The US dollar keeps strengthening against the most liquid currencies. The reason why were the minutes of December FOMC meeting published last night. The meeting participants expressed concerns about potential external effects on the financial market stability caused by the central bank asset purchasing program. As it was said in the minutes, some meeting participants were standing for reduction or even termination of the quantitative easing program before the end of 2013, referring to the large amount of central bank balance sheet (that is about 2.9 trillion dollars at the beginning of 2013). Stock markets reacted to the fall (DJI, S & P 500 and Canadian TSX were closed in the red zone, as well as most of the major Asian indices for today), and the U.S. dollar, oppositely has received strong support.

Moreover, the published employment data on in the private sector (ADP Employment change), showed growth in the number of new jobs for December at 215 000, that is higher than the

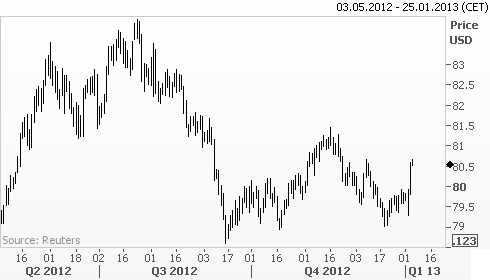

market forecasts. Tonight, the particular attention should be paid to the labor market official statistics (Non-farm payrolls change, unemployment rate), coming out at 14:30 CET. The US dollar index, reflecting its behavior against a bunch of six currencies, hit the highest level since mid-November of last year, at 80.67 (see the chart). The strong labor market data could probably be able to provide additional support for the world main reserve currency.

US dollar index, daily chart

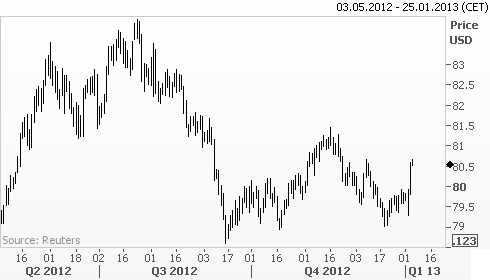

European currencies came under pressure vs. U.S. dollar within the past two trading days. Euro fell to three-week low at 1.3018, comparing to the opening at 1.3259 on January 2. British pound reached this morning the lowest level since December 10th, at 1.6028, in comparison to the opening at 1.6318 on January 2. It is also worthy to note the continuing US dollar growth vs. Japanese yen - the pair rose to 87.82 today, its highest level since 28th of July 2010 (see the chart).

USDJPY, daily chart