- Analytics

- Market Overview

Market participants expect the maximum Nonfarm Payrolls increase within four months - 4.4.2014

As we anticipated in yesterday's review, the Euro (fell on the EURUSD chart) showed weakening after European Central Bank President Mario Draghi said that his department is going to act for increasing inflation. He also noted that it was discussed at the ECB meeting to start the QE program in the EU. As we know by the U.S. example, it means printing money for government bonds redemption. That generally means that the government issues debt obligations, that its own Central Bank redeems by printing money. After this the state obtains money to stimulate the economy, and the debts are accumulated at the CB. In case of the Eurozone there is emission option in the amount of 175 billion Euros considered. Its ultimate goal is to increase inflation from the current 0.5% to 1% by the end of this year, up to 1.3% the next year and up to 1.5% in 2016.

Today the Oil price is growing for the second consecutive day after Libyan rebels blocked oil terminals again. The Crude Oil production in the country fell to 150 000 barrels per day from the last year maximum of 1.4 million. We believe that oil is in a long-term uptrend. Possible sanctions against Russia over the Crimea will not lead to a significant drop in its value. The Copper rose as investors hope that the Chinese economic stimulus will increase the demand. However, the world copper production may increase by 6.5% to 22.4 million tons this year and by 4.3% to 23.3 million tons the next year according to the International Copper Study Group (ICSG) forecast. Now it is difficult to say whether this opinion will affect the quotes or not. Last year the ICSG expected copper deficiency in the amount of 282 thousand tons. That did not prevent the world Copper prices of falling by 7.2% per year. The Corn went up on Wednesday after China refused to buy the next batch of the U.S. grain containing the extra gene MIR 162. Thus, China already rejected about one million tons of genetically modified corn from the United States since November. In our opinion, this increases the demand for conventional corn. However, the growth in its value is not quite impressive because the purchase of transgenic corn is approved by the U.S. in countries such as Egypt, Japan, South Korea, Taiwan and Saudi Arabia. They partially redeem volumes rejected by China.

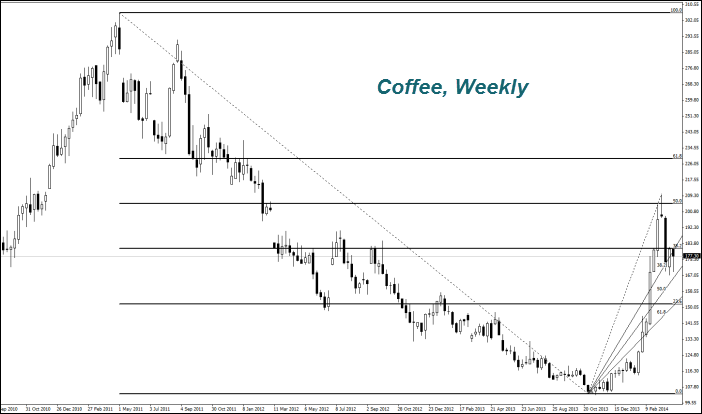

According to the forecast of Coffee Exporters Association of India, the coffee export from India this year may fall by 10% to 286.4 thousand tons for the first time in six years because of the unusual rainy weather. This information caused the growth of the world Coffee prices yesterday and today. Note that India's share in world production is comparatively not great, a little less than 4%.

News

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that...

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that...

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works....

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also