The US dollar was smashed across the board against its major counterparties after the most probable candidate to take Ben Bernanke’s seat as a Federal Reserve Chairman, Lawrence Summer’s withdrew his candidacy. U.S President’s adviser Summers decided to withdraw because of concerns of Democratic senators and market participants that were lobbying against him. Summers was considered more hawkish compared to the next most possible candidate Janet Yellen, and his removal weighed on the greenback.

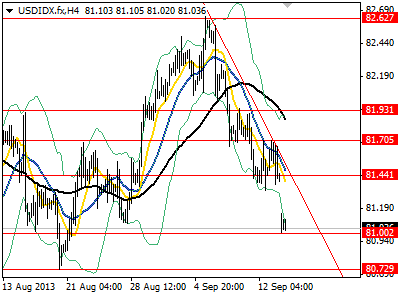

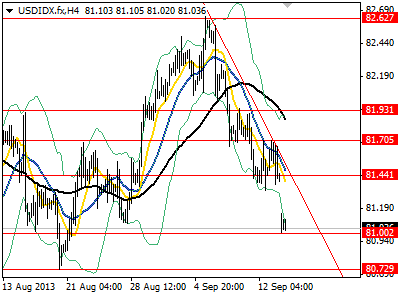

The US dollar index dipped from Friday close at 81.44 to Monday open at 81.00 as investors saw less dovish candidate leaving the scene and opening the way for the more dovish currently vice chairman, Yellen. At the same time, we are all highly anticipating Fed’s two day meeting to end on 18 Sep. while our willingness to bet on significant asset tapering is lessening.

Elsewhere, the British pound jumped sharply to 8-month high at 1.5955 against the greenback maintaining its rally but approaching key psychological resistance at 1.60. The common currency against the US dollar also jumped on Monday morning to as high as 1.3377.

Risk appetite was improved during the weekend as Syria war chances continued to fade. A plan for delivering Syria’s chemical weapons to international control was agreed and now further details are expected by Syria government. Risk sentiment was then boosted by less dovish Summers’s withdrawal from Fed. The

USDJPY declined to support at 98.69 as the safer Japanese Yen was losing ground, moreover volume is thin today due to Japan being on holiday. The Australian against the greenback opened higher on Monday at resistance around 0.9345 and then retreated slightly to 0.9319.

Concerning crosses like EURJPY or AUDJPY they are mainly in sideways on Monday morning since the market mover is solely the greenback. We are cautious ahead of the FOMC Statement and Economic Projections and we consider currency markets would pause expecting monetary decision.