- Analytics

- Market Sentiment

CFTC – sentiment diverges between EUR and GBP

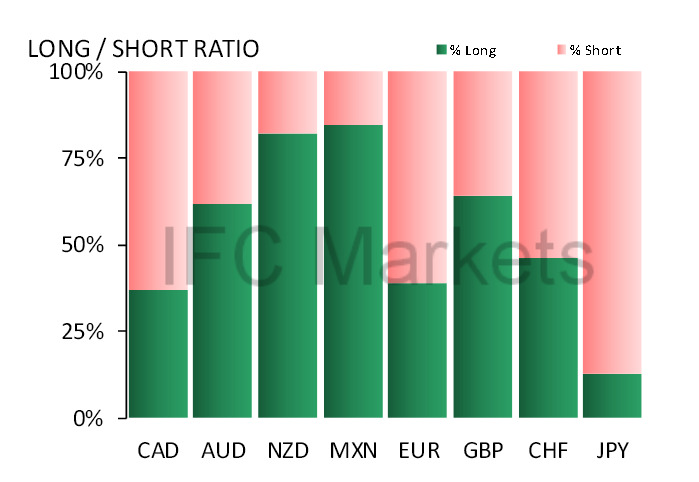

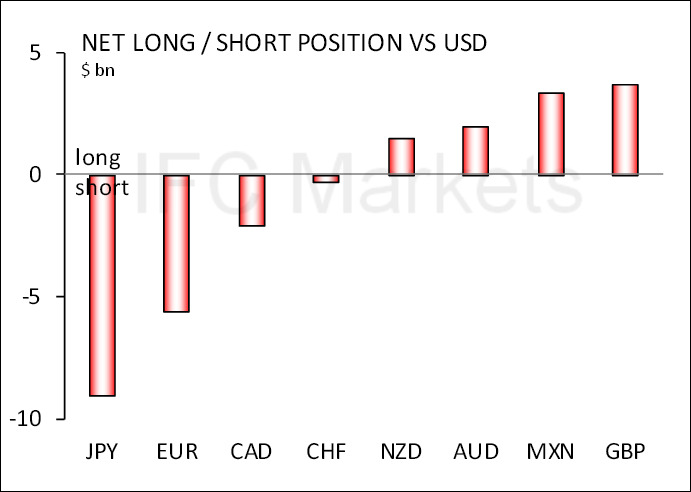

Sentiment continues to diverge with building bearish EUR and JPY positions and steadily bullish AUD, NZD, MXN and GBP holdings. Our forecasts line up well with current positioning, with the exception of CAD, where a stubborn $2bn short position has yet to be covered. The market holds a net long $6.6bn USD position; but it is mainly made up of short EUR and JPY holdings and accordingly is not a broad based strong USD play but instead made up of targeted positions.

The divergence between the net long AUD position at +$2bn and the net short CAD position at $2bn is notable; particularly since both central banks hold neutral stances and have somewhat similar drivers—this could in part be a yield play but is also likely to begin to narrow. The divergence between the net short EUR position at $5.6bn and the net long GBP position at $3.7bn is also noteworthy—see top right hand chart—and highlights diverging fundamental back drops. We expect EUR/GBP to depreciate into year end. CHF sentiment is vaguely bearish and Is likely to follow EUR’s and JPY’s more bearish positioning.

| Currency | Trend bias | Position volume | Weekly change, $bln |

| CAD | down | -2,084 | -75 |

| AUD | up | 1,995 | 527 |

| NZD | up | 1.478 | -59 |

| EUR | down | -5,626 | -2,791 |

| GBP | up | 3,661 | -48 |

| CHF | flat | -281 | 259 |

| JPY | down | -9,050 | -1,814 |

| Gold | up | 7,364 | -1,920 |

Data origin: CFTC, Scotiabank

New Exclusive Analytical Tool

Any date range - from 1 day to 1 year

Any Trading Group - Forex, Stocks, Indices, etc.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

Last Sentiments

- 18Mar2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies...

- 10Mar2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the...

- 4Mar2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies...