- Analytics

- Market Overview

US stocks extend gains - 5.1.2017

Dollar pulls back on less hawkish than expected FOMC minutes

US stocks closed near record highs on Wednesday as investors’ risk appetite was buoyed by better-than-expected car sales. The dollar weakened. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slipped 0.7% to 102.525. The S&P 500 closed 0.6% higher at 2270.75, led by gains in the consumer-discretionary and materials stocks with nine of eleven main sectors finishing up. The Dow Jones industrial average ended 0.3% higher at 19942.16, led by gains in Nike and American Express. Biotechnology shares led the high tech index Nasdaq 0.9% higher to 5477.00.

The dollar pulled back after the minutes from Federal Reserve meeting showed policy makers were less hawkish than previously anticipated. Investors were surprised as the dot plot of policy makers interest rate projections released after December interest rate decision indicated policy makers expected three rate increases in 2017. The minutes showed policy makers were divided over the pace of raising interest rates and noted uncertainty surrounding actual implementation of Trump’s policy plans. Stocks got additional boost from auto sales data indicating better-than-expected sales from General Motors and Ford Motor. Today at 14:15 CET December Employment Change will be published by ADP, the outlook is negative for dollar. At 14:30 CET Initial Jobless Claims and Continuing Claims will be released, the outlook is positive for dollar. At 15:45 CET final Services PMI for December will come out, the outlook is neutral. And at 16:00 December ISM Non-Manufacturing PMI will be released, the outlook is negative for dollar..

Retailer and drugmaker stocks lead European stocks lower

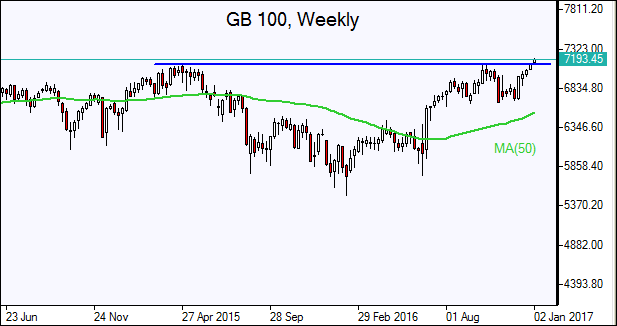

European stocks retreated on Wednesday led by retailer and drugmaker stocks. The euro strengthened against the dollar after positive inflation report showed inflation rose to 1.1% in December, up from 0.6% in November. British Pound also gained against the dollar. The Stoxx Europe 600 extended 0.1% lower from one year high. Germany’s DAX 30 edged up to 11584.31. France’s CAC 40 also ended marginally higher at 4899.40 and UK’s FTSE 100 index outperformed gaining 0.2% to 7189.74.

Shares of retailers ended lower after a downbeat forecast from UK fashion retailer Next PLC and pharmaceutical stocks fell following broker downgrades. Positive economic news supported markets: besides higher than expected inflation in euro-zone, the economy in single currency zone expanded at its fastest pace since May 2011, according to the final composite purchasing managers index for December from Markit. The index rose to 54.4 from 53.9 in November. Today at 10:30 CET December Services and Composite PMIs will be published in UK, the outlook is negative for Pound. And at 13:30 CET ECB monetary policy meeting minutes will be published.

Nikkei pulls back on stronger yuan

Asian stocks are mixed today with investors cautiously optimistic as more positive data point to improvement in economies. Nikkei fell 0.4% to 19520.69 with yen growing stronger against the dollar. Shares of Sharp rallied 11%, on news the company will consider listing its LCD joint venture with Hon Hai. Chinese stocks are rising as Chinese yuan appreciated sharply against the dollar and China’s December Caixin services purchasing managers’ Index rose to 53.4 from 53.1 while Hong Kong’s PMI moved back into growth territory for the first time in nearly two years in December. The Hong Kong’s Hang Seng index is up 1.4% while the Shanghai Composite Index is 0.2% higher. Australia’s All Ordinaries Index gained 0.3% while the Australian dollar gained against the dollar.

Oil prices decline despite US inventory drawdown

Oil futures prices prices are falling today as doubts resurfaced producers would fully implement output cuts agreed upon in November output cut deal reached between the Organization of the Petroleum Exporting Countries and other major producers. The American Petroleum Institute reported late Tuesday higher than expected fall of 7.4 million barrels in US crude inventories instead of 2.2 million. Official inventory data from the Energy Information Administration will be released today at 17:00 CET. March Brent crude closed 1.8% higher at $56.46 a barrel on Wednesday on London’s ICE Futures exchange.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also