Currency markets remain mostly steady from yesterday trading with the US dollar still in 80.52/80.26 tight range following FOMC member Dudley speech. Dudley said that two tests need to be passed for the asset purchases tapering to begin, firstly evidence that labor market has shown improvement and secondly “forward momentum” creating confidence that labor market improvement would continue after tapering.

The FOMC member added that even though unemployment rate dropped from 8.1% to 7.3% in the last year that is overstating actually labor improvement, since other indicators are not so optimistic. Concerning “forward momentum” the test is not yet passed because Dudley is not yet confident about growth sustainability due to fiscal uncertainties. Lastly, the independence between asset purchases tapering and interest rates lifting was emphasized once more.

Thus, uncertainty increased in financial markets whether the Fed is going to slow down its bond purchases pace in October, since another FOMC member, Bullard, said on Friday that decision not to start unwinding was a close call. Thus greenback remained steady and the Japanese Yen got weak with the

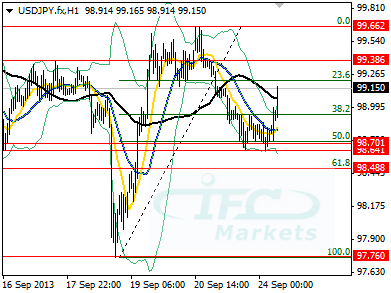

USDJPY bouncing above 99.00. Technically, found support around 50.0% of 97.76 to 99.66, at 98.64 suggesting that corrective move is finished and upside is resuming shifting focus to next resistance at 99.38.

USDJPY

Elsewhere, the Aussie eased against the US dollar after drawing

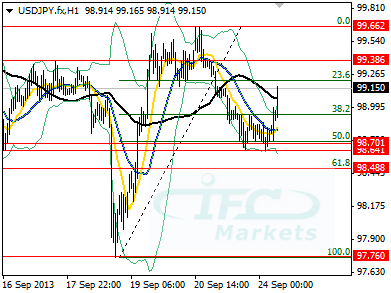

resistance line at 0.9456 with the Australian dollar upside bias losing momentum since there are not any supportive events, thus the pair is dependent on US dollars’ performance. Concerning US data, investors are focusing on Consumer Confidence later today and S&P Case-Schiller HPI. The Euro versus the US dollar did not change much with mixed PMIs yesterday not providing significant support, the pair is currently at 1.3510. Technicals are bullish for the

EURUSD since it is fluctuating in a potentially “flag” pattern suggesting that uptrend would continue.

EURUSD