Milder risk aversion has led the USDJPY to recover previous losses as the military strike to Syria is delaying. UN Security Council is not convinced about the use of chemical weapons with Russia and China opposing military action. US President Barack Obama did not decided on whether to launch a retaliatory strike with just his allies, UK and France sidestepping UN, while UK and France say that they are ready to go.

Last night, US indices bounced up on technical retracement as well as on calmer risk aversion, S&P 500 rose by 0.27%,

Dow jones industrial Average gained 0.33% and

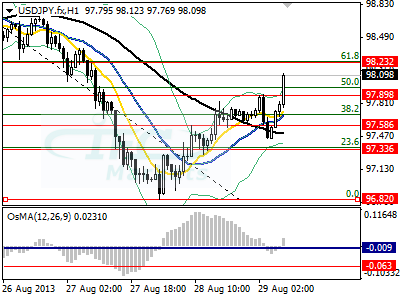

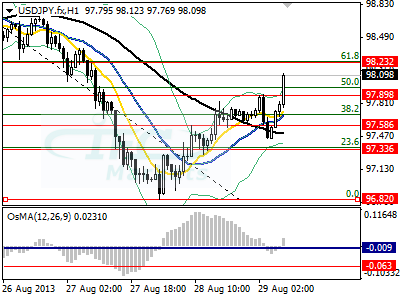

NASDAQ closed up by 0.41%. Asian indices followed in recouping previous session’s losses with NIKKEI 225 surging by 0.91%. NIKKEI was also supported by weakening Japanese Yen, with the USDJPY bouncing back and rising as of typing above the 50.0% resistance of 99.14 to 96.82, at 97.89. Retracement is likely to be capped by 61.8% at 98.23 because most probably risk aversion will return stronger in the market with the military strike launch.

The greenback is getting stronger as of writing against its major peers. The US dollar index penetrated its key resistance at 81.68 and is heading for 81.88 ahead of Preliminary US GDP release for the 2nd quarter, expected to improve to 2.2% and Unemployment Claims. The Euro versus the US dollar was under increased selling pressure and dipped from 1.3382 to currently 1.3269 earlier today with investors anticipating German unemployment and CPI report later on Thursday.

Elsewhere, the British pound rebounded yesterday against the greenback on less hawkish than anticipated BOE Governor, Mark Carney speech reaching resistance at 1.5549. It seems though that the Syria risk still weighs on the currency pair, likely to drive it back below 1.55. The USDCAD found key resistance near almost 2-year high at 1.06 the previous week and retraced to 1.0472, at the moment is consolidating due to stronger US dollar and recently rising Oil prices are not helping loonie.