- Analytics

- Technical Analysis

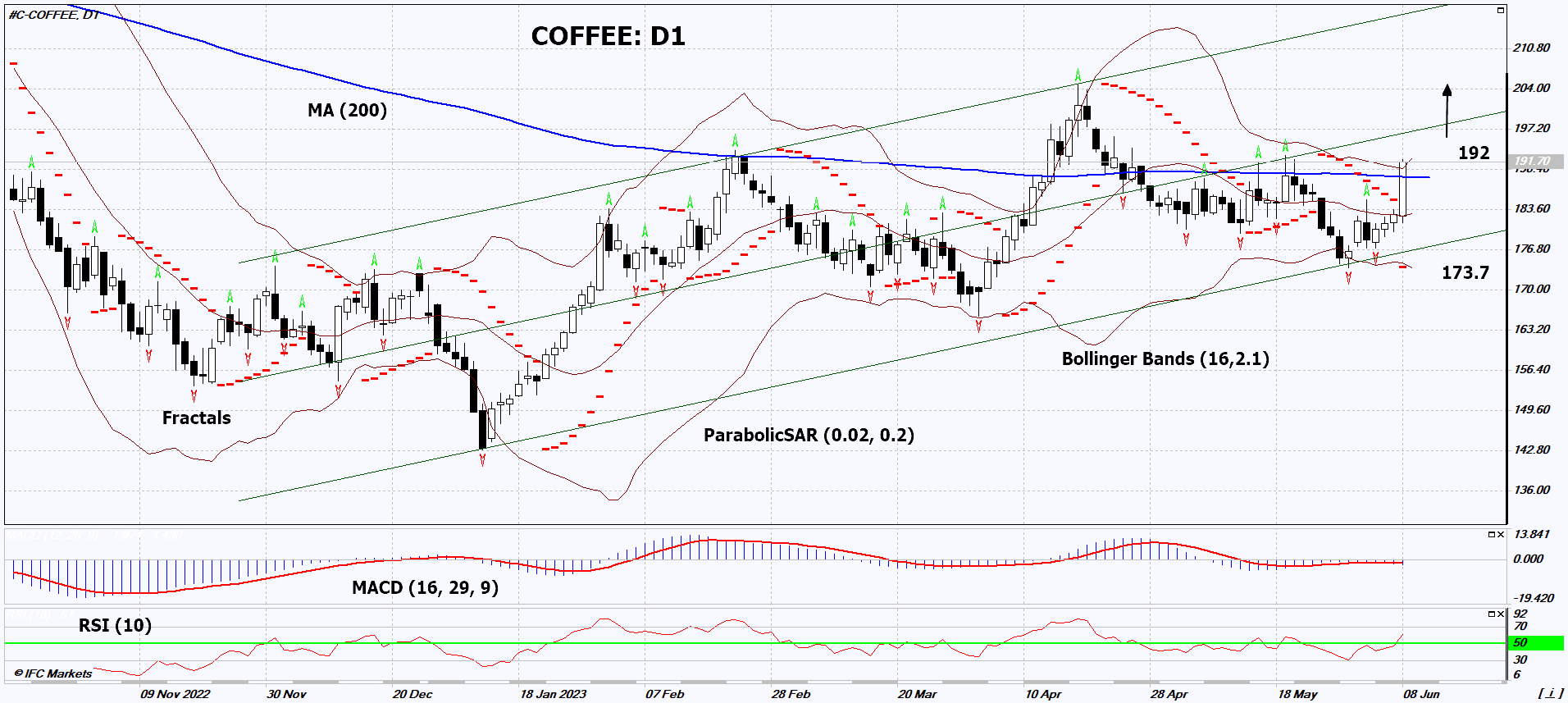

Arabica Coffee Technical Analysis - Arabica Coffee Trading: 2023-06-09

Coffee Technical Analysis Summary

Above 192

Buy Stop

Below 173,7

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Neutral |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

Coffee Chart Analysis

Coffee Technical Analysis

On the daily timeframe, COFFEE: D1 is moving towards the upper boundary of the long-term ascending channel and has surpassed the 200-day moving average line. Several technical analysis indicators have formed signals for further upward movement. We do not exclude a bullish trend if COFFEE: D1 rises above its last maximum at 192. This level can be used as an entry point. The initial risk limit can be set below the Parabolic signal, the 200-day moving average line, the lower Bollinger Band line, and the two most recent lower fractals at 173.7. After opening a pending order, the stop loss can be adjusted along with the Bollinger Bands and Parabolic signals to the next fractal minimum. Thus, we are favorably adjusting the potential profit/loss ratio. The most cautious traders, after executing the trade, can switch to the four-hour chart and set a trailing stop loss in the direction of movement. If the price surpasses the stop level (173.7) without activating the order (192), it is recommended to remove the order as internal changes in the market have occurred, which were not taken into account.

Fundamental Analysis of Commodities - Coffee

Latin America is expecting worsening weather conditions. Will the rise in COFFEE quotes continue?

The U.S. Climate Prediction Center has reported a warming of water in the Pacific Ocean, which could increase the likelihood of the formation of the natural phenomenon El Niño in the current year. Typically, El Niño causes drought in Brazil and rain in India, which can reduce global coffee production. Another positive factor for coffee quotes could be the announcement by the General Department of Vietnam Customs of a 2.2% y/y decrease in Vietnamese coffee exports from January to May, totaling 882 thousand metric tons. Additionally, the United States Department of Agriculture (USDA) forecasted a possible 20% y/y reduction in coffee production in Indonesia for the agricultural season 2023/2024, down to 8.4 million bags. The USDA had previously expected a 12% y/y increase in Arabica coffee production in Brazil in the current season, reaching 44.7 million bags. The forecast may be revised downwards in the event of the actual formation of El Niño. The Brazilian agency Conab has already slightly reduced its forecast for coffee harvest in Brazil for the current year in its May report compared to the January report. Regarding the current situation in the coffee futures market, it can be noted that the price of Robusta has reached a 28-year high, while the price of Arabica is still far from its local peak in February 2022.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.