- Analytics

- Market Overview

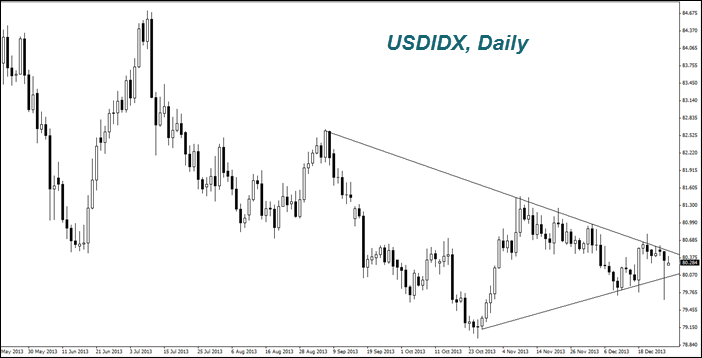

Speculators failed to weaken the U.S. dollar - 30.12.2013

However, the speculative movement of EURUSD was so strong that it initiated a speech of Mario Draghi to calm the foreign exchange markets. However, there was another version of the powerful surge. European banks could repatriate profits at the end of the year before the expected revaluation of their assets by European Central Bank. As expected, the Japanese yen continued to weaken against all other currencies. It is trading on the five-year highs against the U.S. dollar (USDJPY) and the euro (EURJPY). Swiss Franc (CHFJPY) traded near a 30-year peak against Yen. For the first time in six years in Japan base salary can be increased. In our point of view, it may increase consumer prices to the target level of 2% next year. Australian Dollar (AUDUSD) is near to its three-year low. For the first time since 2008 it lost 15% for the year. The reason of this was a decrease in the discount rate from 3% to 2.5%. Today the most expected data is November Pending Home Sales from USA at 16-00 GMT. The preliminary forecast is moderately negative. In other matters, this data is unlikely to have a strong influence on the U.S. dollar because tomorrow more important economic indicator - December consumer confidence index - will be published. The preliminary forecast is positive. Let's note that the 10-year U.S. Treasury yield exceeded the level of 3%. We believe that at this level buyers may appear. This is also positive for the U.S. currency. 10-year German government bonds yield is significantly lower at 1.95%. Happy New Year to all our readers!

News

Why China Wins When Oil Prices Spike

Key Takeaways The Paradox - China's import dependence doesn't...

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also