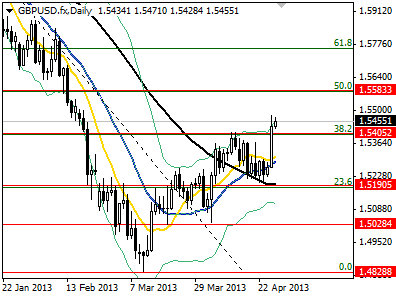

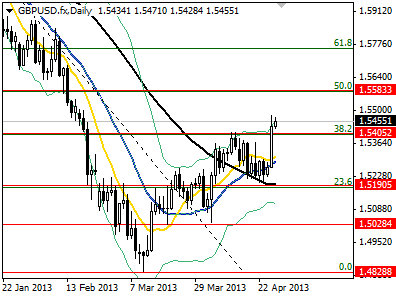

The British pound gained as high as 1.5472 yesterday against the US dollar as preliminary GDP report surprised traders with 0.3% increase in the first quarter compared to previous quarter minus 0.3%, while it was expected to increase only by 0.1%. The GBPUSD penetrated key cap at 1.5405 and managed to hold its ground, it was lastly seen at 1.5434. We expect the pair to stay in consolidation in the immediate trading and later rise to 1.5583 as fundamentals are shining for the sterling, thus that will depend mostly on US dollar.

The US dollar reacted positively and jumped from support at 82.36 towards 82.81, on early US session as the US Jobless Claims were unexpectedly lower, reported at 339K for the previous week compared to revised 355K two weeks ago. That helped US equities to advance and close in positive territory with S&P 500 rising by 0.40%, Dow Jones gaining 0.17% and NASDAQ increasing by 0.62%. Companies’ earnings were mostly stronger than estimates with Amazon reporting $0.18 EPS, higher than $0.10 expected EPS, Starbucks EPS in line with estimations but higher revenue and net income compared to previous year and Exxon Mobil EPS at $2.12 higher than $2.05 estimations. Improved risk sentiment likely induce the geenback to retrace afterwards, investors eyes are on US GDP release, later today.

Concerning the Japanese Yen, the Bank of Japan restated its pledge to succeed 2% inflation in 2 years and increase monetary base by ¥60 to ¥70 Tln per year. However, earlier the nationalized CPI excluding fresh food dropped to minus 0.5% in March, down from -0.3% in February but the Tokyo CPI excluding fresh food rise to -0.3% in March, more than expected, from -0.5% in February. Despite mixed inflation improvement, the USDJPY dropped today from 99.49 to 98.22 as the Japanese competitiveness improves in international trade terms due to weaker Yen.