- Analýza

- Technická analýza

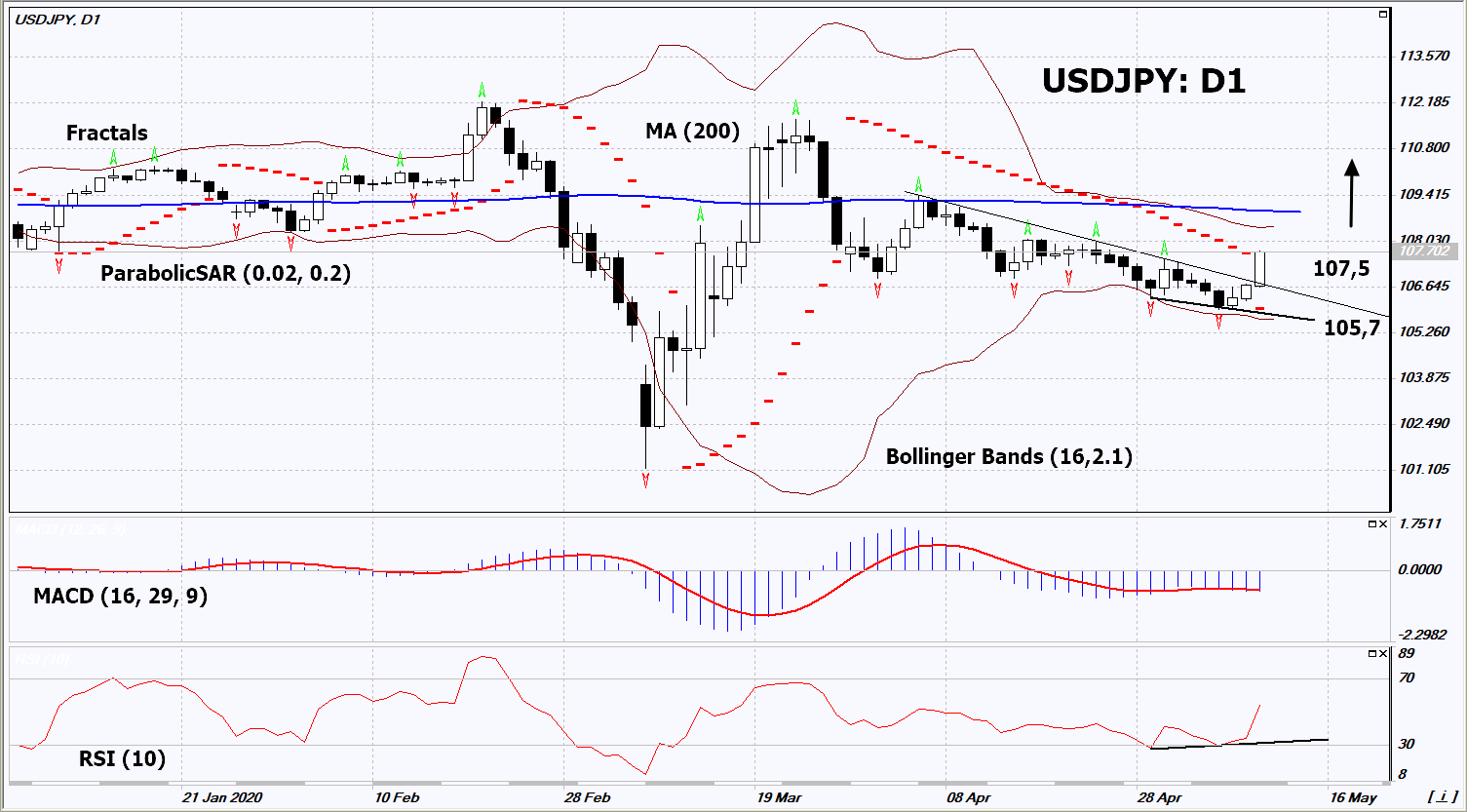

USD/JPY Technická analýza - USD/JPY Obchodování: 2020-05-12

USD/JPY Technical Analysis Summary

výše 107.5

Buy Stop

níže 105.7

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Neutrální |

| MA(200) | Neutrální |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

USD/JPY Chart Analysis

USD/JPY Technická analýza

On the daily timeframe, USDJPY: D1 breached up the resistance line of the short-term downtrend. A number of indicators of technical analysis formed signals for a further increase. We do not exclude a bullish movement if USDJPY rises above its last maximum: 107.5. This level can be used as an entry point. We can set a stop loss below the Parabolic signal, the last lower fractal and the lower Bollinger line: 105.7. After opening the pending order, we move the stop loss after the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit / loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop level (105.7) without activating the order (107.5), it is recommended to delete the order: some internal changes in the market have not been taken into account.

Fundamentální analýza Forex - USD/JPY

April data on the US labor market were better than expected. This contributed to an increase in the dollar index. Will USDJPY quotes grow?

The upward movement means the weakening of the Japanese yen against the US dollar. The yen is included in the dollar index. Previously, the Japanese currency, along with the Swiss franc and gold, was in demand as a protective asset against the backdrop of global risks due to the Covid-19 pandemic. Several countries (France, Japan, New Zealand, Britain, and others) reported a decrease in the number of patients and the mitigation of quarantine measures. The US dollar is in good demand due to positive unemployment data for April and Non Farm Payrolls. They were better than expected. At the same time, the Japanese economic indicator Jibun Bank Composite PMI for April was worse than expected. This week important economic indicators such as Consumer Price, Retail Sales and Industrial Production will be published in the US. In Japan, Eco Watchers Survey, Machine Tool Orders, and Current Account will be released. All of this may affect the dynamics of USDJPY. On Wednesday, Jerome Powell, the head of the United States Federal Reserve, will give a speech. On Monday, the head of the Chicago Federal Reserve Bank (Chicago FRB) Charles Evans said that he does not expect negative Fed rates and a noticeable increase in inflation. Note that according to the American Commodity Futures Trading Commission (CFTC), demand for US dollars (net long) has been growing for the 7th week in a row and peaked in 2 months.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Poznámka:

Tento přehled má informativně poznávací charakter a publikuje se zdarma. Všechny údaje, uvedené v přehledu, jsou získány z otevřených zdrojů, jsou uznávány více méně spolehlivé. Přitom, neexistují žádné garance, že uvedená informace je úplná a přesná. Přehledy se v budoucnu neobnovují. Veškerá informace v každém přehledu, včetně názorů, ukazatelů, grafů, je pouze poskytována a není finančním poradenstvím nebo doporučením. Celý text nebo jeho jakákoliv část a také grafy nelze považovat za nabídku provádět nějaké transakce s jakýmikoliv aktivy. Společnost IFC Markets a její zaměstnanci za žádných okolností nemají žádnou odpovědnost za jakékoli kroky učiněné kýmkoliv po nebo v průběhu seznámení s přehledem.