- Analýza

- Technická analýza

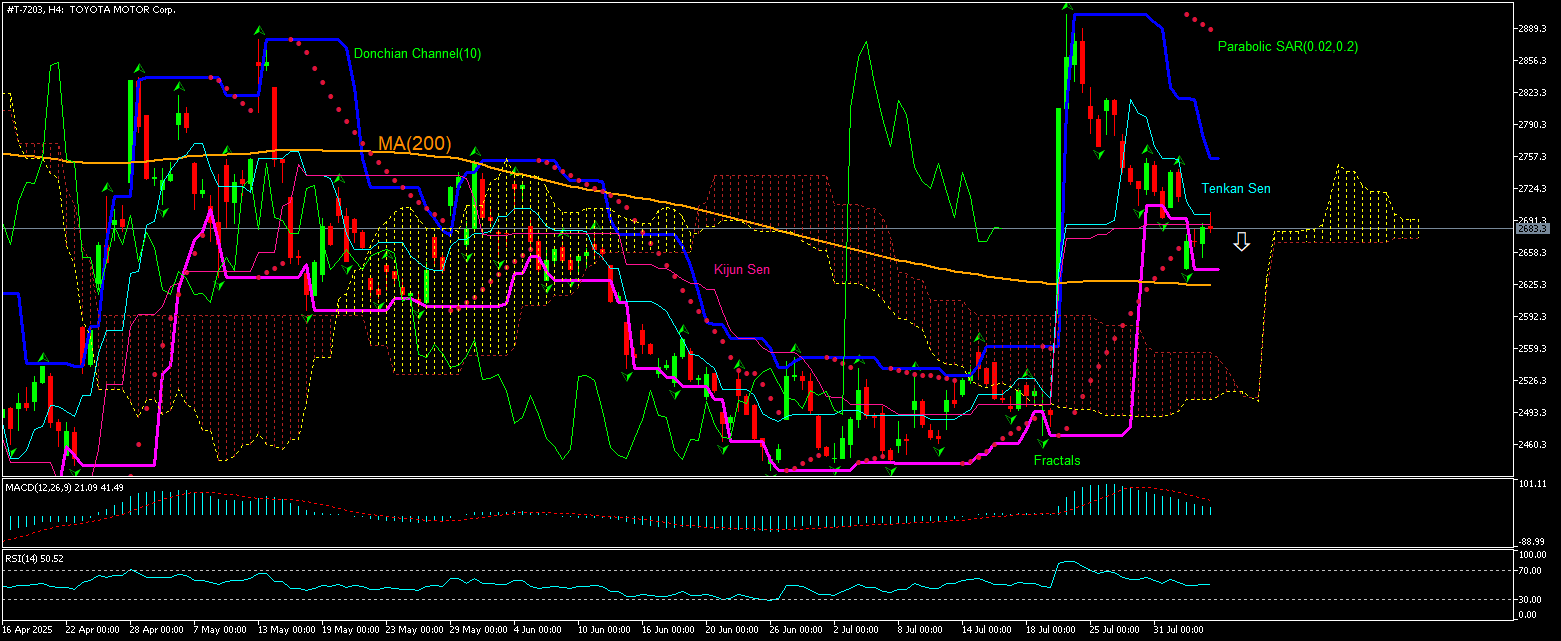

TOYOTA MOTOR Corp. Technická analýza - TOYOTA MOTOR Corp. Obchodování: 2025-08-05

TOYOTA MOTOR Corp. Technical Analysis Summary

níže 2640.3

Sell Stop

výše 2754.8

Stop Loss

| Indicator | Signal |

| RSI | Neutrální |

| MACD | Sell |

| Donchian Channel | Neutrální |

| MA(200) | Buy |

| Fractals | Sell |

| Parabolic SAR | Sell |

| Ichimoku Kinko Hyo | Sell |

TOYOTA MOTOR Corp. Chart Analysis

TOYOTA MOTOR Corp. Technická analýza

The technical analysis of the Toyota Motor stock price chart on 4-hour timeframe shows #S-TM,H4 is retracing lower after rebounding to five-month high above the 200-period moving average MA(200) two weeks ago. We believe the bearish momentum will resume after the price breaches below the lower bound of Donchian channel at 2640.3. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 2754.8. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (2754.8) without reaching the order (3640.3), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentální analýza Akcie - TOYOTA MOTOR Corp.

Toyota Motor is expected to report first-quarter profit drop. Will the Toyota Motor stock price continue retracing lower?

Toyota Motor is expected to report first-quarter profit drop when it announces its earnings this week. Japanese automakers face growing uncertainty in the US with tariffs on imports expected to push up vehicle prices and testing the consumer demand. The company faces the prospect of 15% tariffs on Japanese auto imports into the US. Toyota's global sales rose 5.5% over the first half of the year supported by strong demand for petrol-electric hybrids which typically carry higher margins than conventional petrol cars. Compared to the 4.89 million units sold during the same period the previous year, global sales increased to 5.16 million units. North America, the second-largest market, contributed 1.44 million units, representing a 4.2% over year increase. Toyota’s largest market, Asia, had a 5.4% increase, hitting 1.54 million units. Its Camry and Sienna hybrids remain strong sellers in the US. However, the world's largest automaker is expected nonetheless to report on Thursday a 31% over year operating profit decline to 902 billion yen ($6.14 billion), according to the average of seven analyst estimates in a London Stock Exchange Group poll. Expectations of lower profit are bearish for Toyota stock price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Poznámka:

Tento přehled má informativně poznávací charakter a publikuje se zdarma. Všechny údaje, uvedené v přehledu, jsou získány z otevřených zdrojů, jsou uznávány více méně spolehlivé. Přitom, neexistují žádné garance, že uvedená informace je úplná a přesná. Přehledy se v budoucnu neobnovují. Veškerá informace v každém přehledu, včetně názorů, ukazatelů, grafů, je pouze poskytována a není finančním poradenstvím nebo doporučením. Celý text nebo jeho jakákoliv část a také grafy nelze považovat za nabídku provádět nějaké transakce s jakýmikoliv aktivy. Společnost IFC Markets a její zaměstnanci za žádných okolností nemají žádnou odpovědnost za jakékoli kroky učiněné kýmkoliv po nebo v průběhu seznámení s přehledem.