- Analytics

- Market Overview

US markets retreat on weak earnings reports - 19.4.2017

US stocks close lower as Goldman, Johnson & Johnson earnings disappoint

US stocks closed lower on Tuesday off session lows after results of earnings reports of a number of major companies fell short of expectations. The dollar continued the slide : the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, ended 0.8% lower at 99.507. Dow Jones industrial average fell 0.6% to 20523.28, led by Goldman Sachs and Johnson & Johnson shares, which fell 4.7% and 3.1% respectively. The S&P 500 declined 0.3% settling at 2342.19 led by healthcare and energy stocks. The Nasdaq index lost 0.1% to 5849.47.

Lackluster earnings as companies missed elevated expectations failed to dispel investor doubts high stock valuations are justified by economic performance data. But more companies will be reporting earnings and analysts still expect a strong quarter for corporate results. Meanwhile, President Trump signed an executive order that will make it more difficult for foreign workers to obtain working visas and promote the purchase of US-made products. Other economic data were negative too: housing starts fell 6.8% in March, as did manufacturing production for the first time since last August. Today at 13:00 CET Mortgage Applications will be released in America. And at 20:00 CET the Federal Reserve will release the Beige Book.

European stocks fall as Britain heads toward early election

European stocks fell on Tuesday after UK Prime Minister Theresa May unexpectedly called an early general election. French election uncertainty also undermined investor confidence. Both the euro and British Pound surged against the dollar. The Stoxx Europe 600 fell 1.1%, its biggest one-day drop in five months. Germany’s DAX 30 closed 0.9% lower at 12000.44. France’s CAC 40 lost 1.6% while UK’s FTSE 100 underperformed slumping 2.5% to 7147.50.

Mining stocks led the losses as iron ore prices slumped to their lowest in five months on weak housing data from China. Prime Minister May said she wants Britain to hold a general election on June 8. Analysts expect May will win a bigger mandate enabling the conservative party to stand up to backers of so called hard exit from the EU. The Pound hit the highest level since December. The first round of French presidential election will be held on Sunday, and two of four candidates, Melenchon and Marine Le Pen, have said they will hold a referendum on France’s EU membership in case they win. Today at 11:00 CET March final inflation data will be published in euro-zone, the tentative outlook is neutral for euro.

Asian stocks mixed after Wall Street slide

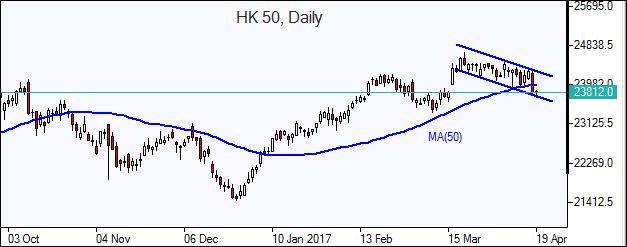

Asian stock indices are mixed today as risk off sentiment endured after losses on Wall Street overnight and continued tension between the United States and North Korea. Nikkei edged 0.07% higher to 18432.20 as yen slid against the dollar. Chinese shares are lower on tighter regulation concerns while the People’s Bank of China strengthened the yuan at its daily fixing by 0.3% against the US dollar. Shanghai Composite Index is down 0.8%, Hong Kong’s Hang Seng Index is down 0.4% on lower liquidity after its biggest daily drop in four months the previous session. Australia’s All Ordinaries Index is off 0.5% led by commodity stocks as Australian dollar continues the slide against the greenback.

Oil prices rise ahead of inventory data

Oil futures prices are edging higher today after the American Petroleum Institute report late Tuesday US crude oil inventories fell by 840 thousand barrels last week to 531.6 million barrels. Prices fell yesterday on concerns over rising US shale oil output with losses limited by output cuts by producers’ compliance with output cuts agreed by the Organization of the Petroleum Exporting Countries and major oil producers. June Brent crude closed 0.9% lower at $54.89 a barrel on London’s ICE Futures exchange on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

News

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also