- Analytics

- Market Overview

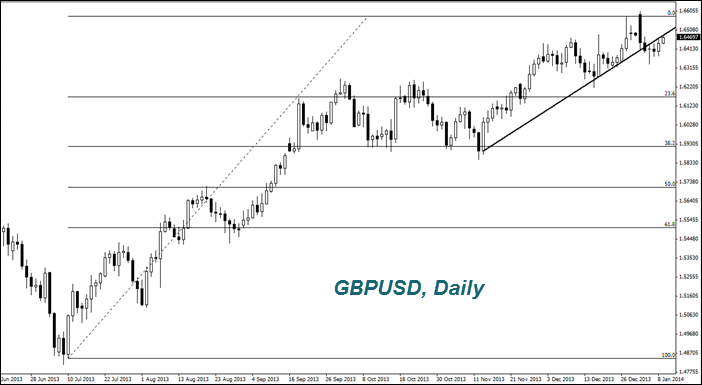

The U.S. dollar index continued its growth due to the good statistics - 9.1.2014

Today, we expect decisions about interest rates in the UK and trade balance for November at 9-30 GMT (0). Eurozone consumer confidence index in December will be released at 10-00 GMT (0). Preliminary forecasts for the pound and the euro are positive. As for Canada, there are the real estate market data (Canadian dollar vernacular) that could affect the course of the Loonie coming out at 13-30 GMT (0). Preliminary forecasts are negative. That is in favor of the USDCAD on the chart in the trading terminal. However, the loonie has weakened so much against the U.S. dollar over the past three days. Therefore it is difficult to predict the market reaction to economic information. At 23-50 GMT (0), there are the data on the volume of gold-currency reserves in Japan and the indicator of economic activity (leading indicator). We believe that they are able to affect the Japanese yen (USDJPY) if not coincide with a neutral outlook. The cost of WTI (OIL) decreased due to the fact that its reserves and reserves of petroleum products in the U.S. were more than expected. Consumption of motor fuel in the country fell to its lowest level in seven months. An additional factor of price drop was the increase of oil production in Libya from 210 thousand barrels per day to 546 thousand Next Overview (GMT+0, Greenwich): 11:00

Questions and suggestions:analytics@ifcmarkets.com

News

Iran Secret Overture to the CIA

A day after US and Israeli strikes began raining down on Iranian...

Why China Wins When Oil Prices Spike

Key Takeaways The Paradox - China's import dependence doesn't...

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also