- Analytics

- Market Overview

Investors are expecting the publication of Non-farm Payrolls - 5.8.2016

European stocks rise on Friday, the 3rd day in a row. With the decline in the discount rate of the Bank of England, the British FTSE 100 stock index updated yearly high. Swiss cement maker LafargeHolcim posted positive quarterly reports, and its shares rose by 5.8%. This contributed to the rise of quotes of the entire construction sector. Shares of the German company Hugo Boss rose by 6.8% due to good forecast on operating surplus. In our opinion, the growth of the European stock markets on Friday limit weak data on industrial orders in Germany for June, as well as the negative reports of some banks. Today, the publication of macroeconomic statistics in the Eurozone is no longer expected.

Nikkei ended the week falling by 2%. Investors were a bit disappointed by the measures of the Bank of Japan to mitigate the monetary policy and the size of the economic stimulus package of 13.5 trillion yen. In particular, the Bank of Japan did not go on further rate cuts. On Friday, the Nikkei fell slightly after rising on Thursday. This was contributed by the decline of the leading economic index and the index of coinciding indicators for June. On Monday next week in Japan a lot of important indicators will come out: the trade balance and the current account balance for June, as well as the economic indices Eco. Quotes of oil fell slightly on Friday after a two-day growth. Participants expect the market data on foreign trade of China for July, which will be published on early Monday morning. Many of them believe that the oil export to China will decline compared to the record level of last year. There are similar concerns about the supply of copper, that is why it ended the week with a fall.

Gold increases the 2nd week in a row on the back of the falling US dollar index. Usually these two assets move in opposite phase, as investors consider gold as an alternative to dollar assets. Since the beginning of the year gold has risen in price by 28%.

Cotton renewed 2-year high due to bad weather of the main producing countries - India and the United States. The volume of US cotton exports for the week rose by 25% compared to the previous week.

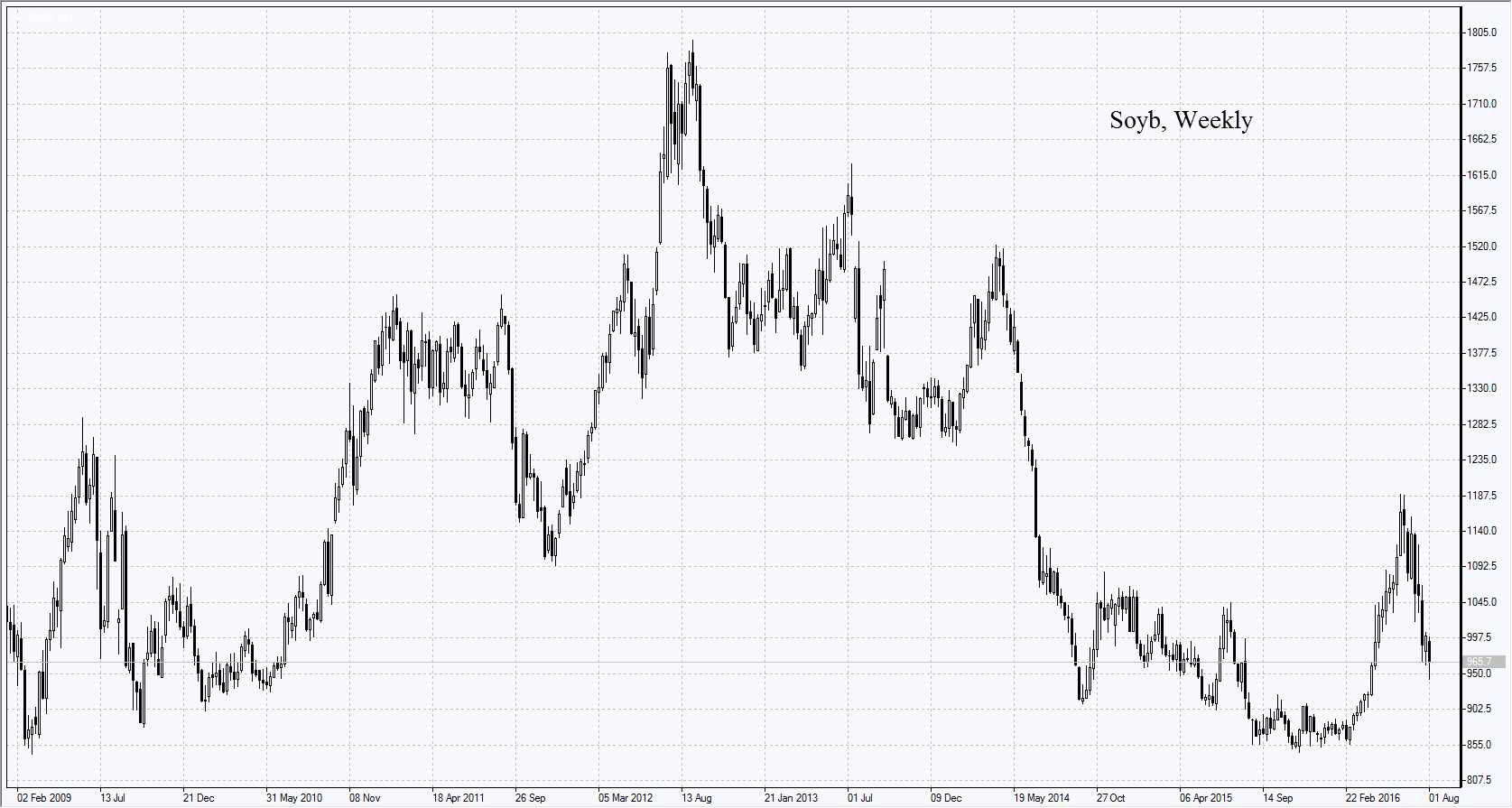

On Friday soybeans have risen by 1% due to the increase of exports from the US up to 1.67 million tons for the week, which is a maximum for 7 and a half months.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account