the continuation of the upward trend, and not its reversal. The "Head", or the top of the pattern, leans on the 200-day moving average line. A number of indicators of technical analysis formed signals for the further increase. We do not exclude the bullish movement if XAUCNH rises above its last high and the maximum since September 2011: 11920. This level can be used as an entry point. The stop loss is possible below the Parabolic signal, the last lower fractal, the 200-day moving average and the lower Bollinger lines: 10660. After opening the pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit / loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop loss, moving it in the direction of the trend. If the price overcomes the stop level (10660) without activating the order (11920), it is recommended to delete the order: market sustains internal changes that have not been taken into account.

分析 PCI - ゴルド対人民元

In this review, we propose to consider the “Gold vs Yuan” Personal Composite Instrument (PCI). It increases with the rise in the gold prices in the world market and the weakening of the Chinese currency. Can XAUCNH quotes rise?

There are two main factors of demand for precious metals. First of all, they are the risks of a global economic downturn due to the coronavirus pandemic. For example, the international bank JPMorgan Chase estimated the loss of the global economy at $ 5.5 trillion within the next 2 years. The Institute of International Finance expects the world trade reduces by 30% this year. Earlier negative forecasts were issued by OECD, S&P Global Ratings and many others. The second important factor making gold attractive may be the risks of the world major currencies weakening due to an increase in their emissions. The Fed, the ECB, the Bank of England, the Bank of Japan and most other central banks announced stimulus programs for their economies affected by Covid-19. In the US, economic assistance will exceed $ 2 trillion, in the EU - 540 billion euros, etc. Against this background, gold may be in high demand as a protective asset. In turn, the depreciation of the yuan may be caused by lower rates of the Chinese Central Bank and the decrease in the world trade. Next week, important macroeconomic data able to affect the dynamics of XAUCNH will come out in China. Trade balance for March will be published on April 14. And the Chinese GDP for the 1st quarter will come out on April 17.

【重要な注意事項】:

本レポートは、当社の親会社であるアイエフシーマーケットが作成したものの邦訳です。本レポートには、当社のサービスと商品についての情報を含みますが、お客様の投資目的、財務状況、資金力にかかわらず、情報の提供のみを目的とするものであり、金融商品の勧誘、取引の推奨、売買の提案等を意図したものではありません。 本レポートは、アイエフシーマーケットが信頼できると思われる情報にもとづき作成したものですが、次の点に十分ご留意ください。アイエフシーマーケットおよび当社は、本レポートが提供する情報、分析、予測、取引戦略等の正確性、確実性、完全性、安全性等について一切の保証をしません。アイエフシーマーケットおよび当社は、本レポートを参考にした投資行動が利益を生んだり損失を回避したりすることを保証または約束あるいは言外に暗示するものではありません。アイエフシーマーケットおよび当社は、本レポートに含まれる不確実性、不正確性、不完全性、誤謬、文章上の誤り等に起因して、お客様または第三者が損害(直接的か間接的かを問いません。)を被った場合でも、一切の責任を負いません。