- Analytics

- Technical Analysis

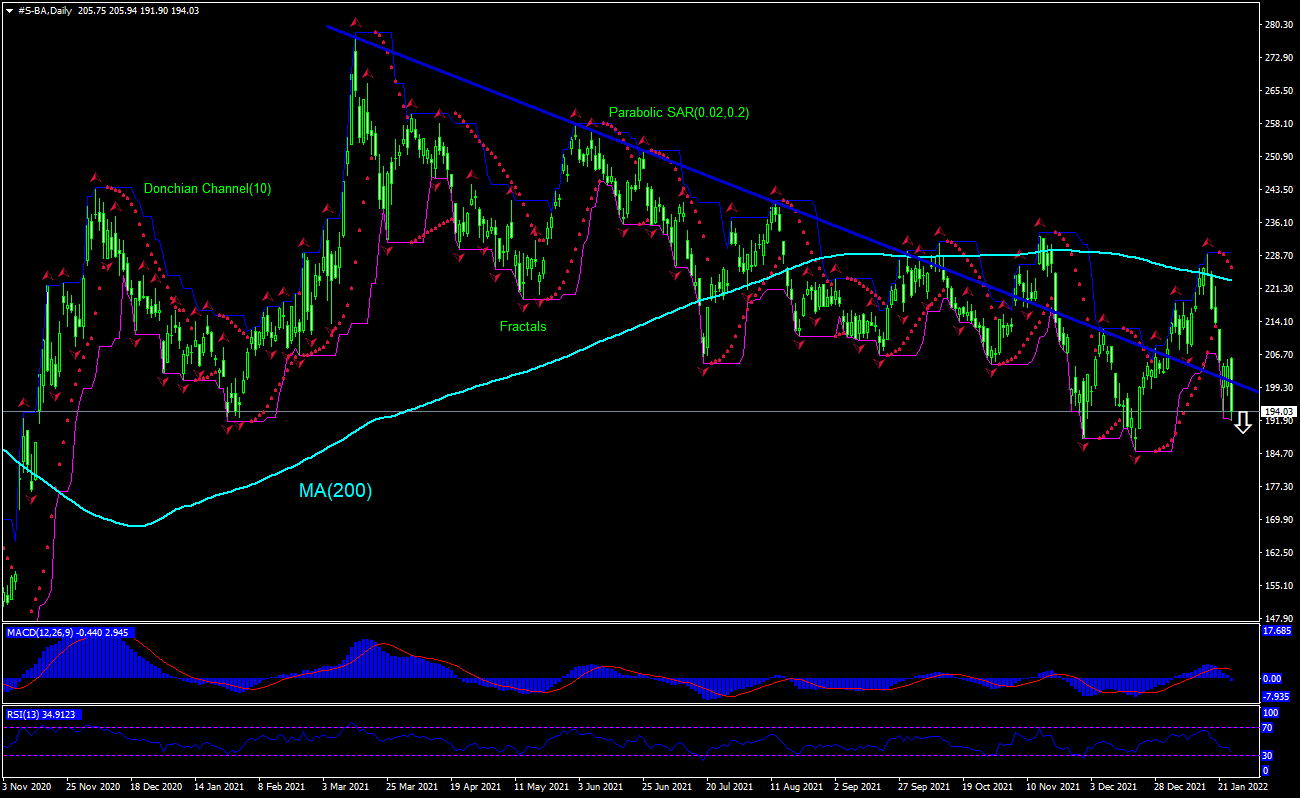

Boeing Technical Analysis - Boeing Trading: 2022-01-27

Boeing Technical Analysis Summary

Below 192.42

Sell Stop

Above 229.48

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Neutral |

| MA(200) | Sell |

| Fractals | Neutral |

| Parabolic SAR | Sell |

Boeing Chart Analysis

Boeing Technical Analysis

The technical analysis of the Boeing stock price chart on daily timeframe shows #S-BA, Daily has fallen below the resistance line under the 200-day moving average MA(200) which is declining. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 192.42. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the upper boundary of Donchian channel at 229.48. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (229.48) without reaching the order (192.42), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Boeing

Boeing stock fell after Boeing reported third annual loss in a row. Will the Boeing stock price continue retreating?

The Boeing Company is an American multinational corporation that designs, manufactures, and sells civilian and military aircraft, satellites and telecommunications equipment operating through four segments: Commercial Airplanes; Defense, Space & Security; Global Services; and Boeing Capital. The market capitalization of the company is at $120.51 billion. The stock is trading at Forward P/E ratio of 34.01 currently, Boeing earned $62.79B revenue (ttm) and has a Return on Assets (ttm) of -1.43%. Boeing recorded 79 orders for planes in Q4, for a total of 479 net orders on the year. Boeing stock was little changed Tuesday despite news the company is in advanced talks with Qatar Airways to secure a launch order for a proposed new freighter. Qatar Airways is looking at renewing its existing fleet of around 34 freighters with the larger new 777X version in a deal potentially worth $14 billion at list prices. Qatar has indicated it is willing to look at buying as many as 50 freighters, with the larger number likely to include options. Boeing was expected to turn in another loss in fourth-quarter results before the market opened Wednesday. However Q4 revenue was seen rising 8% to $16.54 billion. Boeing reported Q4 revenue fell 3% from a year ago to $14.79 billion due to Boeing taking a $3.5 billion pre-tax non-cash charge on the 787 Dreamliner program. Production problems have prevented Boeing from delivering its 787 Dreamliner for most of the last 15 months. And the manufacturer posted its third consecutive annual loss. At the same time Boeing reported free cash flow of $494 million for the fourth quarter, up from an outflow of $4.27 billion a year earlier. And the company stated it expects passenger traffic to return to 2019 levels next year or in 2024. After earnings report shares closed down 4.8%.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.