- Education

- About Forex

- What is Forex Chart

What is Forex Chart

Forex price charts show historical price and volume data for one or more currency pairs. The forex chart displays the historical behavior of the currency in different time frames, as well as technical patterns, indicators and overlays. Reading forex charts becomes easier when focusing on the 10 strongest currencies in the world because their price action is clearer.

KEY TAKEAWAYS

- The Forex chart allows the trader to look at the history of price changes, which, from the point of view of technical analysis, will help to foresee the future price movement.

- There are three main types of Forex charts that display online quotes.

- Forex technical analysis is used to determine when to buy or sell currency pair decisions using resources such as charting tools.

What is Forex Chart

The Forex chart allows the trader to look at the history of price changes, which, from the point of view of technical analysis, will help to foresee the future price movement. For clients who have open and funded trading accounts, most forex brokers provide free forex charting software. Forex charts display data that can be used for technical analysis of a particular currency pair.

Forex charts are vital tools for forex traders who use technical analysis to decide where to spend their money, as with forex charts and further technical analysis, the price trend can be inferred with some accuracy. Technical analysis is the study of historical market prices and technical indicators to predict future investment movements.

Short-term price fluctuations, according to technical analysts, are the result of the dynamics of supply and demand in the market for a particular security. As a result, for these specialists, the fundamentals of an asset are less important than the current balance between buyers and sellers.

Price history can be studied in different types of charts. Line, histogram and candlestick charts can be used on forex charts, and the standard time frames provided by the charting software of most platforms range from tick data to yearly data. The x-axis of a standard forex chart is a period of time, and the y-axis is the exchange rate.

Forex Chart Types

An analysis of the current situation in any financial market is carried out using a price movement chart, since price changes follow certain patterns that traders use to their advantage. Even stock scalpers keep charts of traded instruments at hand to determine the existing trend, some significant levels, and the like. In this regard, it is worth knowing what Forex charts exist, their types are quite diverse and provide analysts with various information.

Each graphic construction usually takes place in some tick or time coordinates. At the same time, the choice of timeframe for some categories of traders is crucial, and there are plenty to choose from. Now Forex charts are used for analysis with a timeframe from one minute to one year, although the largest time period for trading usually does not exceed a month. To know in detail about Forex trading, you can learn what Forex trading is and how does it work.

Charts differ from each other, for example, one shows the general direction, the other will make it possible to track the price range within a certain period, determine the opening, closing point, and the like.

There are three main types of Forex charts that display online quotes:

- Linear chart

- Bar chart

- Japanese candlestick

Line Chart Type

The line chart type was developed at the very beginning, so it is the simplest and least informative. The chart is built quite simply, each new period of time has 2 main parameters - the opening price and the closing price. Each of these parameters forms a point on the chart, after which the opening price point is connected to the closing price point.

A continuous connection of dots forms a line. Currently, this type of chart is used extremely rarely, because it does not carry information about the highs and lows of the price for the selected period. Although it can be used for trend analysis because it smooths out such a phenomenon as a false breakout of a trend line or price level.

Line Chart Type

Let's see the main features of the linear view of the graph display:

- The chart is suitable for working on price patterns based solely on geometric figures, because it filters data on price lows and highs and provides actual parameters on closing and opening prices.

- At long time intervals - since at these intervals trend lines are price ranges, for the construction of which it is the key price parameters that are important.

- Also, this type of chart is often used in related trading strategies based on the chart and the EMA indicator, because it more accurately gives a signal to enter a trade.

Forex Bar Chart

The type of forex bar chart was developed after the line chart appeared, it is more informative and complex.

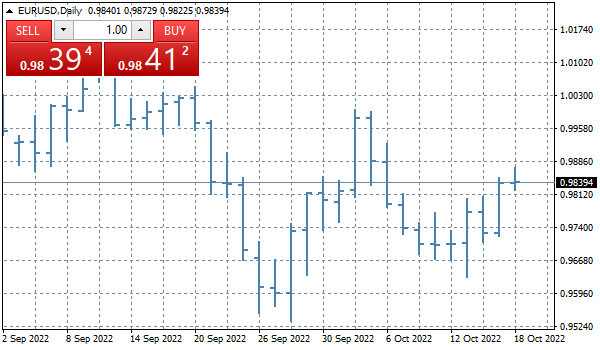

A bar chart consists of vertical bars called bars. In the bar chart, any trading interval is shown as a vertical line drawn from the low to the high of the day. Unlike a line chart, bars carry additional information in addition to information about the closing and opening prices, the high and low prices have also been added.

During the movement, the price can exceed the closing price several times, so the concept of a maximum shows what maximum levels the price reached during the formation of the bar. Same thing with the minimum.

Forex Bar Chart

The essence of charting comes down to the sequential appearance of bars on the chart one after another, after one bar closes, a new one opens, and so on. Several bars, one above the other, form an uptrend, similarly with a downtrend.

Using this chart, you can determine the price dynamics within a certain period of time, which is extremely important for a complete analysis of forex charts.

So let's consider the main features of this type of chart display:

- The opening and closing prices are displayed as serifs: the serif on the left is always the opening price of the bar, and the serif on the right is always the closing price.

- There are two types of bar charts: an up bar and a down bar. For a rising bar, the opening price is always lower than the closing price, and for a falling bar, the opposite is true.

- The main strategies for working on bars are: “pinbar”, “inside bar”, “absorption”.

Japanese Candlestick Chart

The Japanese candlestick chart was developed the most recent. Historically, it is believed that the Japanese candlestick chart was invented to visualize the highs and lows of the price. The chart combines all the main types of display and surpasses the bars due to the fact that it also carries color information about the rise and fall. Let's take a look at what this graph consists of:

Japanese Candlestick Chart

A candlestick consists of a red or green body and an upper or lower shadow or a candle wick. The upper and lower borders of the shadow display the high and low prices for the selected time period. The boundaries of the body display the opening and closing price.

If the price has risen, then the body of the candle will be green. If prices have fallen, then the body is red.

If the opening and closing prices coincide with the high or low of the shadow (or both shadows), there may not be. If the opening and closing prices coincide, the body of the candle may not exist, and such a candle is called “rain”.

However, no matter how informative this type of display is, the candlesticks do not contain information about the price movement within the time interval, and also do not indicate whether the maximum or minimum was reached first, or how many times prices increased or decreased. To obtain this information, you should try changing the time interval of the chart from a larger to a smaller one.

The essence of plotting comes down to the sequential appearance of candles on the chart one after another, after one candle closes, a new one opens, and so on. Several candles, one above the other, form an uptrend and similarly with a downtrend. Due to the fact that the candles are colored in different colors, it is much easier to identify trends on the chart, because it is just a consistent combination of candles of the same color.

The main features of this type of chart display:

- The opening and closing prices are displayed as the lower or upper boundaries of the candle body. For a rising candle, the opening price is always at the bottom, and for a falling candle, the opening price is always at the top.

- There are several types of candles: a green growth candle with shadows, a green growth candle without shadows, a candle without shadows and a body, a candle without a body with shadows, a red candle with shadows, a red candle without shadows.

- Even a separate type of graphical analysis has been developed, which is called candlestick analysis. The essence of this analysis is to look for repeating combinations of similar candles on the chart.

How to Predict Forex Charts

To predict Forex charts, traders use technical analysis. This is not a 100% tool, but it can be achieved through price history research and experience.

Technical analysis is performed using price charts that show the historical dynamics of the exchange rate. Forex technical analysis is used to determine when to buy or sell currency pair decisions using resources such as charting tools.

To predict the movement of exchange rates, past market data is used, so traders are looking for patterns and signals. Previous price moves trigger patterns that technical analysts try to identify and, if they are correct, should signal where the exchange rate is heading next. There are many tools available to traders to identify patterns and signals.

Traders often use chart patterns when conducting technical analysis. The behavior of the Forex market shows patterns, and since chart patterns usually appear during trend reversals or when trends begin to form, traders often follow them when trading.

There are well-known patterns such as head and shoulder patterns, triangular patterns, engulfing patterns, and others.

Here are some of them, let’s check them out

Cup and Handle

A cup and handle is a technical chart pattern that resembles a cup and handle where the cup is in the shape of a "u" and the handle has a slight downward drift. Looks like this

It is worth worth paying attention to the following when detecting cup and handle patterns:

- Length: Generally, cups with longer and more "U" shaped bottoms provide a stronger signal. Avoid cups with sharp "V" bottoms.

- Depth: Ideally, the cup should not be overly deep. Avoid handles that are overly deep also, as handles should form in the top half of the cup pattern.

- Volume: Volume should decrease as prices decline and remain lower than average in the base of the bowl; it should then increase when the stock begins to make its move higher, back up to test the previous high.

Flag Pattern

Flag is a price pattern that moves in a shorter time frame against the prevailing price trend observed in a longer time frame on a price chart. Reminds the trader of the flag, hence the name.

Flag patterns can be upward trending (bullish flag) or downward trending (bearish flag).

Note: Flag may seem similar to a wedge pattern or a triangle pattern, it is important to note that wedges are narrower than pennants or triangles.

Flag patterns have five main characteristics:

- The preceding trend

- The consolidation channel

- The volume pattern

- A breakout

- A confirmation where price moves in the same direction as the breakout

Wedge Pattern

Wedges form as an asset’s price movements tighten between two sloping trend lines. There are two types of wedge: rising and falling.

Wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods, which ensures a good track record for forecasting price reversals. A wedge pattern can signal bullish or bearish price reversals. In either case, this pattern holds three common characteristics:

- The converging trend lines;

- Pattern of declining volume as the price progresses through the pattern;

- Breakout from one of the trend lines.

The two forms of the wedge pattern are a rising wedge, which signals a bearish reversal or a falling wedge, which signals a bullish reversal.

Rounding Bottom Pattern

This pattern is identified by a series of price movements that graphically form the shape of a "U". Rounding bottoms are found at the end of long downward trends and signify a reversal in long-term price movements.

It could take from several weeks to several months and it happens quite rarely.

Double Top Pattern

Double top is a bearish technical reversal pattern. Traders use double top to highlight trend reversals. Typically, an asset’s price will experience a peak, before retracing back to a level of support. It will then climb up once more before reversing back more permanently against the prevailing trend.

Double Bottom Pattern

Double bottom patterns are the opposite of double top patterns. Double top patterns if identified correctly are highly effective. However, if they are interpreted incorrectly. Therefore, one must be extremely careful before jumping to conclusions.

The double bottom looks like the letter "W". The twice-touched low is considered a support level.

Forex Charts with Indicators

There are some common Forex chart indicators used to predict Forex charts, let’s check a few of them out.

So, technical indicators fall into four main categories: trend, momentum, volatility, and volume.

Trend Indicators

ADX Indicator

This indicator is a lagging Forex technical indicator designed to show the strength of a trend and is derived from two directional indicators:

Directional Movements

Directional Movements is a calculation of how the highs, lows, and closes of the current day compare to the highs, lows, and closes of the previous day. The sum of these figures is then divided by the average true range (ATR). Basically, +DI tells us how strong the bull is today compared to yesterday, while -DI informs us how strong the bear is today compared to yesterday. ADX takes the values +DI and -DI and tells us who is stronger today compared to yesterday - a bull or a bear.

Momentum Indicators

Relative Strength Index

RSI is a very popular momentum indicator that signals how much relative strength is left in a market move when the move may have dried up. RSI compares the closing prices of the current and previous candles for uptrends and downtrends, and then turns the result into an EMA, and then calculates how the uptrend's EMA compares to the downtrend's EMA when fluctuating on a scale of 1 to 100. The greater the difference between today and yesterday during the day - the stronger the impulse.

Volatility

Bollinger Bands

In the Bollinger Bands trading channel, the trend lines at the resistance and support levels are based on the moving average movement. The resistance trendline is two standard deviations above the moving average.

The support line is two standard deviations below the moving average. An instrument defined by a set of trend lines applies two standard deviations (positive and negative) from the simple moving average (SMA) of the security's price. This gives investors a higher chance of correctly identifying when an asset is oversold or overbought.

Volume Indicators

OBV Indicator

This indicator is used to change the volume of a traded instrument, relative to its price. The volume precedes price and that it can be used to confirm price moves. Total daily volume is assigned a positive number if it increases, in comparison to the previous day and a negative value is assigned if total volume has decreased since the previous day. When prices go strongly in one direction, so too should the OBV. A divergence between the price and the OBV would indicate a weakness in the market move.

Bottom line on Forex Charts

In conclusion, we wanted to add: the type of chart display that you choose for yourself directly depends on what strategy you use in the market.

If you work on patterns - your choice of candles, if you work on a trend, then it will be more convenient for you to use the Bar chart. Well, if you work on mathematical indicators, then the simpler one is better, therefore, the usual line chart.

Many indicators are also developed for bars, candles, etc. Many traders use several types of charts to more accurately analyze online Forex quotes and identify the balance of power in the market.

Determining exactly your strategy and choosing the right type of forex chart is a good start to competent trading.

FAQs

How does Forex Work?

Forex (Foreign Exchange) is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another. Forex trading is performed electronically over-the-counter (OTC), which means the FX market is decentralized and all trades are conducted via computer networks.

What is Forex Market?

The Forex market is the largest and most traded market in the world. Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations.

What is Forex Trading?

Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

What is The Best Forex Trading Platform?

IFC Markets offers 3 trading platforms: MetaTrader4, MetaTrader5, NetTradeX. MT 4 Forex trading platform is one of the most downloaded platforms which is available on PC, iOS, Mac OS and Android. It has different indicators necessary for making accurate technical analysis. NetTradeX is another trading platform offered by IFC Markets and designed for CFD and Forex trading. NTTX is known for its user-friendly interface, reliability, valuable tools for technical analysis, distinguished functionality and the opportunity to create Personal Composite Instruments (PCI) which is available specifically on NetTradeX.