- Analytics

- Market Overview

Federal Reserve’s decision in focus - 20.9.2017

All three major US stock indices close at record highs

US stock indices ended at record highs on Tuesday as Federal Reserve two-day meeting, expected to produce a decision on starting date and pace of its balance sheet reduction, commenced. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slipped 0.2% to 91.82. The S&P 500 added 0.1% settling at record high 2506.65, led by telecom stocks. Dow Jones industrial average rose 0.2% closing at fresh record high 22370.80. The Nasdaq composite index gained 0.1% to record high 6461.32.

Treasury yields were little changed ahead of the Federal Reserve decision. Traders will focus on details about the Fed’s planned reduction of its bond holdings. The Fed is expected to start shrinking its balance sheet by $10 billion a month, increasing the pace by $10 billion every quarter up to a maximum of $50 billion a month. Also changes to Fed members’ forecasts for future interest rates known as the dot plot will be in focus, for indication of a change in policy makers’ stance. While there is a widespread concern about slow pick-up in inflation as the economy operates at full employment, recent stronger than expected inflation report supports the case for continuing rate hikes. Economic data were mixed: new houses in August declined 0.8% to an annual rate of 1.18 million, building permits jumped 5.7%. At the same time import prices climbed 0.6% in August.

European stocks extend gains

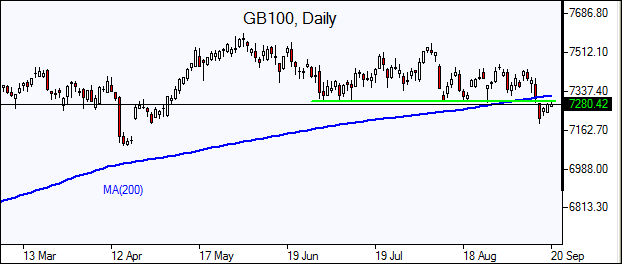

European stocks closed higher on Tuesday in cautious trade. Both the euro and British Pound ended higher against the dollar. The Stoxx Europe 600 inched 0.04% higher. Germany’s DAX 30 gained 0.02% closing at 12561.79. France’s CAC 40 advanced 0.2% and UK’s FTSE 100 rose 0.3% to 7275.25. National indices opened lower today except for France's CAC 40 which opened 0.1% higher.

In economic news the ZEW economic expectations index for Germany jumped to 17.0 in September, up from 10.0 in August, beating forecasts of a 12.7 reading.

Asian markets higher

Asian stock indices are mostly higher today while investor refrained from big bets ahead of Fed’s policy decision. Nikkei rose 0.1% to 20310.46 despite resumed yen strength against the dollar. Chinese stocks are higher: both the Shanghai Composite Index and Hong Kong’s Hang Seng Index are 0.2% up. Australia’s All Ordinaries Index is down 0.1% as Australian dollar resumed strengthening against the greenback.

Oil climbs ahead of US inventory report

Oil futures prices are rising today after Iraq’s oil minister said OPEC and other crude producers were considering extending or even deepening a supply cut. The American Petroleum Institute industry group reported late Tuesday US crude stocks rose by 1.4 million barrels last week to 470.3 million, instead of expected 3.5 million barrels increase. Prices slipped yesterday: November Brent crude fell 0.6% to $55.14 a barrel on London’s ICE Futures exchange on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

News

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also