- Analýza

- Technická analýza

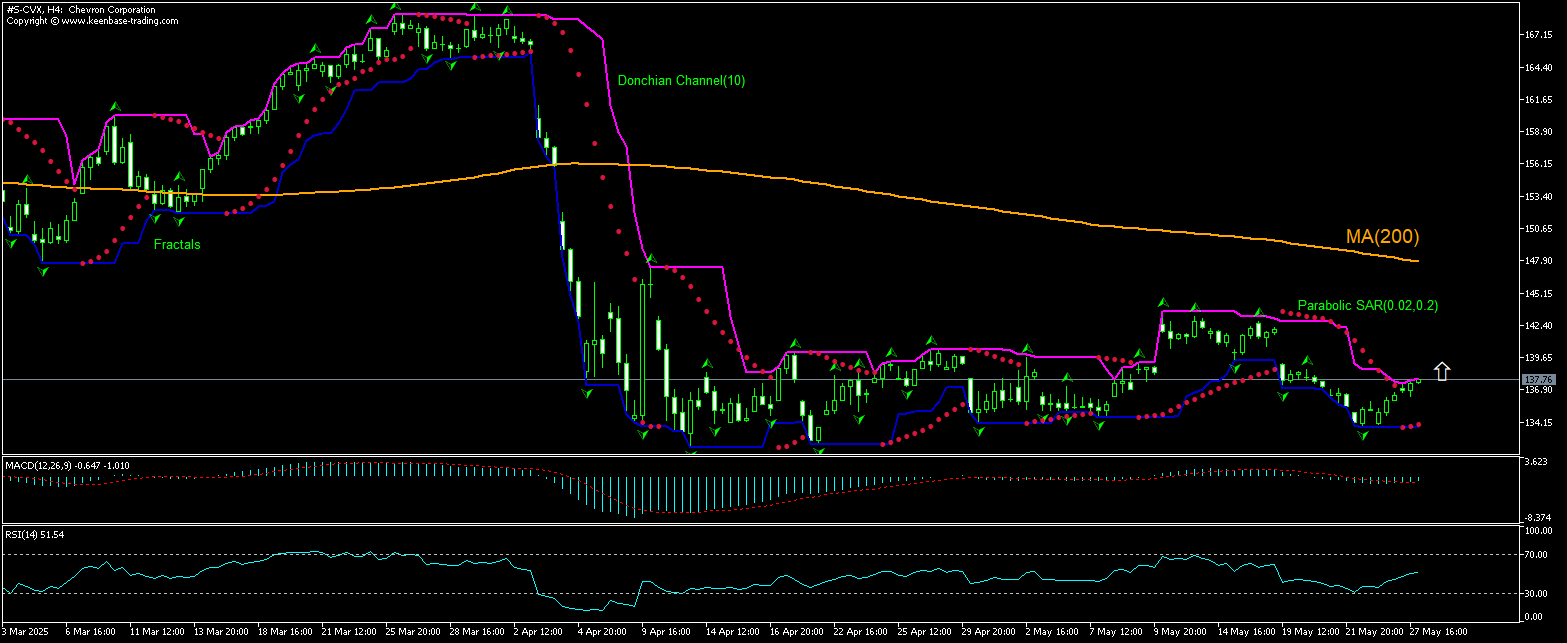

Chevron Technická analýza - Chevron Obchodování: 2025-05-28

Chevron Technical Analysis Summary

výše 137.71

Buy Stop

níže 133.91

Stop Loss

| Indicator | Signal |

| RSI | Neutrální |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Buy |

Chevron Chart Analysis

Chevron Technická analýza

The technical analysis of the Chevron Corporation stock price chart on 4-hour timeframe shows #S-CVX,H4 is rebounding toward the 200-period moving average MA(200) following a retreat from four-week high two weeks ago. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 137.71. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 133.91. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (133.91) without reaching the order (137.71), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentální analýza Akcie - Chevron

Chevron Corporation stock rose yesterday ahead of news the company is expected to receive a license to keep oil assets in Venezuela. Will the Chevron Corporation price advancing persist?

Chevron Corporation is an American energy company engaged in the hydrocarbon exploration and petrochemical manufacturing. Company’s market capitalization is $238.75 billion. Chevron Corporation’s stock trades at price-to-earnings (P/E) ratio of 15.61 for trailing twelve months (ttm), Forward P/E of 15.70 and Price/Sales ratio (ttm) of 1.28. Over the past 12 months, it has generated revenue of $195.11 billion, Return on Assets (ttm) of 5.23% and Return on Equity (ttm) of 10.08%. There were reports yesterday the US government is preparing to grant Chevron a limited license to keep its oil-producing assets in Venezuela. While the license would enable Chevron to maintain key infrastructure in Venezuela, it would prevent the company from exporting oil from the country. The purpose of the US ban to expand Chevron activities or export oil is to continue preventing any possible payments to President Nicolas Maduro's administration. The aim of the license is ensuring the company can promptly resume operations if relations between the two nations improve while reducing the risk of Venezuela seizing Chevron’s assets.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Poznámka:

Tento přehled má informativně poznávací charakter a publikuje se zdarma. Všechny údaje, uvedené v přehledu, jsou získány z otevřených zdrojů, jsou uznávány více méně spolehlivé. Přitom, neexistují žádné garance, že uvedená informace je úplná a přesná. Přehledy se v budoucnu neobnovují. Veškerá informace v každém přehledu, včetně názorů, ukazatelů, grafů, je pouze poskytována a není finančním poradenstvím nebo doporučením. Celý text nebo jeho jakákoliv část a také grafy nelze považovat za nabídku provádět nějaké transakce s jakýmikoliv aktivy. Společnost IFC Markets a její zaměstnanci za žádných okolností nemají žádnou odpovědnost za jakékoli kroky učiněné kýmkoliv po nebo v průběhu seznámení s přehledem.