- Analýza

- Technická analýza

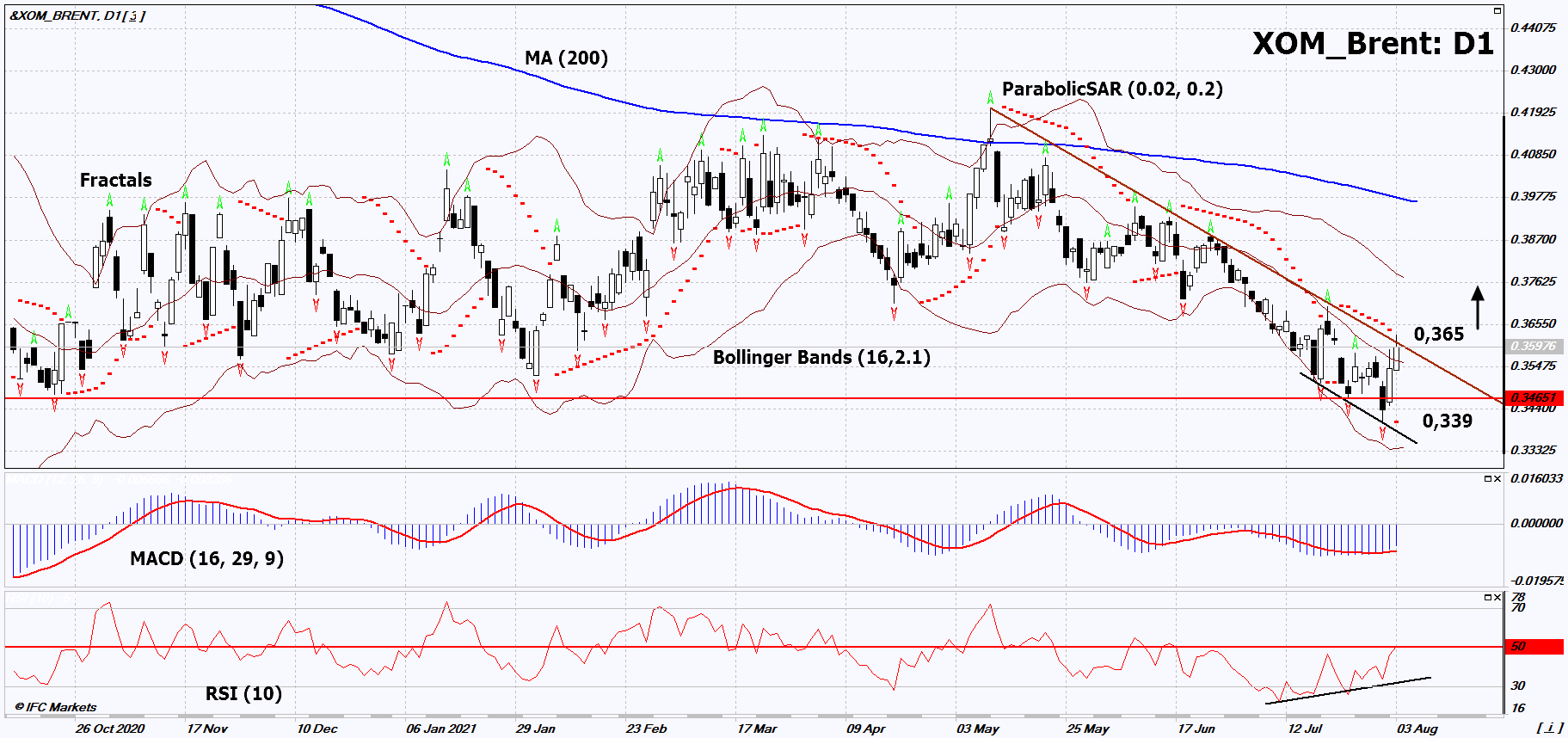

Акции Exxon Mobil proti Brent Technická analýza - Акции Exxon Mobil proti Brent Obchodování: 2021-08-04

Акции Exxon Mobil proti Brent Technical Analysis Summary

výše 0.365

Buy Stop

níže 0.339

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Buy |

| MA(200) | Neutrální |

| Fractals | Neutrální |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutrální |

Акции Exxon Mobil proti Brent Chart Analysis

Акции Exxon Mobil proti Brent Technická analýza

On the daily timeframe, XOM_Brent: D1 approached the downtrend resistance line. It must be broken upward before opening a position. A number of technical analysis indicators have generated signals for further growth. We do not rule out a bullish movement if XOM_Brent rises above its last high: 0.365. This level can be used as an entry point. Initial risk limitation is possible below the Parabolic signal, the low since October 2013 and the last down fractal: 0.339. After opening a pending order, move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit / loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (0.365) without activating the order (0.339), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamentální analýza PCI - Акции Exxon Mobil proti Brent

In this review, we suggest looking at the XOM_Brent personal composite tool (PCI). It reflects the price action of the shares of the American oil company Exxon Mobil Corporation against the deliverable futures for Brent crude oil. Will the XOM_Brent quotes rise?

The growth of this PCI means that Exxon Mobil shares are appreciating faster than oil. The company's 2Q2021 financials were better than expected. Earnings per share amounted to $ 1.1 against the forecast of $ 0.97. The total profit was $ 4.7 billion. In the 2nd quarter of 2020, the financial result was much worse. The loss per share was $ 0.26, and the total loss was $ 1.1 billion. Exxon Mobil's revenues in the 2nd quarter of 2021 reached $ 67.7 billion and exceeded the forecast of $ 65 billion. the current share price is about 6% per annum. In turn, oil quotes are now declining amid an increase in the number of patients with the new strain of the Delta coronavirus in the United States and China. This can reduce the demand for fuel. Also, expectations of a new round of talks between Iran and Western countries on easing sanctions and the "nuclear deal" have a negative impact on the price of oil. Earlier, Iran was going to increase oil production by 1.5 million barrels per day if the sanctions were lifted.

Poznámka:

Tento přehled má informativně poznávací charakter a publikuje se zdarma. Všechny údaje, uvedené v přehledu, jsou získány z otevřených zdrojů, jsou uznávány více méně spolehlivé. Přitom, neexistují žádné garance, že uvedená informace je úplná a přesná. Přehledy se v budoucnu neobnovují. Veškerá informace v každém přehledu, včetně názorů, ukazatelů, grafů, je pouze poskytována a není finančním poradenstvím nebo doporučením. Celý text nebo jeho jakákoliv část a také grafy nelze považovat za nabídku provádět nějaké transakce s jakýmikoliv aktivy. Společnost IFC Markets a její zaměstnanci za žádných okolností nemají žádnou odpovědnost za jakékoli kroky učiněné kýmkoliv po nebo v průběhu seznámení s přehledem.