Why JPMorgan Thinks Stablecoins Won't Hit $2 Trillion Anytime Soon

JPMorgan is skeptical about recent predictions that the stablecoin market will reach $2 trillion by 2028 - the projection is unrealistic.

Right now, the stablecoin market is worth around $270 billion, dominated by Tether (USDT) and USD Coin (USDC). JPMorgan expects growth will happen, but likely two to three times the current size, rather than a 7x jump.

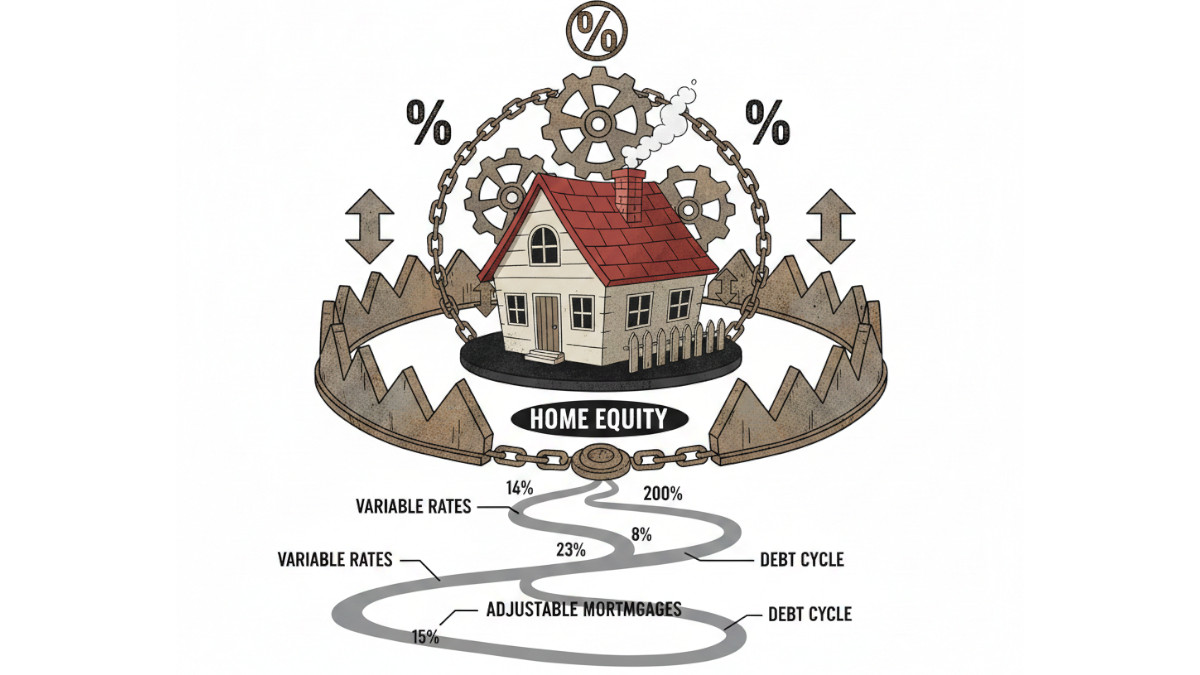

Stablecoins are still mostly used for crypto trading and DeFi. Until they’re used as a digital cash for everyday life, their growth will remain limited.

- Most consumers and businesses still rely on trusted services like Visa, PayPal, or Apple Pay. Without a strong payment network, stablecoins face serious competition. Big companies and institutional investors haven’t yet shifted large amounts into stablecoins. They still prefer traditional safe assets - bank deposits or short term Treasuries.

- Stablecoins also face pressure from government backed apps and central bank digital currencies. In China, platforms like WeChat Pay and Alipay already dominate digital payments, which makes stablecoins less attractive in those regions.

- Many countries are actively developing their own CBDCs, which would offer official digital alternatives to stablecoins, potentially reducing the global demand for privately issued coins.

New US Stablecoin Law: The GENIUS Act

The GENIUS Act is focused on stablecoins. It sets out strict requirements for who can issue stablecoins, what they must be backed with, and how they must operate under federal oversight.

From now on, only approved issuers, banks or licensed nonbank financial firms, will be allowed to issue stablecoins in the US. They must back every stablecoin they release with highly liquid assets; cash or short term US government bonds.

- Issuers are required to publish monthly reports showing proof of reserves and undergo regular independent audits.

- One important fact is that stablecoin issuers are banned from offering interest or yield to users. That keeps these coins focused on payments. It prevents them from competing with traditional banks for savings.

- The law includes consumer protection measures. In the case of bankruptcy, stablecoin users will have priority claims, and their funds must be kept separate from the company’s operational money.

This could lead to the exit of smaller offshore or loosely regulated stablecoin issuers who can’t meet these standards. At the same time, it opens the door for major financial firms, tech companies, and payment providers to enter the market with stablecoins of their own.

Will This Affect the U.S. Dollar?

Not immediately. The law doesn’t shift interest rates or move big money right away. But over time, it could help support the U.S. dollar globally.

Here’s how:

- More demand for dollars. Since stablecoins are backed by US dollars or Treasury bonds, wider use means more need for real dollars in reserve.

- A digital edge for the dollar. With clearer laws and more trust, stablecoins make US dollars easier to use across borders. Other currencies don’t have this kind of digital reach yet.

- Stronger demand for U.S. debt. If stablecoins must hold Treasury bonds, it increases demand for them. That helps the US government borrow money at stable rates.

Still, there are limits. No interest means less appeal for big institutions. And if other countries build their own digital currencies quickly or try to block dollar backed stablecoins, it could slow the dollar’s spread.