- Analytics

- Technical Analysis

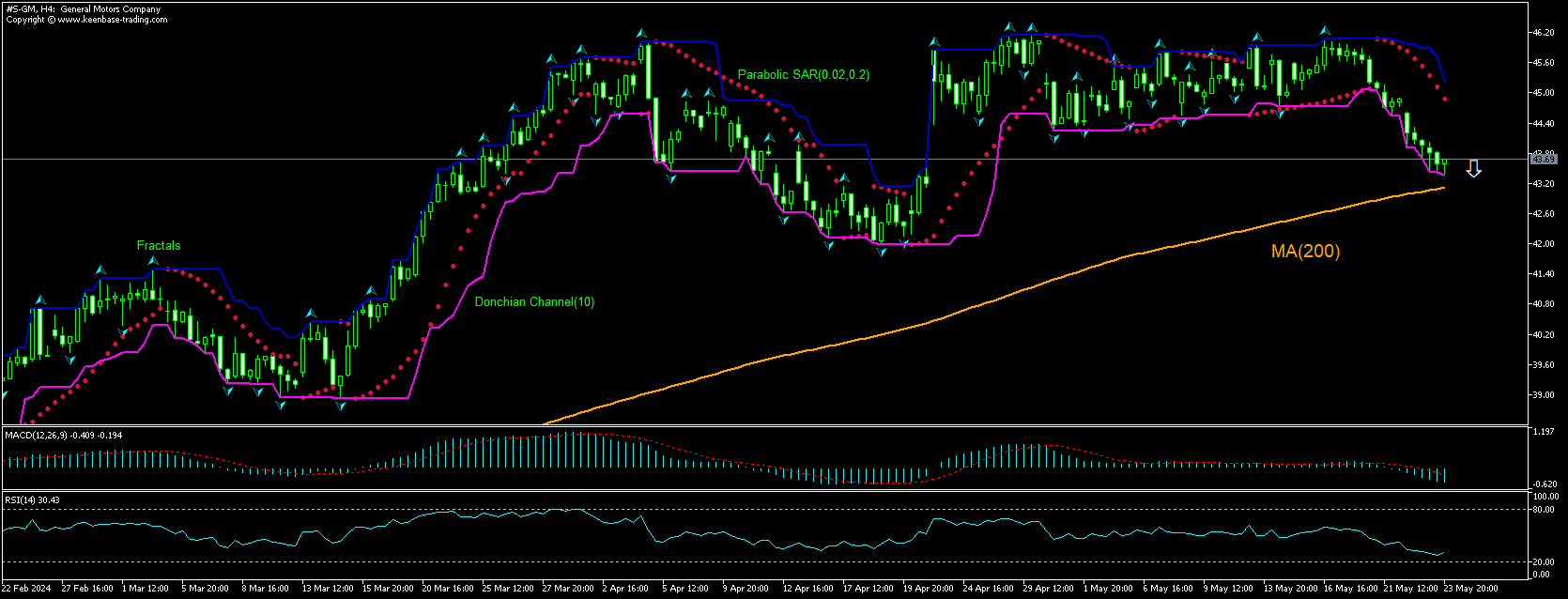

General Motors Technical Analysis - General Motors Trading: 2024-05-24

GM Technical Analysis Summary

Below 43.37

Sell Stop

Above 44.88

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Sell |

GM Chart Analysis

GM Technical Analysis

The technical analysis of the GM stock price chart on 4-hour timeframe shows #S-GM,H4 is retracing down to test the 200-day moving average MA(200) which is rising still. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 43.37. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 44.88. After placing the order, the stop loss is to be moved every day to the next fractal high indicator, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (44.88) without reaching the order (43.37), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - GM

General Motors stock has been retreating after news GM and LG finally agreed upon Bolt battery recall settlement. Will the GM stock price continue retreating?

General Motors Company recalled around 141,000 vehicles between late 2020 and 2021 after a few fire complaints in some Chevrolet Bolt EVs. GM used LG-manufactured batteries in its Chevrolet Bolt EVs. In 2021, the automaker announced a billion-dollar recall campaign for thousands of Bolt EVs, which resulted in a production and sales halt of Bolt for more than six months. It took until now for the automaker and its battery supplier to reach an agreement on who should pay for the recall. GM and LG Energy Solution have agreed to establish a $150 million relief fund for Chevrolet Bolt EV owners affected by faulty batteries. 22,560 owners will receive $1,400, while around 80,000 others will get checks for $700. GM's Chevy Bolt battery issues and low EV sales have hurt its market share, which fell to 2.8% in the first quarter from 3.4% in the previous year. However, GM aims to double its EV production capacity and reach profitability by mid-2024, despite last year's demand slowdown. News on product recall settlement is bullish for a company stock price. However, GM stock price lost 4.7% in five sessions after the settlement news.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.