- Analytics

- Market Overview

US indexes rebound after surprise rate cut - 5.3.2020

Dollar weakening intact

US stock market rebounded on Wednesday after the surprise half-a-percentage-point rate cut by the Fed on Tuesday. The S&P 500 advanced 4.2% to 3130.12. The Dow Jones industrial average jumped 4.5% to 27090.86. Nasdaq rose 3.9% to 9018.09. The dollar weakening stalled as the Institute for Supply Management reported its nonmanufacturing index in February rose to 57.3% from 55.5% in the previous month. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.2% to 97.37 but is lower currently. Futures on stock indexes point to lower openings today.

FTSE 100 led European indexes recovery

European stocks extended gains on Wednesday. EUR/USD reversed lower yesterday while GBP/USD accelerated its climb with both pairs higher currently. The Stoxx Europe 600 ended up 1% led by utility shares. Germany’s DAX 30 advanced 1.2% to 12127.69. France’s CAC 40 gained 1.3% while UK’s FTSE 100 rose 1.5% to 6815.59.

Shanghai Composite leads Asian indexes recovery

Asian stock indices are sharply higher today tracking changes on Wall Street overnight. Nikkei added 1.1% to 21330.50 despite yen resuming its climb against the dollar. Markets in China are rising: Shanghai Composite Index is 2% higher while Hong Kong’s Hang Seng Index is up 1.7%. Australia’s All Ordinaries Index rebounded 1.1% despite Australian dollar’s continuing climb against the greenback.

Brent down

Brent futures prices are extending losses today. Prices fell yesterday after the Energy Information Administration report US crude oil inventories rose by smaller than expected 785 thousand barrels last week: May Brent lost 1.4% to $51.13 on Wednesday.

Gold falls as Dollar strengthens

Gold prices are extending losses while dollar inched up. The price of an ounce of gold for April delivery slipped 0.1% to $1643 an ounce on Wednesday.

News

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that...

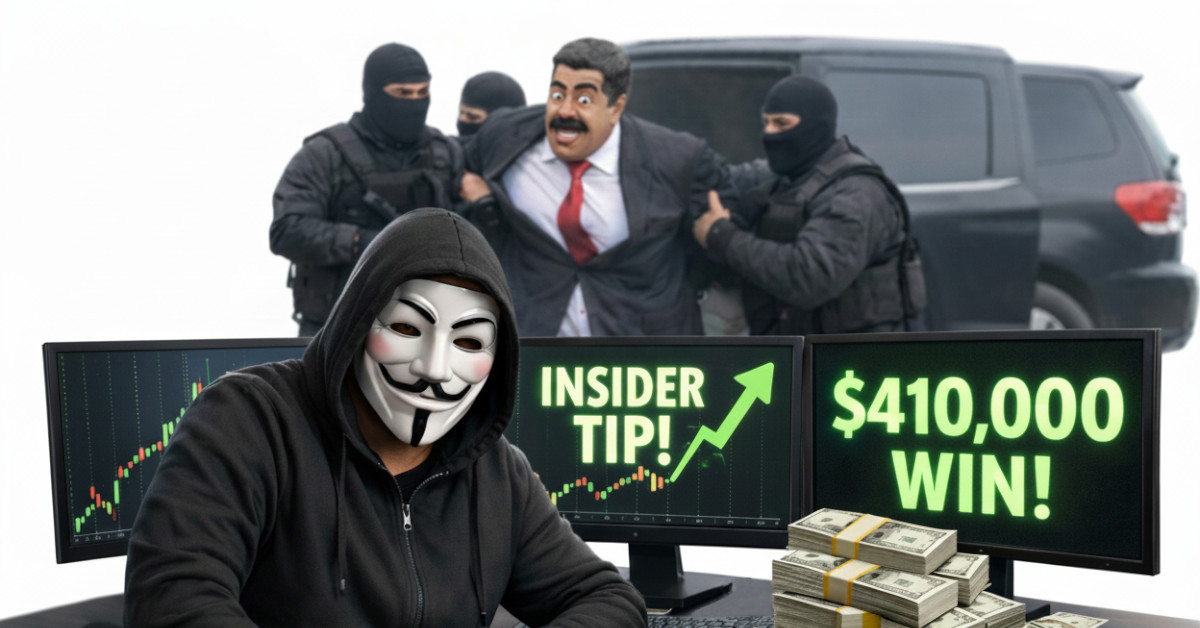

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also