- Analytics

- Technical Analysis

EUR USD Technical Analysis - EUR USD Trading: 2017-01-13

Better than expected growth in euro-zone is bullish for euro

The dollar uptrend has stalled as investors are looking for details how Trump’s proclaimed prо-growth policies will be formulated. And higher than expected German economic growth in 2016, according to preliminary reading, is bullish for euro. Will the euro continue recovery?

The major driver of euro exchange rate recently is still the European Central Bank (ECB) monetary policy divergence with the Federal Reserve. The European Central Bank extended its quantitative easing program by nine months at its December 8 meeting though it reduced the volume of monthly asset purchases. The central bank reduced the monthly asset purchases to USD 60 billion, down from USD 80 billion, while extending the purchases program, scheduled to end in March 2017, till the end of 2017. At the same time the bank signaled it will continue to support the economic recovery and may even expand the program in terms of size and/or duration in case financial conditions deteriorate. The Federal Reserve, on the other hand, hiked the rates for the second time in decade on December 14 and surprised markets by signaling a faster pace of rate hikes than previously believed. The dot plot of policy makers’ projections indicated three interest rate hikes in 2017 instead of just two as predicted in September projections. This boosted the dollar index which had pulled back after a rally supported by Trump’s proposals to cut taxes and implement massive infrastructure projects. But the dollar rally seems to have run out of steam recently as market participants wonder what will be the actual delivery of the proposed expansionary measures by the newly elected president. At his first news conference on Wednesday Trump failed to provide any details on his plans for tax policies and infrastructure spending projects. This was bearish for dollar. Meanwhile, the German economy recorded the strongest growth rate in 2016 since 2011, advancing by 1.9% after growing by 1.7% in 2015, according to a preliminary estimate from the Federal Statistics Office on Thursday. This points to better than expected growth in euro-zone in 2016, which is bullish for euro.

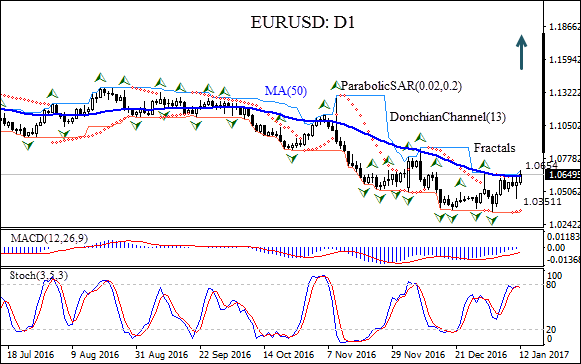

On the daily timeframe EUR/USD has been rising after hitting a 14-year low on January 3. The price has breached above the 50-day moving average MA(50).

- The Donchian channel is flat, indicating no trend yet.

- The MACD indicator gives a bullish signal.

- The Parabolic indicator has formed a buy signal.

- The stochastic oscillator has approached the overbought zone but has not breached into it yet.

We believe the bullish movement will continue after the price closes above the MA(50) and last fractal high at 1.0654. It can be used as an entry point for a pending order to buy. The stop loss can be placed below the Parabolic at 1.03511. After placing the pending order the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop-loss level (1.03511) without reaching the order (1.0654) we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

| Position | Buy |

| Buy stop | Above 1.0654 |

| Stop loss | Below 1.03511 |

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.