- Analytics

- Market Overview

Markets shrug off Italian referendum news - 6.12.2016

US stocks rise on higher ISM services reading

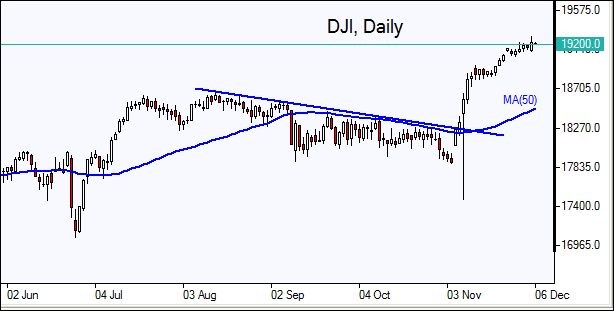

US stocks climbed higher on Monday as positive data showing services sector continued accelerated expansion offset concerns about euro-zone political uncertainty after Italians rejected the proposed constitutional reform in a referendum on Sunday. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, closed 0.54% lower at 101.151. The Dow Jones industrial closed at all time high 19216.24 gaining 0.2% led by Visa and Goldman Sachs shares. The S&P 500 rose 0.6% settling at 2204.71 with financial and technology stocks leading the market higher. The Nasdaq index added 1% to 5308.89.

The November US stock market rally continued with Donald Trump’s campaign promises to cut taxes and initiate major infrastructure projects boosting investor risk appetite on expectations of fiscal expansion despite anticipated tightening of monetary policy at Fed’s December meeting. Three Federal Reserve officials spoke yesterday - New York Federal Reserve Bank President William Dudley, Chicago Fed President Charles Evans and St. Louis Fed President James Bullard. Dudley supported gradual rate hikes saying the Fed wasn’t far from its policy goals, though he warned against excessive public spending projects adding that monetary and fiscal policies must not work at “cross-purposes.” The Federal Reserve two-day policy meeting starts next week on Tuesday and it is widely expected policy makers will raise rates. The Fed now entered its “blackout” period when Fed officials refrain from making public comments ahead of the upcoming policy meeting. The Institute for Supply Management positive data boosted market sentiment: ISM Non-manufacturing index showed the US services sector grew in November at its fastest pace in a year, with the index rising to 57.2%, compared with 54.8% in the prior month. Any reading over 50 indicates expansion. Today at 14:30 CET October Trade Balance will be released in US. The tentative outlook is negative. At 16:00 CET October Factory Orders will be published. The outlook is positive.

Italian banks hurt the most after Italian referendum

European stocks closed higher on Monday paring earlier losses as markets opened lower after Prime Minister Matteo Renzi announced his resignation following the rejection of a constitutional reform in the Sunday referendum. The euro rose against the dollar while the British Pound ended little changed having both opened with a gap lower on political uncertainty and the possibility of another euro-zone crisis. The Stoxx Europe 600 index added 0.6%. The DAX 30 rose 1.6% to close at 10684.33, France’s CAC 40 gained 1% and UK’s FTSE 100 added 0.2% to 6746.83.

Italian banks were the biggest losers on concerns the political uncertainty will negatively affect plans of financial aid to troubled Italian banks in need of recapitalization as they struggle with the load of bad loans. Banca Popolare di Milano Scarl sank 7.9% and Banca Monte dei Paschi di Siena fell 4.2%. The yield on Italy’s 10-year bond rose above 2% despite European Central Bank’s assurance of stepped up purchases of Italian government bonds in case of increased volatility. Markets recovered as investors shrugged off the news despite a slightly lower final November reading for the euro-zone services purchasing managers index at 53.8 against the flash reading of 54.1. That figure still indicated a 11-month high for the services sector. Ministers of finance will hold a meeting today in euro-zone. And at 14:00 CET final third quarter GDP will be released in euro-zone, the outlook is neutral for euro.

Asian stocks edge higher on limited fallout from Italian referendum

Asian stocks are advancing today as investors confidence was boosted by a limited fallout after Italian Prime Minister Matteo Renzi announced his resignation following Sunday’s referendum. Nikkei ended 0.27% higher at 18360.54 today as yen edged lower against the dollar. The Shanghai Composite Index is 0.1% lower while Hong Kong’s Hang Seng index is 0.6% higher after Monday’s launch of a trading link between the Hong Kong and Shenzhen exchanges, which will allow Chinese investors to buy into some small cap stocks. Australia’s All Ordinaries Index is 0.5% higher despite weaker Australian dollar against the dollar as Australia’s central bank kept its cash rate at a record low 1.5% and gave a cautious outlook for a mixed economy.

Oil prices fall on doubts OPEC will agree to output cuts

Oil futures prices are rising today after climbing to 17 month high on Monday following the rally sparked by the Organization of the Petroleum Exporting Countries dal to curb crude output last week. Traders are focusing on coming OPEC meeting on December 10 in Vienna where non-OPEC producers are expected to agree to add an output cut of 600000 barrels per day. February Brent crude rose 0.9% to $54.94 a barrel on London’s ICE Futures exchange on Monday.

News

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also