- Analytics

- Market Data

- Stock CFDs Prices

- Tesla Share Price Today

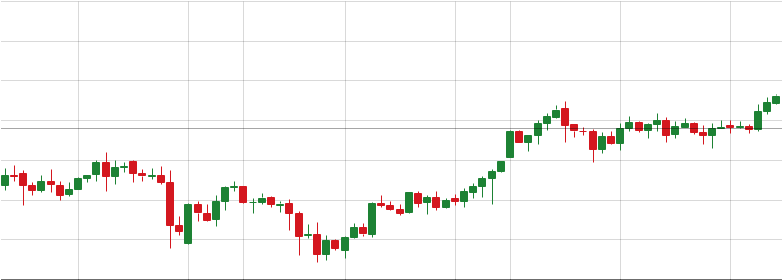

Tesla Share Price Chart

Tesla stock price today is $396.38. On this page you can find complete information about Tesla stock, including the current price and its change on the live chart, which can be viewed across 8 different time frames.

By moving the start and end of the timeframe in the bottom panel you can see both the current and the historical price movements of the instrument. In addition, you have an opportunity to choose the type of display of the Tesla share price – Candles or Lines chart – through the buttons in the upper left corner of the chart. All clients that have not yet decided which instrument to trade are in the right place since reading the full characteristics of the Tesla stock and watching its performance on the charts will help them to make their final decision.

Tesla Share Price Today

- 1m

- 5m

- 15m

- 30m

- 1h

- 4h

- 1d

- 1w

Technical Analysis

Technical analysis is a method of studying and evaluating market dynamics based on the price history. Its main purpose is to forecast price dynamics of a financial instrument in future through technical analysis tools. Technical analysts use this method of market analysis to forecast the prices of different currencies and currency pairs. This type of the analysis will allow you to make market forecast based on studying historical prices of the trading instruments.

See also latest technical analysis of the price dynamics of #S_TSLA Dollar: TSLA forecast.

Tesla News

Tesla Stock Drops After Musk Launches New Political Party

Tesla stock dropped 6.8% to $293.94 on Monday after Elon Musk...

The Musk vs Trump Feud Is Theater

In recent months, headlines have been buzzing with claims of...

Tesla Posts One of Worst Quarters Since 2022

Automotive revenue, which has always been Tesla’s main driver,...

Tesla “Company Update” - Speculation Ahead of Q1 Earnings

Tesla is preparing for a high-stakes Q1 earnings report this...

BYD’s Five-Minute EV Charging: Just Hype?

BYD claims its new ultra-fast charging tech can add 250 miles...

Tesla Stock Price Analysis

Tesla is set to report its Q2 earnings on July 17th, but before...