- Analýza

- Technická analýza

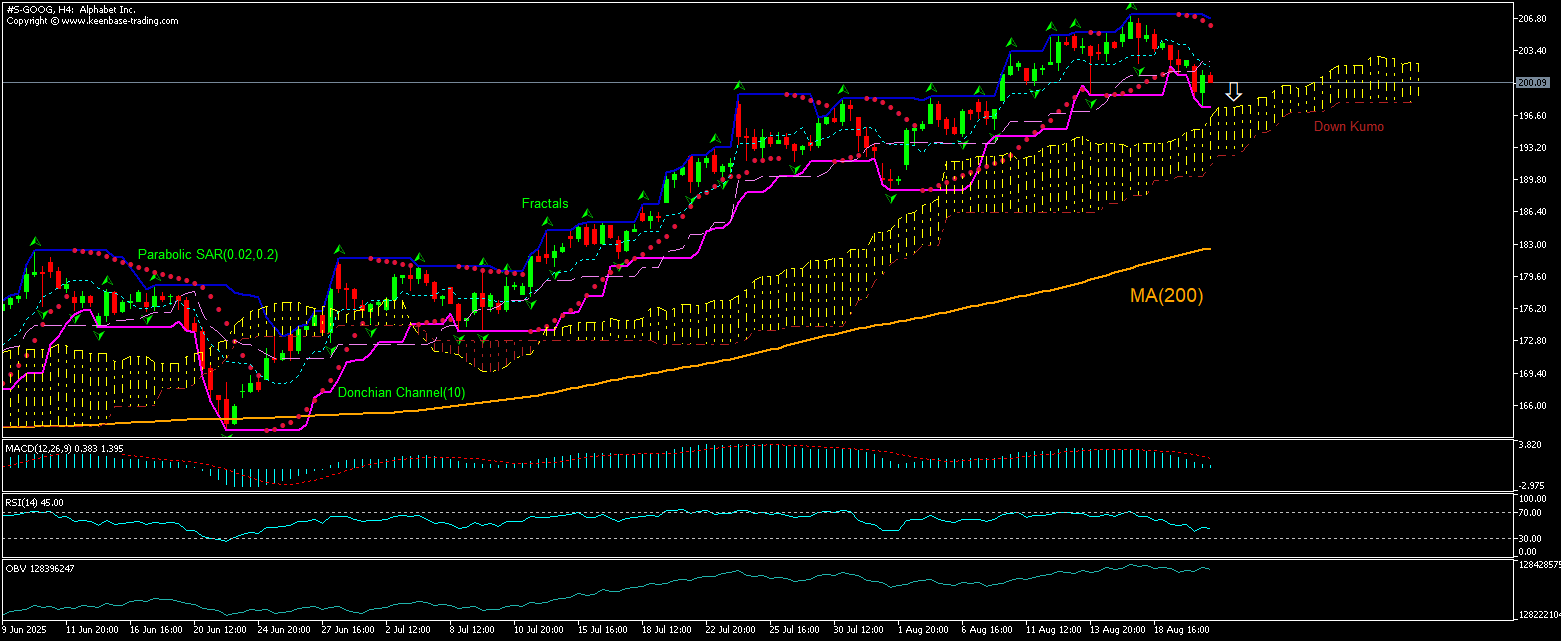

Alphabet Technická analýza - Alphabet Obchodování: 2025-08-21

Alphabet Technical Analysis Summary

níže 197.39

Sell Stop

výše 206.08

Stop Loss

| Indicator | Signal |

| RSI | Neutrální |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | Neutrální |

| Parabolic SAR | Sell |

| On Balance Volume | Sell |

| Ichimoku Kinko Hyo | Buy |

Alphabet Chart Analysis

Alphabet Technická analýza

The technical analysis of the GOOGLE stock price chart on 4-hour timeframe shows #S-GOOG,H4 is retreating down toward the 200-period moving average MA(200) after rebounding to six-month high six days ago. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 197.39. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 206.08. After placing the order, the stop loss is to be moved every day to the fractal high indicator following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (206.08) without reaching the order (197.39), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentální analýza Akcie - Alphabet

Alphabet stock continued declining after the company revised its Google Play terms. Will the GOOGLE stock price retreating reverse?

The stock of Alphabet, Google’s parent company, fell 1.14% on Wednesday after reports the company is updating its External Offers Program for the European Union with revised fees and more options for Android developers. Alphabet has made updates to its external offers program to offer more flexibility for developers as part of its continued compliance with the EU Digital Markets Act, or DMA. In March, the EU competition watchdog found Google failed to comply with the region's DMA for two services. The Commission alleged that parent Alphabet treats Google Shopping, Hotels, Flights, etc., "more favorably" in search results versus services offered by third parties and gives "more prominent treatment" to its own offerings. Furthermore, the EC said the company's app store Google Play prevents developers from steering customers to offers and distribution channels of their choice and unjustly charges them for customer acquisition. Revised Google Play terms are designed to make it easier for app developers to steer customers to platforms other than Google after the European Commission found that the company allegedly breached EU's rules. Developers must meet eligibility requirements, and complete their enrollment in this program before promoting external offers. Revision of search results terms that will restrict the favorable treatment of services offered by Google versus services offered by third parties is bearish for Google stock price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Poznámka:

Tento přehled má informativně poznávací charakter a publikuje se zdarma. Všechny údaje, uvedené v přehledu, jsou získány z otevřených zdrojů, jsou uznávány více méně spolehlivé. Přitom, neexistují žádné garance, že uvedená informace je úplná a přesná. Přehledy se v budoucnu neobnovují. Veškerá informace v každém přehledu, včetně názorů, ukazatelů, grafů, je pouze poskytována a není finančním poradenstvím nebo doporučením. Celý text nebo jeho jakákoliv část a také grafy nelze považovat za nabídku provádět nějaké transakce s jakýmikoliv aktivy. Společnost IFC Markets a její zaměstnanci za žádných okolností nemají žádnou odpovědnost za jakékoli kroky učiněné kýmkoliv po nebo v průběhu seznámení s přehledem.