- Analytics

- Market Sentiment

WEEKLY TOP GAINERS/LOSERS: 04.04.2018

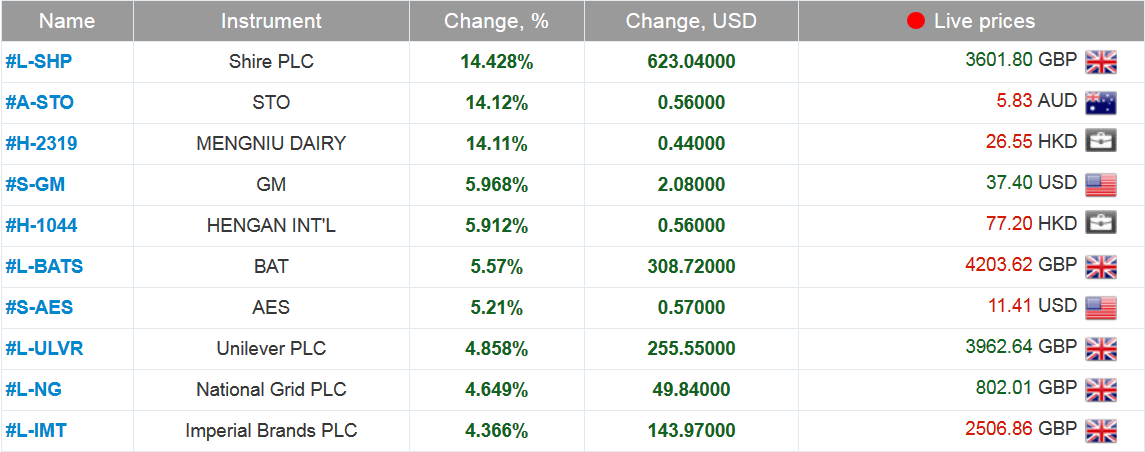

Top Gainers – The World Market

Top Gainers – The World Market

1. Shire PLC – growth in stock prices of the Irish biopharmaceutical company is due to reports that the Japanese pharmaceutical giant Takeda Pharmaceutical is going to acquire it.

2. Santos Ltd – stock prices of the Australian oil and gas company rose after the US investment fund Harbour Energy again offered to purchase its shares. This is the 4th offer since August last year.

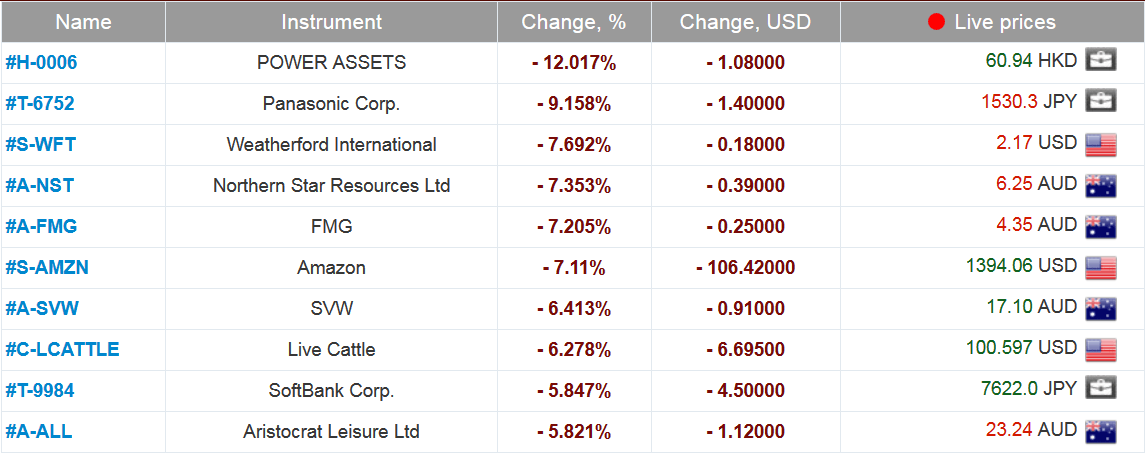

Top Losers – The World Market

Top Losers – The World Market

1. Power Assets Holdings – stocks of the company fell after the major Japanese investment bank Mizuho Securities lowered its recommendations on them. Earlier, the head of Power Assets Holdings, 89-year-old billionaire Li Kashin announced his resignation.

2. Panasonic Corp – stocks fell amid the reports by the US authorities on the start of the fatal crash investigation of the Tesla Model X electric car in California. Batteries manufactured by Panasonic are used in its production.

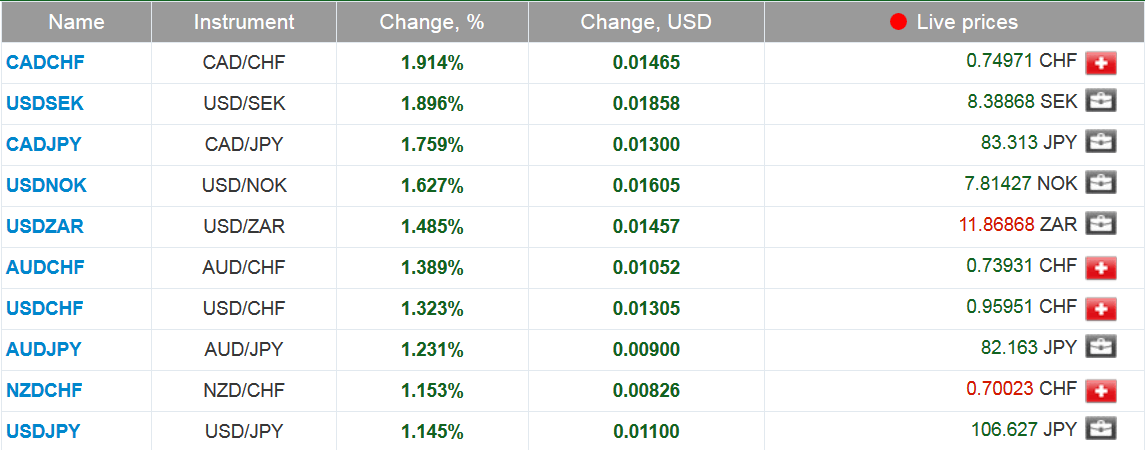

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. CADCHF - growth of the currency pair is due to the strengthening of the Canadian dollar. Investors positively reacted to the next round of negotiations on the revision of the North American Free Trade Agreement. In addition, another increase in the Bank of Canada rate cannot be excluded. Since July last year, it has already increased the rate thrice after the US Fed. In turn, member of the governing board of the Swiss National Bank Andrea Maechler spoke out against a hasty rate hike in Swiss.

2. USDSEK - Swedish krona rose after the head of the Bank of Sweden Cecilia Skingsley’s statement about a possible rate hike later this year. Now the rate is minus 0.5%, in case of inflation - 1.6%.

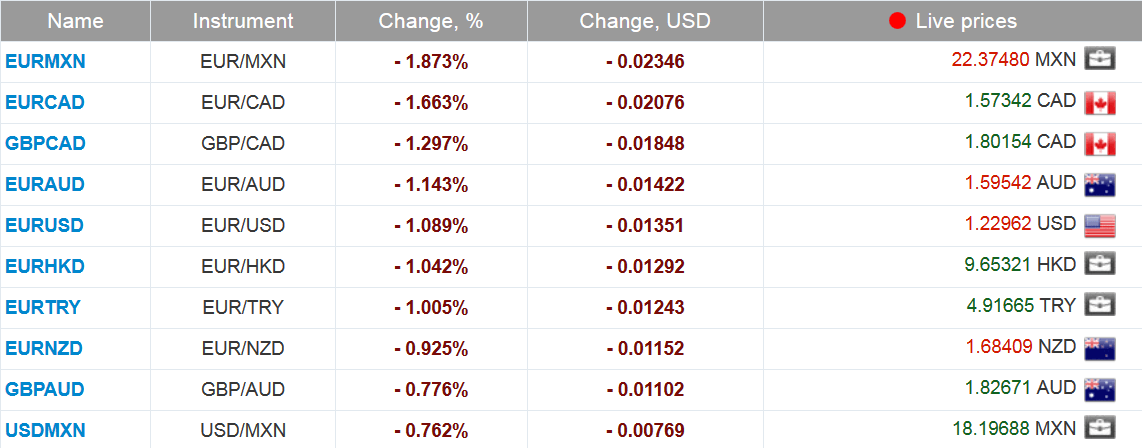

Top Losers - Foreign Exchange Market (Forex)

Top Losers - Foreign Exchange Market (Forex)

1. EURMXN, EURCAD - weakening of the euro against the Mexican peso and the Canadian dollar occurred amid investors' expectations that the ECB will continue an easy monetary policy while continuing the rate hike of the US Fed. According to Reuters, the share of US bonds in the portfolios of the largest European investment funds in March 2018 increased to 20.7% from 18.2% in February. This level is the highest since September 2017.

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

Last Sentiments

- 18Mar2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies...

- 10Mar2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the...

- 4Mar2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies...