- Analytics

- Market Overview

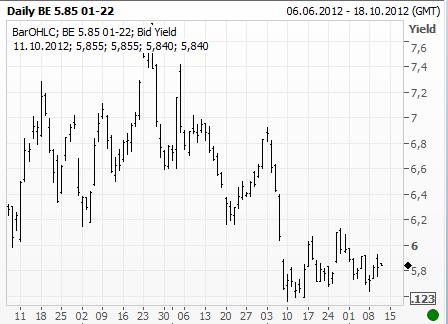

Rating Agencies Keep Finger On The Trigger - 11.10.2012

News

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that...

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that...

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works....

AI That Steals Faster Than You Can Audit

The era of manual auditing in DeFi is ending. GPT-5 and Claude's...

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also