- Analytics

- Market Overview

Bank of Japan upheld the basic parameters of its monetary policy emission - 18.2.2014

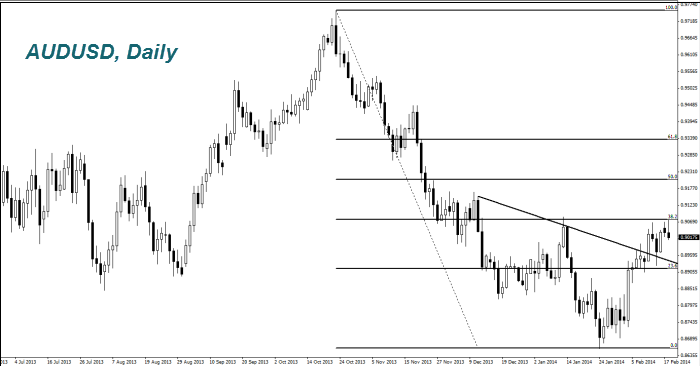

The Reserve Bank of Australia kept interest rates at 2.5% at the yesterday meeting. Thus, it noted that when it changes the main factor is the consumer price index. This figure will be released only at the end of April. Tomorrow at 00-30 GMT (0) we expect the data on wages, which are accounted in the prediction of inflation. We do not exclude that after the Australian dollar (AUDUSD) goes into neutral trend until the end of February. The ECB Governing Council member Ewald Nowotny opposed the further reduction of the discount rate. This caused a slight strengthening of the Euro (growth on the EURUSD chart). The main factor of the exchange rate of the European currency today will be the German ZEW index of economic activity which will be released at 10-00 GMT (0). The forecast, in our opinion, is a neutral.

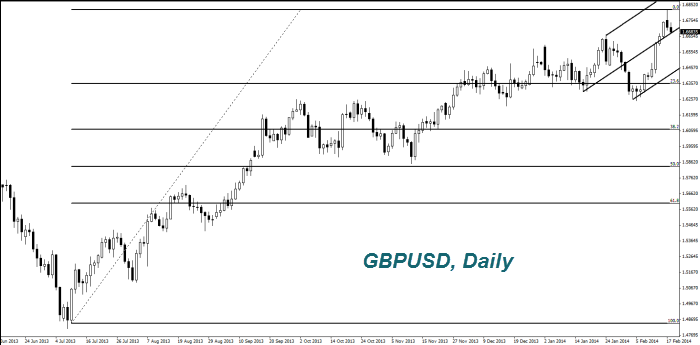

At 9-30 GMT (0), there are data on inflation in the UK for January. The preliminary forecast is neutral. If it is not justified, perhaps the Pound will move strongly (GBPUSD). The Gold (XAUUSD) started correcting down after the rapid growth. We believe that this was due to the negative outlook of Western companies and banks. According to the World Gold Council (World Gold Council), the demand for it in the last year fell by 15% to 3756.1 tons. Due to the liquidation of positions of Western investors the gold market received 881 tons. Because of this, the price of the metal fell to 32 % of maximum. Physical volumes were purchased by China, India and other developing countries. Earlier this year, the demand for gold was the highest since 1983. Nevertheless, many large Western banks and companies expect lower prices for precious metals, around $ 1,050 per ounce.

News

Iran Secret Overture to the CIA

A day after US and Israeli strikes began raining down on Iranian...

Why China Wins When Oil Prices Spike

Key Takeaways The Paradox - China's import dependence doesn't...

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also