- Analytics

- Market Overview

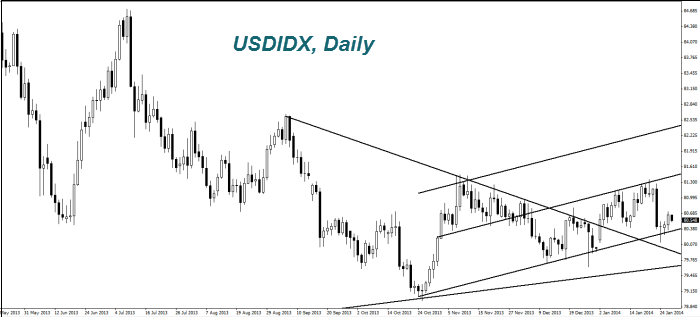

The U.S. Dollar index is slightly corrected down in the morning after raising rates in Turkey - 29.1.2014

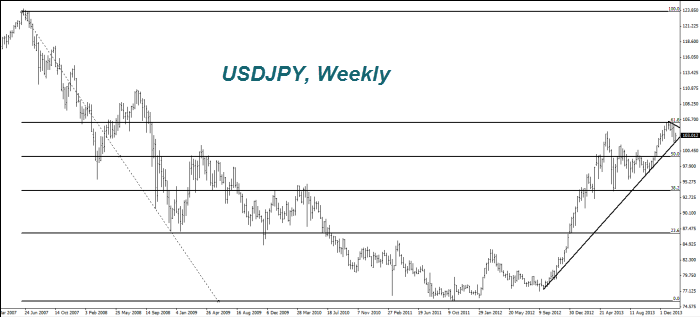

As it was expected, the Japanese Yen (USDJPY) and Swiss franc (USDCHF) got weak (growth on the chart) after the rate hike in Turkey. Today at 23-50 GMT (0), we expect the economic data from Japan. We believe that the preliminary forecasts are negative for the yen. The British Pound (GBPUSD) has not changed. Yesterday's GDP figures coincided with the forecasts. Market participants expect the head of the Bank of England speech, which will take place today at 13-15 GMT (0). It is assumed that he may give a hint of raising the interest rates in the UK in the near future. The natural gas price (NATGAS) and the oil price (OIL) in the United States rose on an increasing demand because of the extreme cold. Today at 15-30 GMT (0), we expect the data on oil and petroleum products in the U.S.. According to the EIA the Crude Oil reserve is expected to increase by 2.25 million barrels, gasoline - by 1.6 million and decrease in distillate stocks by 2.55 million barrels is also expected. We believe that in case the forecast is justified, then the cost of WTI may be corrected downwards. The U.S. natural gas now costs about $ 175 per thousand cubic meters. It costs more than double price in Europe. We believe that in case of reducing the shale gas production in the U.S., the cost of the (NATGAS) contract has a considerable potential for growth not depending on the weather conditions in America. The cost of soybean (SOYB) fell after Brazil published its crop forecast for the current year - 89.5 million tons. It was 500 tonnes higher than the official USDA forecast. In addition, market participants expect a good soybean harvest in Argentina due to increased rainfall in the northern and central parts of the country.

News

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production...

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also