- Analytics

- Market Overview

Trump criticizes drug makers - 12.1.2017

Nasdaq records seventh straight day of gains

US stocks rebounded on Wednesday as oil prices jumped. The dollar slid as Trump’s press conference yielded no clarity on president-elect’s fiscal stimulus measures. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, closed 0.18% lower at 101.846. The S&P 500 advanced 0.3% settling at 2275.32 with the energy and utilities sectors the best performers. The Dow Jones industrial average rose 0.5% to 19954.28, led by gains in Merck and IBM shares. The Nasdaq Composite index ended at a new record high up 0.2% at 5563.65, the seventh straight day of gains for the technology index.

While Trump’s conference provided no details about his tax policies and infrastructure spending projects, Trump criticized biotechnology companies for high drug prices. Biotechnology stocks fell after his remark. Investors will be focusing on Federal Reserve officials’ speeches and Delta Airlines earnings report scheduled today which kicks off the US reporting season. Today at 14:30 CET Federal Reserve District Presidents Evans and Lockhart will speak on economy in Naples, Florida. At the same time Initial Jobless Claims and Continuing Claims will be released, the outlook is negative for dollar. And at 19:15 CET Fed's Bullard Speaks in New York on us economic outlook, at 19:45 CET Fed’s Kaplan will speak on economy in Dallas. And at 16:30 CET the Energy Information Administration will release US Natural Gas Storage data.

Trump’s comments weigh on drug stocks

European stocks extended gains on Wednesday with drug stocks limiting markets’ advance. Both the euro and British Pound strengthened against the dollar as US Treasury yields slipped after Trump’s press conference. The Stoxx Europe 600 added 0.2%. Germany’s DAX 30 outperformed rising 0.5% to 11646.17 . France’s CAC 40 ended marginally higher at 4888.71 and UK’s FTSE 100 index gained 0.2% to 7290.49, recording an an all-time high for a tenth straight session helped by 2.1% rise in industrial production in November.

Oil and auto maker companies were the best performers. Volkswagen shares gained 3.4% after the German auto maker on Tuesday confirmed that it has agreed to pay $4.3 billion in penalties to the US Justice Department to settle charges that it used special software to cheat on diesel emissions tests. Porsche Automobil Holding rallied 4%, Daimler shares added 0.8%. In other economic news, UK trade deficit widened to £4.2 billion ($5.096 billion) in November. Today at 11:00 CET November Industrial Production will be published in euro-zone, the outlook is positive for euro. And at 13:30 CET ECB monetary policy meeting minutes will be published.

Asian markets slip after Trump’s news conference

Asian stocks are retreating today after Trump’s conference on Wednesday failed to provide additional details on president-elect’s stimulus plans. Nikkei fell 1.2% to 19134.70 as yen continued strengthening against the dollar. Investors shrugged off the report the surplus in the current account rose 28% from a year earlier. Chinese stocks are also in negative territory with the Shanghai Composite Index down 0.5% and Hong Kong’s Hang Seng index 0.6% lower as investors booked gains from previous session. Australia’s All Ordinaries Index slid 0.04% as the Australian dollar edged still higher against the dollar.

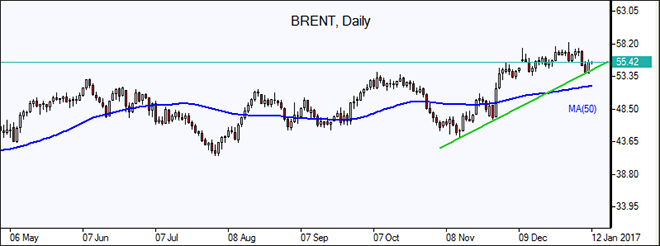

Oil prices rise despite US inventory build

Oil futures prices are edging higher today after the report of the Energy Information Administration US crude stocks climbed by 4.1 million barrels to 483.11 million barrels. However, record US refinery runs of 17.1 million barrels per day (bpd), up 418000 bpd on the week, indicated strong demand, supporting prices. March Brent crude closed 2.7% higher at $55.10 a barrel on Wednesday on London’s ICE Futures exchange.

News

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also